US stock markets were closed today in observance of a national day of mourning, marking the official state funeral of former President Jimmy Carter. In currency and bond markets, the dollar index remained steady around the 109.2 level, while the 10-year US Treasury yield edged slightly lower, settling at 4.66%.

Economic data from China this morning underscored persistent deflationary pressures. Consumer Price Index growth softened as expected, declining from 0.2% in November to 0.1% in December, pointing to subdued consumer demand. The Producer Price Index, which measures factory gate prices, contracted by 2.3% YoY in December, slightly better than analysts’ forecasts of a 2.4% decline and improving from a 2.5% fall in November. Despite the slight improvement, PPI remains in deflationary territory for the 27th consecutive month, reflecting ongoing challenges in pricing power across China’s industrial sector.

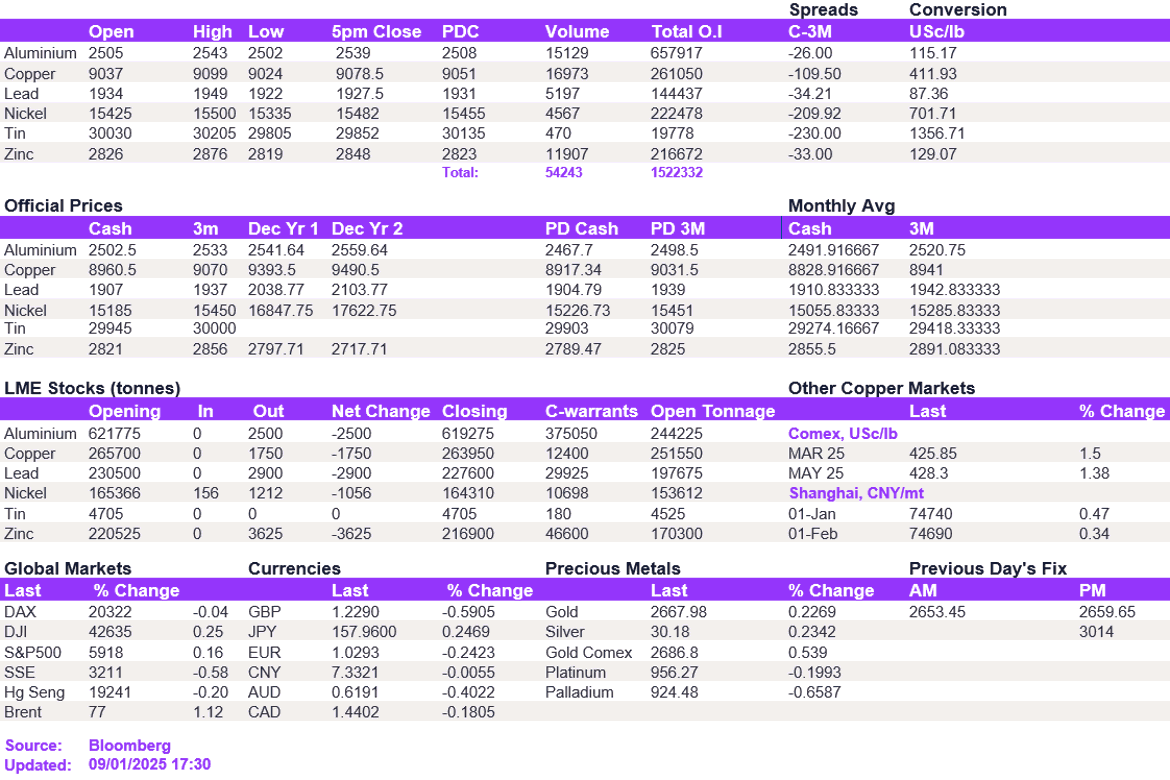

Base metal movements were muted today but showed signs of moderate optimism as prices edged higher, testing resistance levels not seen since mid-December. In particular, copper continued to gain momentum above the $9,000/t mark, edging higher to $9,078.50/t. Aluminium also remained above the key support level at $2,500/t. Nickel is approaching the $15,500/t mark, but as mentioned in yesterday’s comment, the appetite to break above this level is diminishing. Zinc closed at $2,848/t.

Precious metals extended their gains, with gold nearing $2,680/oz and silver approaching $30.50/oz as safe-haven demand continued to strengthen. No trading activity was recorded for WTI or Brent crude today due to the US market closure.

All price data is from 09.01.2025 as of 17:30