US stocks opened lower today as investors positioned cautiously ahead of the Fed statement scheduled for this evening. Forward swaps continue to price in an almost 100% chance of a 25bps interest rate cut, but market focus will be on Powell’s comments to gauge the Fed’s policy path for 2025. Over recent months, expectations for aggressive monetary easing have been consistently pared back due to the economy’s resilient performance. Fresh US data released today showed retail sales rising by 0.7% MoM in November, driven largely by a jump in motor vehicle purchases, underscoring robust consumer demand heading into year-end. In currency and bond markets, the dollar index edged higher, trading just below 106.9, while the 10-year US Treasury yield held steady, hovering around 4.38% after failing to break through the 4.4% level.

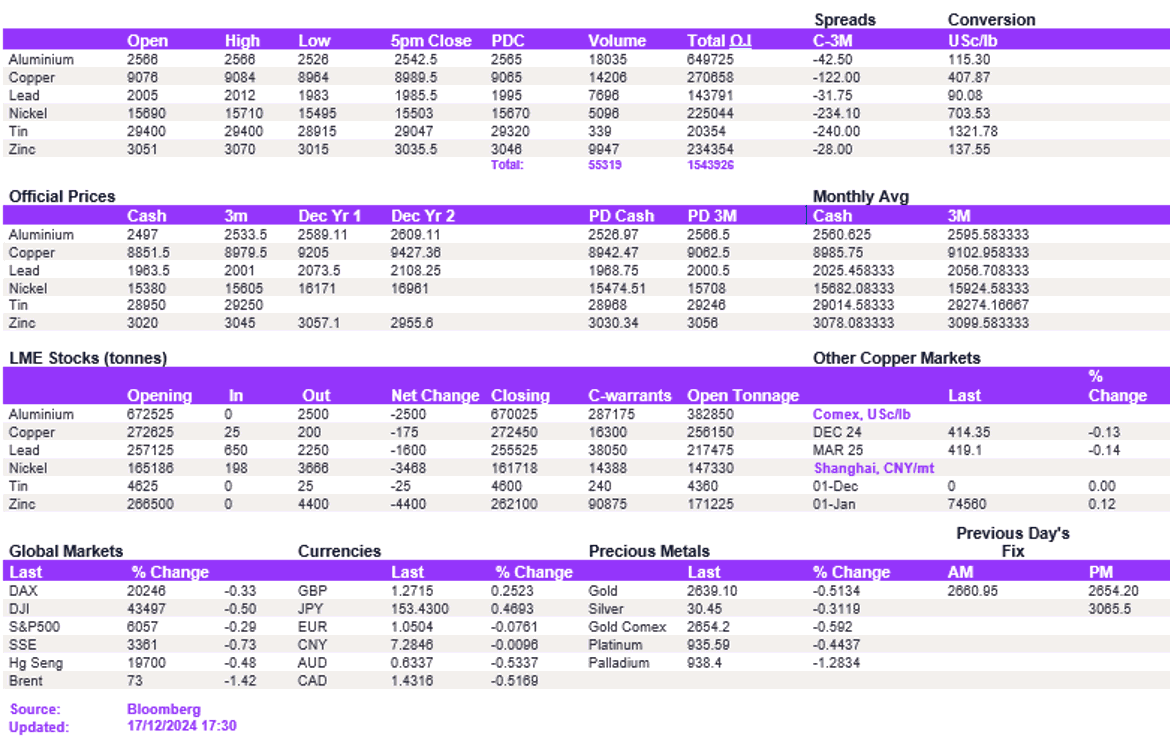

LME base metals were broadly lower today, with all major contracts in the red. Copper fell below the key $9,000/t mark, trading at $8,985/t at the time of writing. Aluminium dropped to $2,543/t, its lowest level since mid-November. Lead broke through the $2,000/t support level, slipping to $1,985/t, while zinc declined to $3,040/t. Nickel also weakened, testing the $15,500/t level.

Precious metals weakened today. Gold slipped to $2,639/oz, while silver declined to $30.40/oz. Oil prices also gave back recent gains, with WTI at $69.40/bbl and Brent crude at $72.70/bbl, reflecting softer sentiment in energy markets.

All price data is from 17.12.2024 as of 17:30