US stocks opened higher today, driven by strong gains in tech stocks. Nvidia surged 5%, with investors eagerly anticipating CEO Jensen Huang’s speech. Final PMI prints for December highlighted mixed economic signals. The US Composite PMI was revised lower to 55.4 from 56.6, indicating a slight slowdown in economic activity. The UK PMI also came in below expectations, while the Eurozone reading saw a modest upward revision, providing a glimmer of optimism for the region. These results contributed to the euro edging slightly higher against the pound. The dollar index fell sharply, dropping to just above 108, as it corrected from last week’s holiday-driven volatility. Thin liquidity and fewer participants had heightened moves in the currency space, but this week’s focus shifts to US payrolls data, which could reinvigorate dollar strength if the numbers exceed expectations. In bond markets, the US Treasury auction later today pushed yields on 30-year bonds to their highest level in over a year. Meanwhile, the 10-year US Treasury yield climbed above 4.6%.

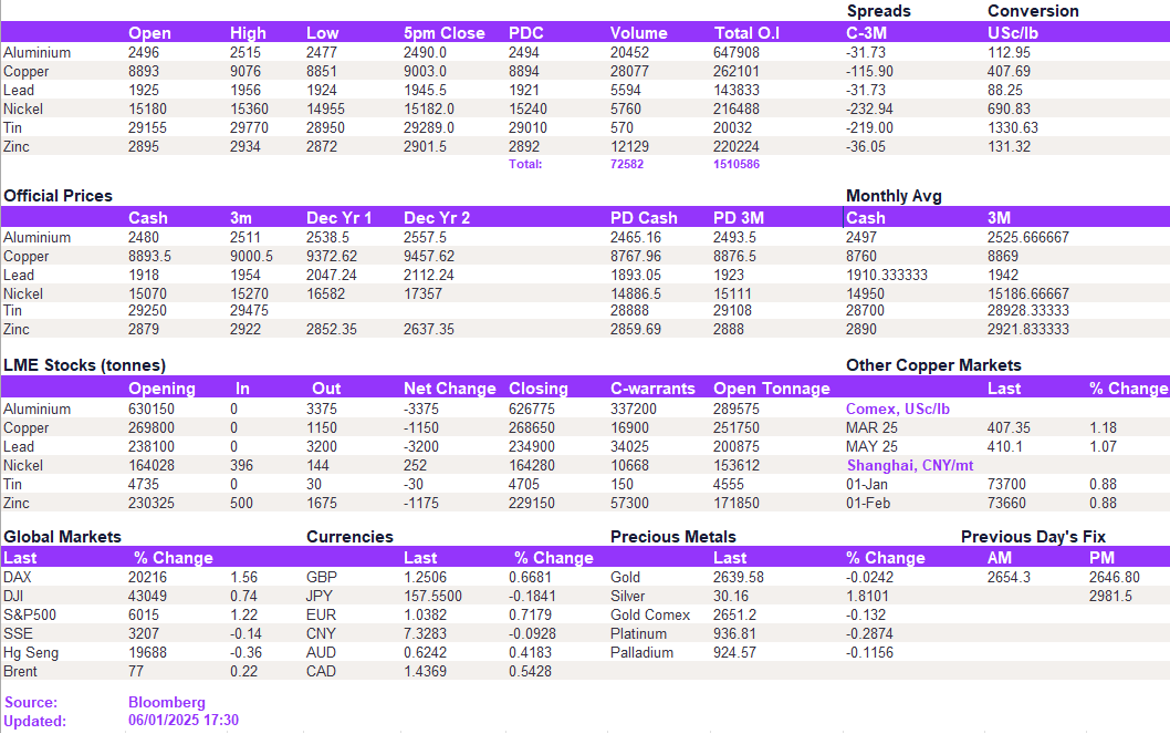

The LME saw limited activity as the market continued to await a clear catalyst, particularly the direction of policies under Donald Trump’s upcoming presidency. Copper managed to break above $9,000/t, while lead recouped Friday’s losses but struggled to breach $1,950/t. Other metals remained relatively flat: aluminium held below $2,500/t, nickel edged up to $15,215/t, and zinc hovered just under $2,890/t.

Precious metals delivered a mixed performance. Gold dipped slightly to $2,640/oz, , while silver jumped above $30.10/oz, reaching its highest level since mid-December. Oil prices moved higher, supported by optimism over supply-demand dynamics and falling US crude inventories. WTI rose to $74.20/bbl, while Brent crude climbed to $76.80/bbl, extending their recent upward trend.

All price data is from 06.01.2025 as of 17:30