US stocks opened higher today, with the Dow Jones reaching new record highs as markets geared up for a pivotal week of economic data and geopolitical developments. Investors are closely watching Wednesday's PCE data, which will provide fresh insights into US inflation trends, and Friday's Eurozone CPI report, which is expected to shape expectations for the ECB's next steps. Forward swaps are currently pricing a 50/50 chance of a 25bps rate cut from the Fed in December, signalling mixed sentiment about the central bank's near-term policy direction. Meanwhile, the ECB is expected to ease again, with markets anticipating at least a 25bps cut at the next meeting as the Eurozone grapples with slowing economic growth. Adding to the uncertainty, Trump's proposed tariffs on EU goods have raised alarms about their potential economic impact. Analysts estimate that the tariffs could shave 1% off the Eurozone's GDP growth, exacerbating existing challenges in an already fragile economic environment. The dollar index softened today, hovering just below the 107 level, while the 10-year US Treasury yield dropped to 4.28%.

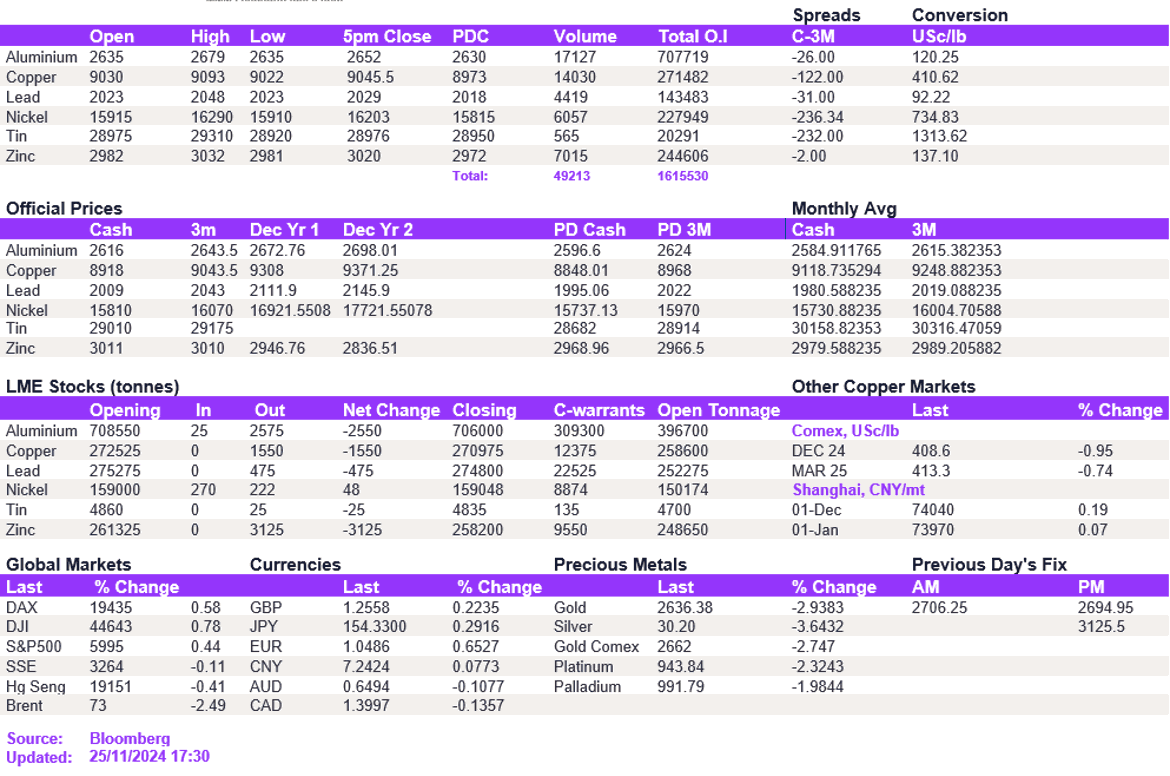

Base metals opened the week on the front foot, benefitting from easing dollar pressures. However, the gains in base metals were relatively modest compared to the extent of the dollar's decline. This indicates that the market may be waiting for a further drop in the dollar before committing to a more pronounced upward trend. Moreover, with the news about the newly appointed Trump administration members settling in, investors are likely to take a more cautious stance, avoiding significant risk-taking as the year-end approaches. While we anticipate upward pressure on base metals in the coming weeks, the strength of this momentum is likely to remain subdued. In the meantime, nickel jumped above the $16,000/t level to $16,203/t. Aluminium and copper held their nerve at $2,652/t and $9,045.50/t, respectively. The rest of the complex edged marginally higher.

Reports of a potential cease-fire agreement between Israel and Hezbollah led to a sharp decline in safe-haven demand for gold. The precious metal declined, trading at $2,627/oz, with silver following suit, retreating to just above $30.20/oz. Oil prices also softened, with WTI at $69.10/bbl and Brent crude at $73.10/bbl, as markets digested the potential for reduced tensions in the Middle East and its implications for energy supply stability.

All price data is from 25.11.2024 as of 17:30