US stocks opened higher today, tracking gains in European equities, as investors digested PMI data. In the US, November’s S&P PMI readings brought a mix of optimism and caution. The Manufacturing PMI showed a slight improvement from October, rising to 48.5, though it remained in contraction territory (below 50). The Services PMI, however, delivered a strong upside surprise, climbing to 57 from 55 in October, far exceeding expectations of a flat reading. This robust services sector performance suggests resilience in the broader US economy, even as manufacturing struggles. Across the Atlantic, the picture was less optimistic. The UK’s PMI readings reflected weakening momentum, with Manufacturing slipping from 49.9 to 48.6 and Services falling from 52.0 to 50.0, barely clinging to expansion. In the Eurozone, conditions deteriorated further: Manufacturing dropped from 46.0 to 45.2, while Services fell from 51.6 to 49.2, signalling a move into contraction territory. These figures reinforce concerns about slower growth in the region and may add further pressure on central banks. The mixed economic data drove a significant move in the US dollar, which jumped to 107.6 as investors favoured the greenback over its European counterparts. Meanwhile, the 10-year US Treasury yield held steady above 4.4%.

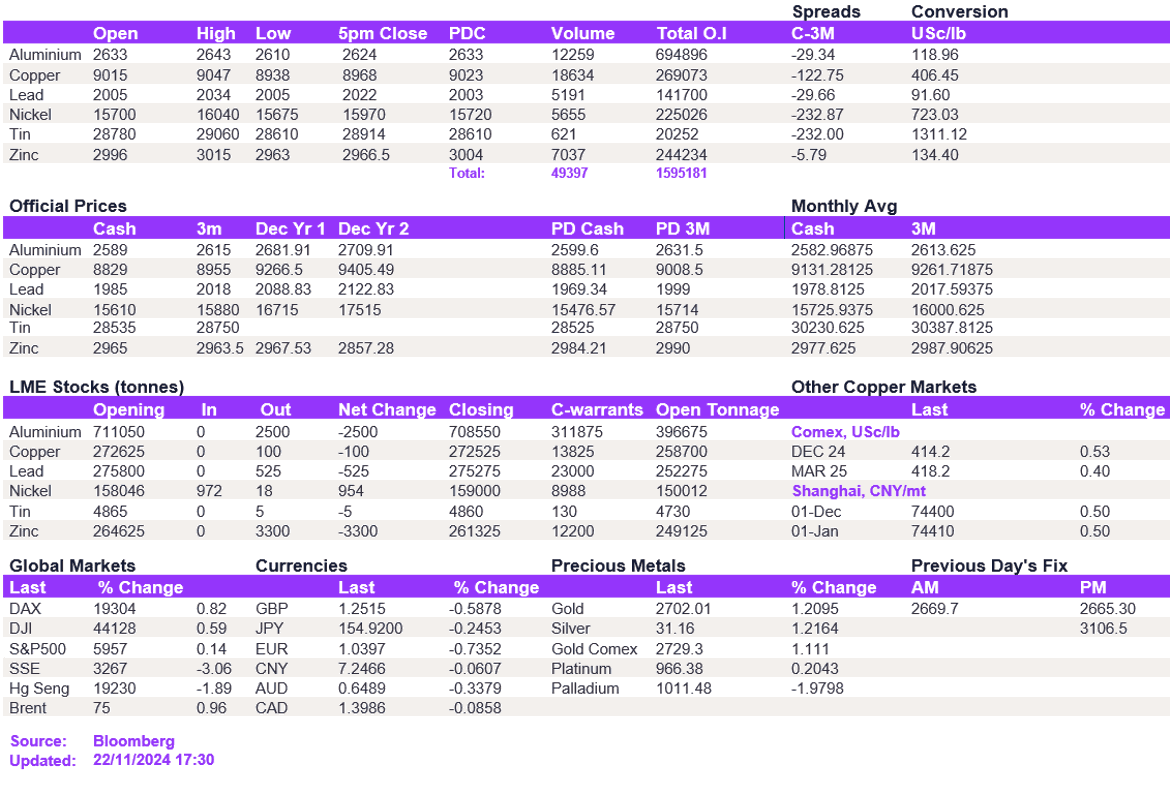

Base metals remained largely unchanged today, primarily due to the strength of the dollar, which has limited any potential for price increases. Consequently, prices closed the week steadily. We believe the dollar is constraining upside potential; however, we expect it to start weakening next week, which should allow metal prices to recover to levels seen in October. Copper has experienced notable selling pressure in recent weeks, slipping below the strong support level of $9,000/t today to $8,968/t. Aluminium managed to maintain its position above $2,600/t, closing at $2,624/t. Nickel, on the other hand, struggled to stay above $15,660/t and ultimately returned to $15,970/t.

Gold continued its upward momentum, breaking above $2,700/oz, driven by safe-haven demand amid geopolitical tensions. Silver followed suit, climbing to $31.25/oz. Oil prices also edged higher, with WTI trading at $70.7/bbl and Brent crude reaching $74.7/bbl. The rise in oil prices was supported by improving risk sentiment and steady demand signals, despite ongoing concerns about weaker growth in Europe.

All price data is from 22.11.2024 as of 17:30