While the Dow Jones and S&P 500 opened slightly lower, the Nasdaq continued its upward trajectory, reaching record highs. Investors are closely watching tomorrow’s US CPI data, which is expected to show a slight uptick in November inflation and will be key in shaping expectations for the Federal Reserve’s policy decision next week. Forward swaps are now pricing in nearly a 90% chance of a 25bps rate cut at the Fed’s meeting. Meanwhile, the ECB is widely expected to proceed with a 25bps cut tomorrow as part of its ongoing easing cycle. Geopolitical developments have also influenced markets, with the rapid fall of the Al-Assad regime in Syria boosting demand for safe-havens. This has pushed the dollar index above the 106.5 level, while the 10-year US Treasury yield rose, trading at 4.23%.

Today, China stated that it might raise its budget decision to the highest level in three decades and further intensify its cutting cycle. This follows a recent statement from policymakers aimed at boosting stimulus in the new year. While this news is encouraging for the base metals complex in the near term, we do not anticipate it will boost long-term confidence. The construction sector remains under pressure, dampening physical demand for the material. Additionally, the current decline in demand is mitigating the effects of the concentrate shortages that markets are facing right now, further weighing on pricing prospects.

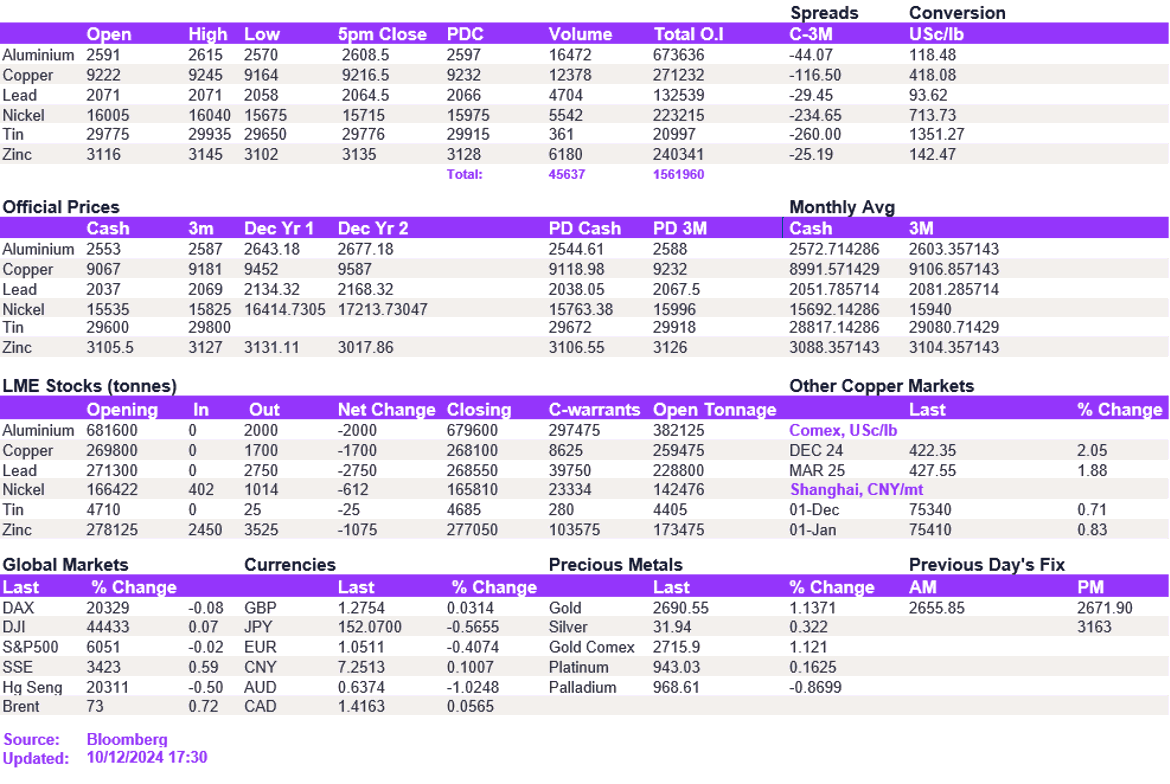

Moreover, changes in fiscal or monetary policy typically take 2-3 quarters to translate into real market impacts. As a result, we do not expect to see a continuous improvement in the region until the second half of 2025. Without clear signs of sustained recovery in the construction sector, it will be challenging for the market to establish a lasting upward trend. The base metal’s moves today underscore this narrative as prices held steady. Copper remained slightly above the $9,200/t mark at $9,208.50/t. Aluminium continued to fluctuate around the $2,600/t level. Nickel, on the other hand, dropped back below the $16,000/t level to $15,75/t.

Gold saw a significant rise, approaching $2,690/oz, while silver edged slightly higher but struggled to break the $32/oz level. Oil prices moved modestly higher, with WTI at $68.90/bbl and Brent crude at $72.60/bbl.

All price data is from 10.12.2024 as of 17:30