US equities opened lower today, tracking declines in European markets, as weaker-than-expected economic data weighed on sentiment. November’s New Home Sales in the US came in slightly below expectations at 664k but showed improvement compared to October’s revised figure of 627k, signalling some resilience in the housing market. Meanwhile, the Conference Board’s Consumer Confidence Index for December fell sharply to 104.7, missing forecasts of 113.2 and lower than the upwardly revised 112.8 in November. The decline highlights growing caution among consumers as inflationary pressures and economic uncertainty persist. The dollar remained elevated, with the dollar index trading at 108.2, reflecting continued demand for the greenback. The 10-year US Treasury yield rose steadily throughout the session, reaching 4.57% at the time of writing, underscoring hawkish sentiment surrounding the Fed’s next steps. In the UK, GDP for Q3 was flat at 0.0% QoQ, falling short of expectations and reinforcing concerns about the country’s fragile economic recovery. The GBP/EUR pair traded rangebound, hovering around 1.206 as markets digested the data.

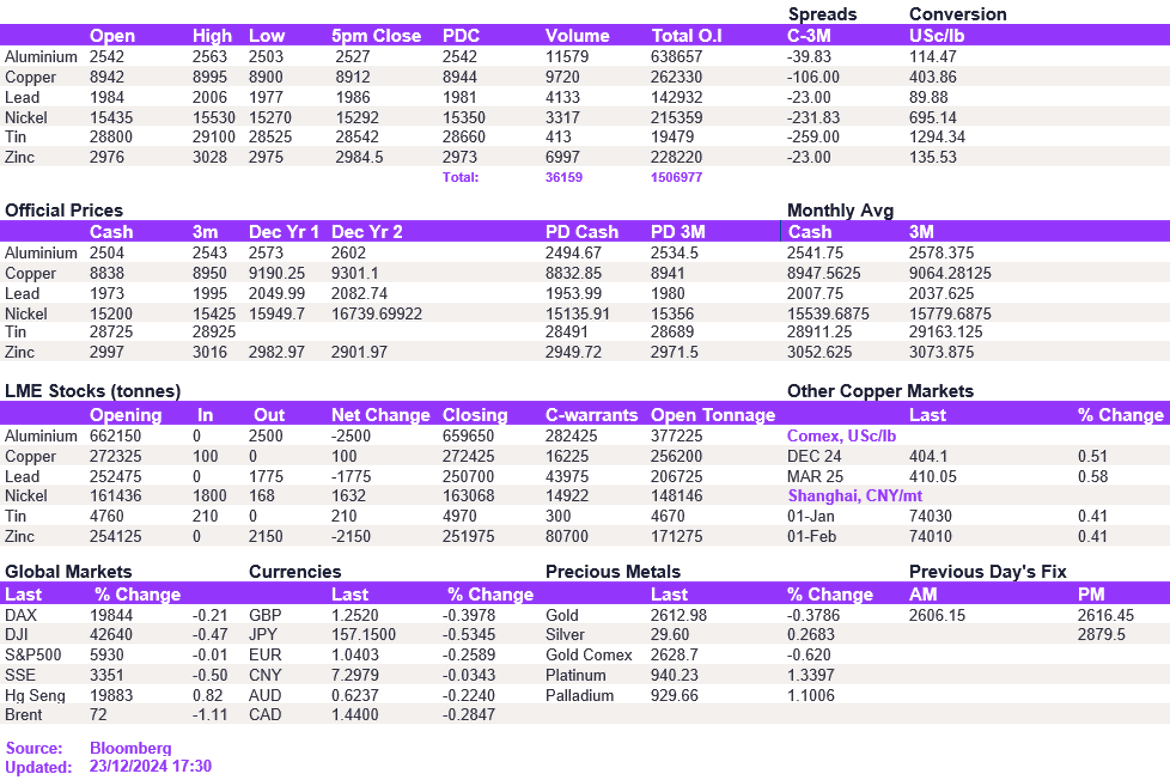

Base metals opened the day on the front foot but struggled to break above the psychological resistance levels, resulting in moderate moves. In particular, aluminium and copper tried to breach the £2,550/t and $9,000/t mark, but a lack of appetite above these levels prompted them to close lower to $2,527/t and $8,912/t, respectively. Likewise, lead and zinc failed above $2,200/t and $3,000/t. Nickel remained below $15,500/t.

Gold softened, slipping to $2,612/oz, while silver remained below $29.60/oz. Oil prices initially saw minor gains in early trading but later reversed, with WTI at $68.80/bbl and Brent crude at $72.20/bbl.

All price data is from 20.12.2024 as of 17:30