The S&P 500 and Nasdaq opened higher today, while the Dow Jones retreated after nearing record highs in the previous session, buoyed by investor reactions to Jerome Powell’s comments last night. Powell noted that the economy has proven more resilient than the Fed anticipated in September when it began easing interest rates. He also suggested that the pace of future rate cuts might slow, indicating a cautious approach to further monetary policy adjustments. On the macroeconomic front, the US trade deficit narrowed significantly in October, contracting 11.9% to $73.8 billion from a revised $83.8 billion in September. This improvement was driven by a decline in imports across capital goods, consumer goods, and industrial supplies, marking the largest drop since late 2022. However, services imports rose to a record high. Exports also presented a mixed picture, with goods exports decreasing while services exports increased. Initial jobless claims for the week ending November 30 came in higher than expected at 224,000, indicating a slight softness in the labour market. The dollar index saw a sharp drop, trading just above 106. Meanwhile, the 10-year US Treasury yield remained steady, hovering slightly above 4.2%.

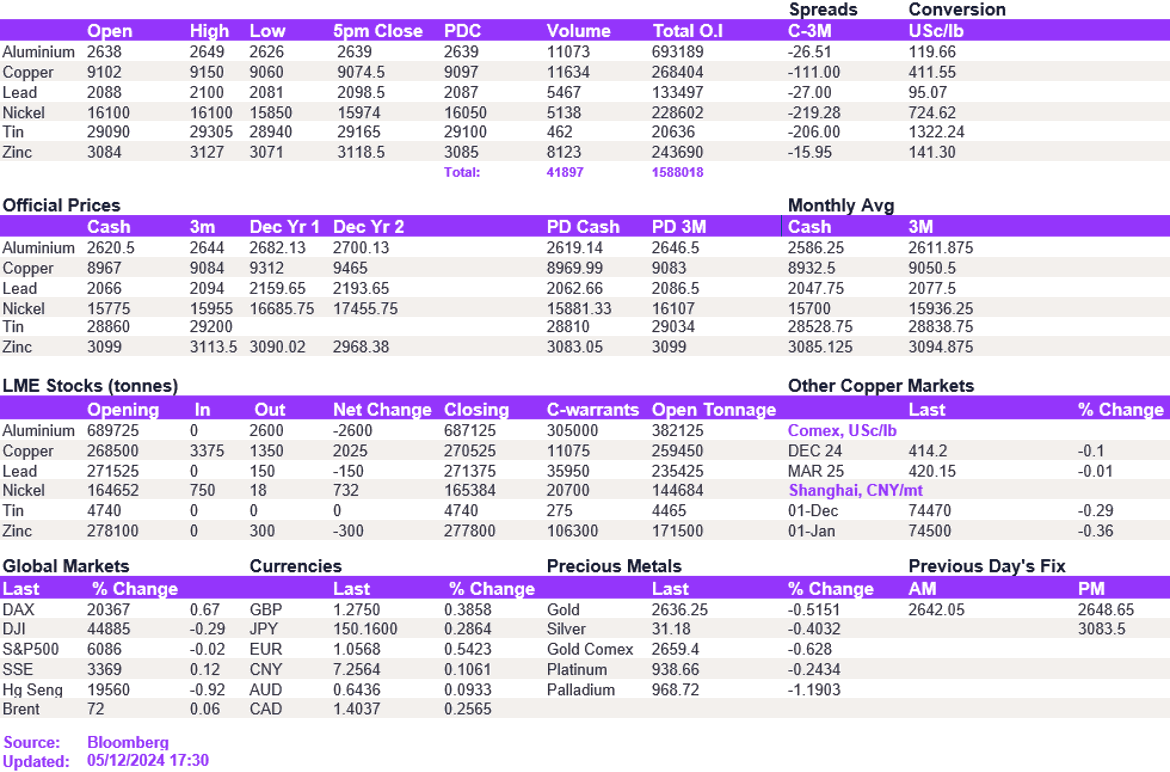

Base metals showed little change despite the weakness of the dollar, indicating a lack of strong risk-on appetite. Copper remained below the $9,100/t level at $9,074.50/t, as aluminium remained above $2,600/t at $2,639/t. Lead and zinc continued to slowly edge higher, closing at $2,098.50/t and $3,118.50/t, respectively.

Precious metals softened following Powell’s comments, which dampened enthusiasm for safe-haven assets. Gold eased to $2,634/oz, while silver fell to $31.0/oz. In energy markets, OPEC announced a delay in its planned production increase of 180,000 bbl/d, originally set for January, by three months. Despite the news, oil prices edged lower, with WTI trading at $68.6/bbl and Brent crude at $72.5/bbl.

All price data is from 05.12.2024 as of 17:30