US stocks opened higher today, supported by softer-than-expected producer inflation data. The Producer Price Index (PPI), a key measure of wholesale inflation that tracks the prices producers receive for their goods and services, rose to 3.3% YoY in December, up from 3.0% in November. While this represents a strengthening of inflationary pressures, the increase came in below market expectations of 3.5% YoY, suggesting that price pressures are intensifying at a slower pace than anticipated. In the bond market, the 10-year US Treasury yield continued to hover near the critical 4.8% level but failed to break it. The softer PPI data acted as a counterweight, preventing the yield from surpassing this threshold, which was last breached in October 2023. Any future data or comments from Trump hinting at inflationary risks could provide the push needed to drive yields above 4.8%. The dollar index edged lower today, trading at 109.3, largely due to a recovery in the euro. Heavily oversold in recent days, the euro strengthened, pulling the USD/EUR pair below 0.972 at the time of writing.

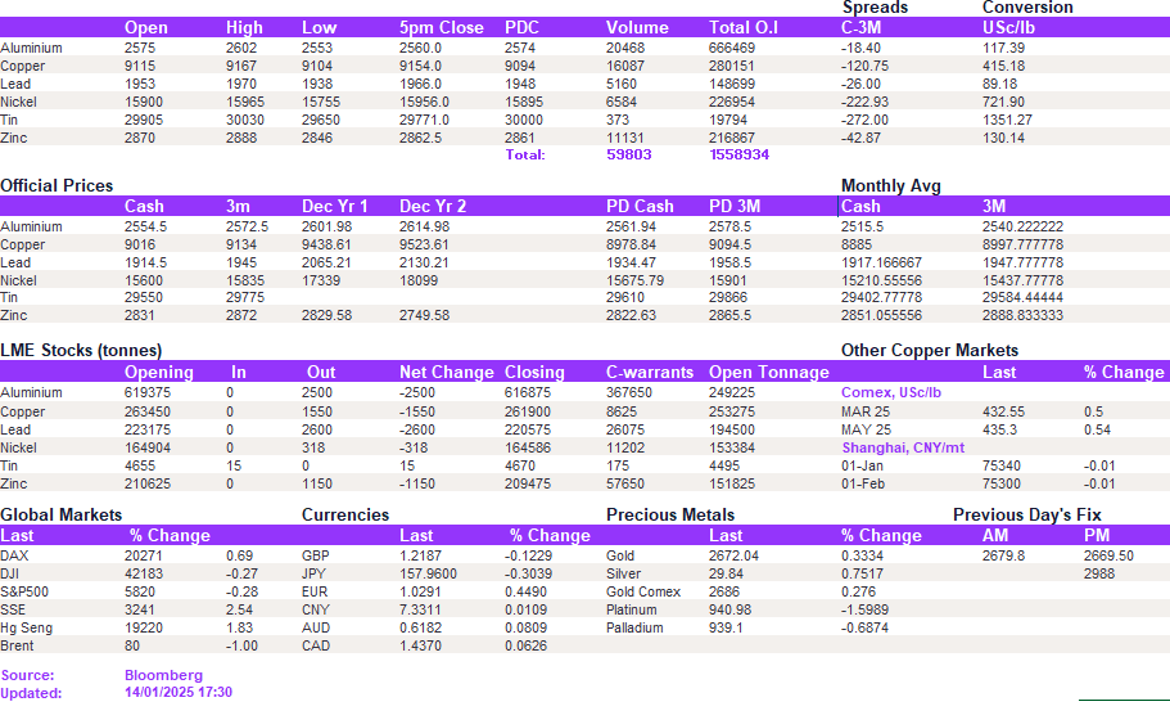

The base metals complex marked another day of moderate gains, with prices moving according to their own trends rather than being influenced by macroeconomic or political events. Indeed, in the last couple of weeks, a stronger dollar did little to sway the market; instead, prices continued to behave in a relatively linear fashion in line with their own pricing fundamentals. In particular, copper and nickel have exhibited consecutive days of moderate rallies, approaching key resistance levels of $9,200/t and $16,000/t, respectively. A break above these levels could set the scene for much sharper gains. Elsewhere, lead continued to fluctuate around the $1,950/t level as zinc remained below the $2,900/t mark. Aluminium held its nerve at $2,562/t.

Precious metals rebounded slightly after yesterday’s losses. Gold climbed above $2,672/oz, while silver tested the $30.00/oz level, though it remained just below that threshold. Conversely, oil prices dipped, with WTI trading at $80.40/bbl and Brent crude at $77.90/bbl.

All price data is from 14.01.2025 as of 17:30