US stocks opened lower today as investors positioned cautiously ahead of key US labour market data due later this week, which is expected to provide further insights into the health of the economy and the Federal Reserve's potential policy path. After a sharp rise yesterday, the dollar softened slightly, trading at 106.36. Meanwhile, the 10-year US Treasury yield stayed steady, hovering just below 4.2%, reflecting subdued movements in the bond market.

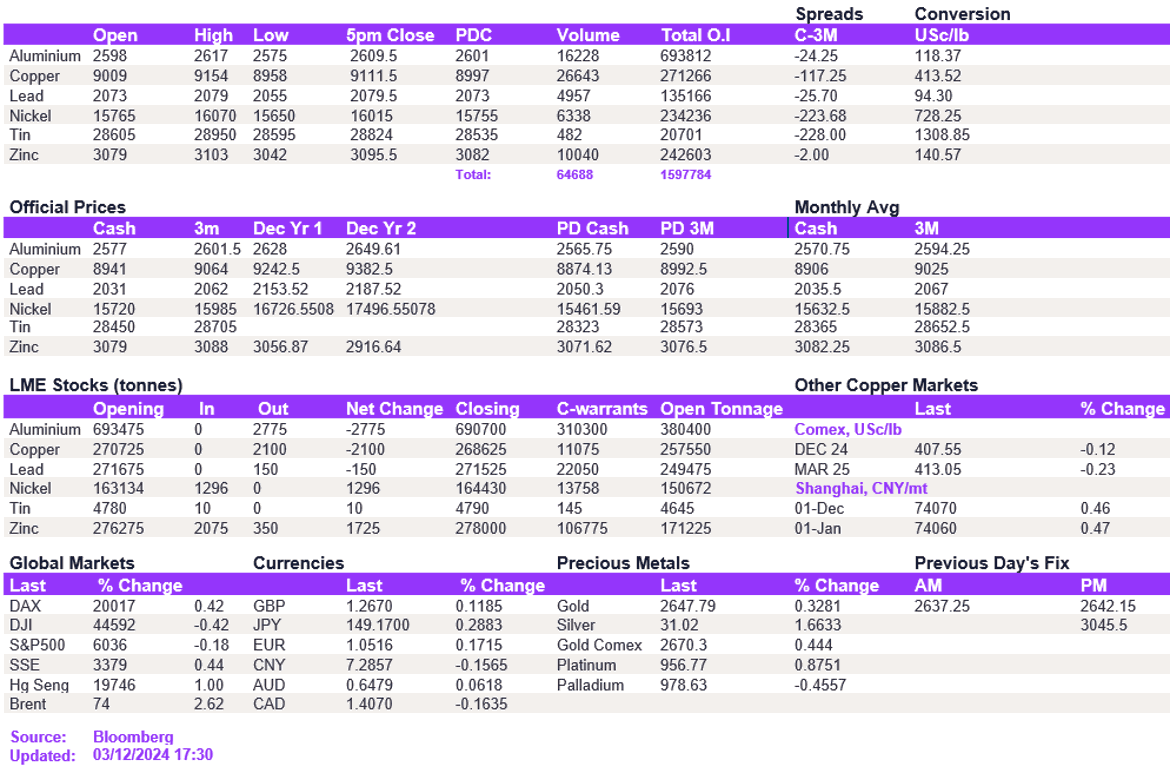

Base metals started on the front foot this morning, thanks to a softer dollar. However, with the support at 106 standing firm, the upside for metals' prices was limited. In particular, copper strengthened back above $9,000/t but struggled above $9,150/t, closing at $9,111.50/t. Likewise, nickel bounced back, offsetting the previous day's losses to $16,050/t. Lead remained supported above $2,050/t, and zinc struggled above the $3,100/t level.

Gold traded flat around $2,638/oz, while silver saw a modest uptick, edging higher to $30.80/oz. Oil prices climbed as anticipation built around OPEC's upcoming meeting on Thursday, where members are expected to extend supply cuts for an additional three months. WTI rose to $69.6/bbl, and Brent crude reached $73.6/bbl, buoyed by tightening supply expectations.

All price data is from 03.12.2024 as of 17:30