US stocks opened lower today as markets reacted to fresh economic data and global developments. The final S&P Global PMI figures for December showed a significant upward revision in US Manufacturing PMI, rising from 48.3 to 49.4. While still in contraction territory, the revision indicates a smaller-than-expected slowdown in the manufacturing sector. In contrast, Eurozone and UK manufacturing PMIs were revised slightly downward, heightening concerns about weakening economic conditions, which are expected to be exacerbated by potential tariffs from Trump’s administration. The US economy continues to demonstrate resilience, supported by robust GDP growth and persistently low unemployment levels. This strength pushed the USD/EUR currency pair to its highest level since 2022, approaching 0.98. The dollar index surged past the 109 mark, trading at 109.4, while the 10-year US Treasury yield held steady above 4.6%, reflecting steady sentiment in bond markets.

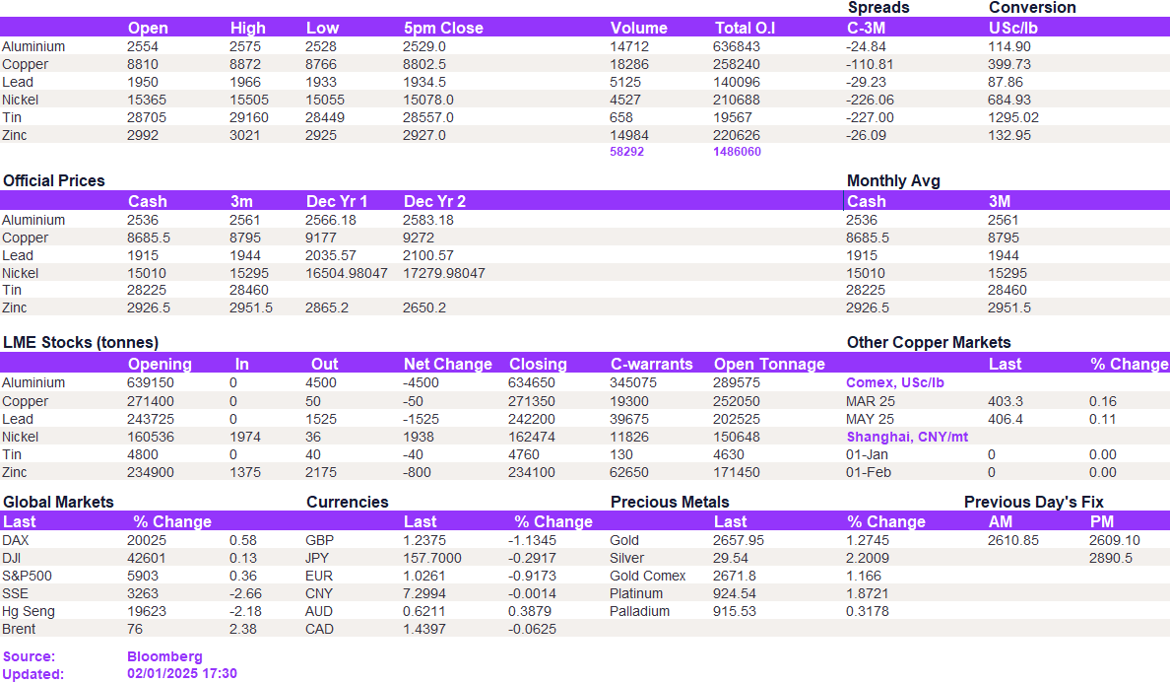

In Asia, December’s Caixin China Manufacturing PMI came in at 50.5, slightly lower than expectations and barely in expansion territory. The disappointing data weighed on the LME base metals complex, with declines across the board. Aluminium broke the $2,550/t support level, falling to $2,528/t, while copper slipped below $8,790/t. Lead breached its long-standing $1,950/t support level, trading at $1,936/t, and zinc dropped to $2,933/t. Nickel also saw declines, settling at $15,090/t.

Conversely, precious metals gained momentum today, with gold climbing to $2,657/oz and silver jumping to $29.50/oz as investors sought safe-haven assets. Oil prices also advanced, supported by data showing US crude inventories falling for the sixth consecutive week. WTI rose to $73.60/bbl, while Brent crude increased to $76.30/bbl.

All price data is from 02.01.2025 as of 17:30