US stocks opened higher today, with the S&P 500 reaching record highs and approaching the 6,100 mark. The index has surged 28% year-to-date, driven by a robust economic backdrop and resilient corporate earnings. November's Nonfarm Payrolls exceeded expectations, rising by 227k compared to a modest 12k in October, although the unemployment rate edged up to 4.2% from 4.1%. The slight increase in unemployment has reinforced expectations of a 25bps rate cut at the Federal Reserve's meeting next week, with forward swaps now pricing in a 90% probability, up from 70% just yesterday. This pushed the 10-year US Treasury yield down to 4.15%, its lowest level since mid-October. Meanwhile, the University of Michigan's preliminary sentiment reading climbed to 74.0, its highest level since April, signalling improving consumer confidence alongside rising inflation expectations. Anticipated inflationary pressures from Trump's proposed tariffs continue to support the dollar, with the dollar index holding steady above the 106.0 level.

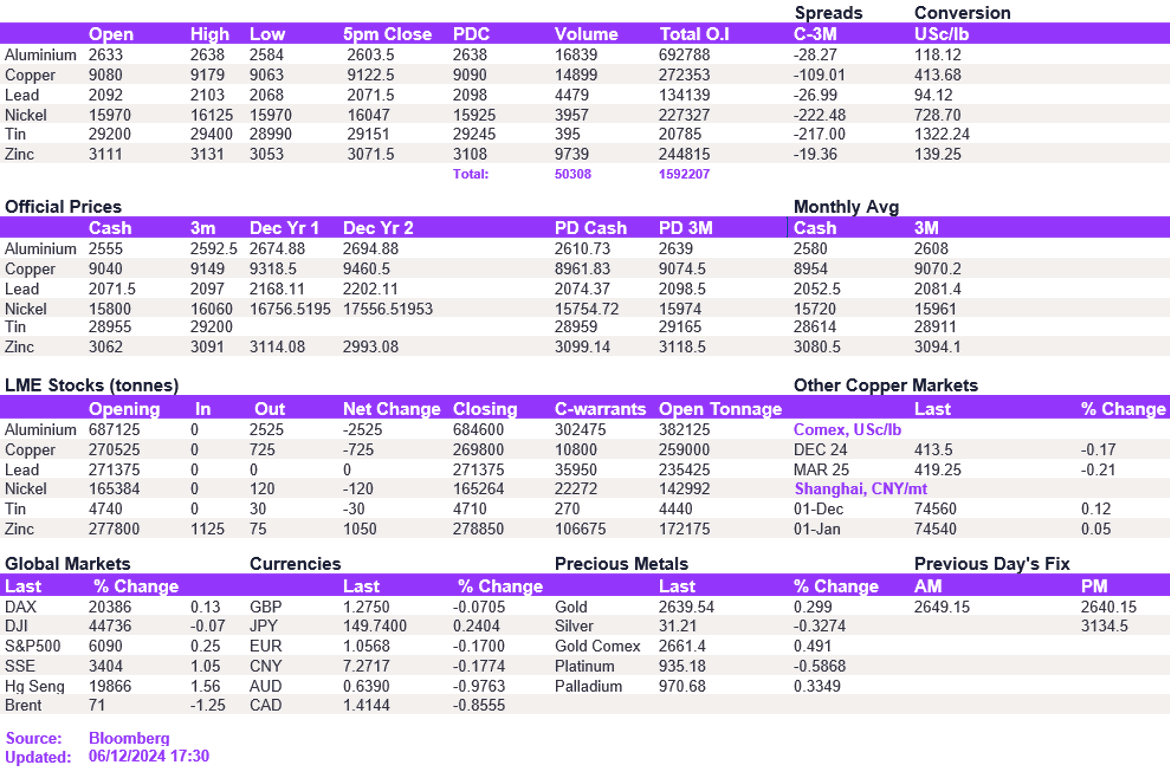

The base metals complex showed mixed sentiment at the close of the week. Copper continued to fluctuate around the $9,100/t level, maintaining its range from recent weeks. In contrast, aluminium weakened, but remained above the $2,600/t mar, closing at $2,603.50/t. Lead and zinc were also softer, falling to $2,071.50/t and $3,071.50/t, respectively. Although the market experienced weakness today, the movements were marginal, indicating a decreasing risk appetite among investors, which is likely to keep prices within current ranges as the year-end approaches. Additionally, the cash to three-month spreads are all in contango, suggesting that there are no expectations for market tightness in the near term.

The strong dollar continues to weigh on precious metals. Gold remained subdued, edging only slightly higher to $2,638/oz, while silver slipped to $31.10/oz. In energy markets, oil prices declined, with WTI at $67.00/bbl and Brent crude at $70.80/bbl.

All price data is from 06.12.2024 as of 17:30