US stock indexes opened lower today, with the exception of the Dow Jones, which managed a modest rise. Recent winners, including artificial intelligence companies and bitcoin-related stocks, led the decline as traders adjusted their expectations for Fed policy this year. The prospect of substantial relief through rate cuts has diminished amid strong economic data, placing pressure on these high-performing sectors. In global trade news, China’s trade surplus with the rest of the world reached a record high of nearly $1 trillion in 2024. This surge was likely a result of "front-loading" exports, as producers accelerated shipments to get goods out before a potential trade war with the incoming Trump administration. In currency and bond markets, the dollar index tested the 110 level, reflecting its strength amid shifting Fed expectations. The 10-year US Treasury yield edged slightly lower but remained near 4.8%, a level not seen since 2023 before monetary policy easing began. This persistence at elevated levels is due to robust US economic data, which has reshaped market expectations, now anticipating only one 25bps rate cut from the Fed this year instead of a more aggressive easing cycle.

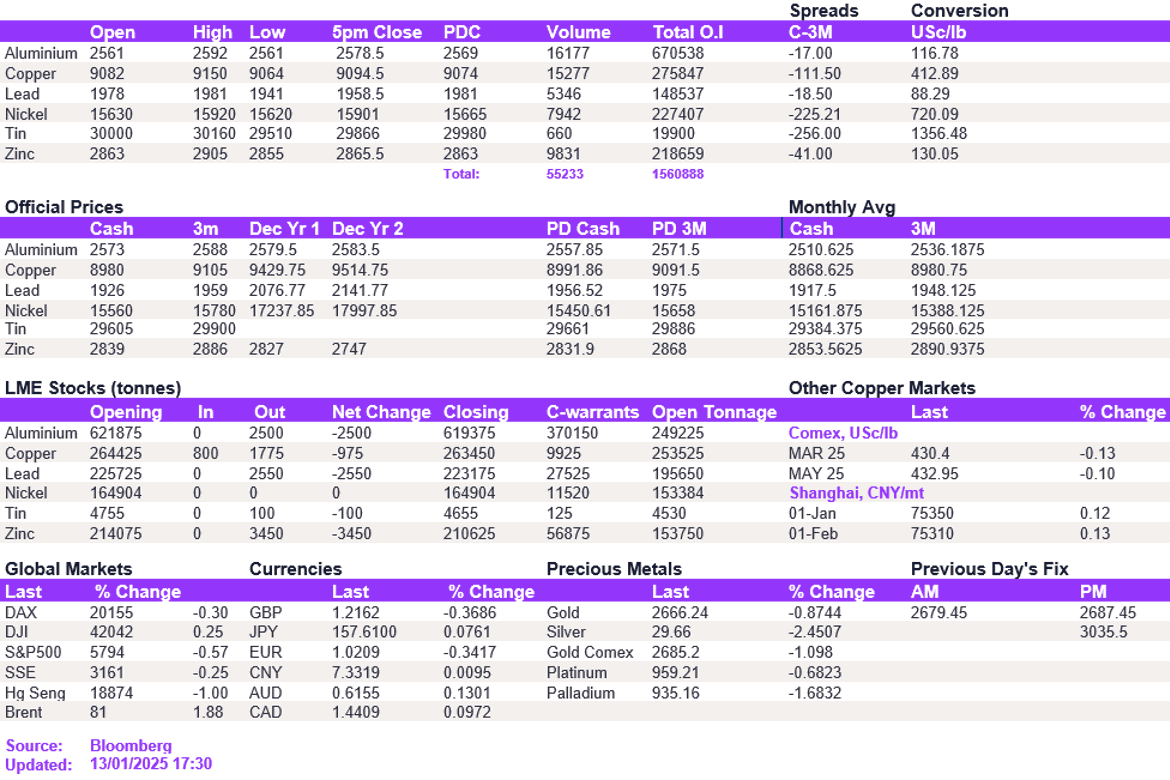

Base metals have maintained a modest rally despite the continued strength of the US dollar index, which has climbed to 110. Indeed, a decoupling appears to be emerging between base metals and the dollar, which traditionally exhibits a strong negative correlation. Instead, the COMEX/LME copper arb is creating volatility in the market, prompting LME to align with the gains seen in COMEX. If copper gains above the $9,200/t level, we expect that more market participants will rejoin the market, leading to further price increases. In the meantime, copper remained slightly below the $9,100/t mark at $9,094.50/t. Aluminium remained elevated, finding support at $2,550/t. Lead corrected back to $1,958.50/t, while zinc held at $2,865.50/t. Nickel continued to gain momentum above $15,500/t.

Gold gave back gains from the previous session, retreating to $2,665/oz, while silver fell sharply below the $30.00/oz mark, trading at $29.60/oz. Oil prices held steady, with WTI at $78.40/bbl and Brent crude at $80.10/bbl.

All price data is from 13.01.2025 as of 17:30