US stocks opened higher today, recovering from yesterday’s declines as investors adjusted their positions ahead of key central bank meetings later this week. However, today’s macroeconomic reports painted a mixed picture of the economy. Durable Goods Orders for December fell by 2.2%, significantly missing expectations of a 0.6% increase. Durable Goods Orders measure the demand for long-lasting manufactured goods, providing insight into business investment and consumer spending trends. A decline suggests softer capital expenditures and potential cooling in economic activity. Additionally, Conference Board Consumer Confidence dropped more than expected, with January’s reading at 104.1, down from an upwardly revised 109.5 in December. The decline reflects increasing consumer concerns about future economic conditions, particularly amid uncertain policy developments. Despite these weaker data points, the dollar index strengthened, rising against major currencies, including the Japanese yen, and trading at 107.9. Meanwhile, the 10-year US Treasury yield also climbed, standing at 4.57%.

Today, President Trump threatened to impose tariffs on US imports of copper, aluminium, and steel. While this marks first direct remark targeting the metal sector, there is still little clarity on the timing, scale, or specifics of these tariffs. Currently, tariffs stand at 10% on aluminium and 25% on steel, with no formal tariffs on copper. These levels also vary for materials imported from China.

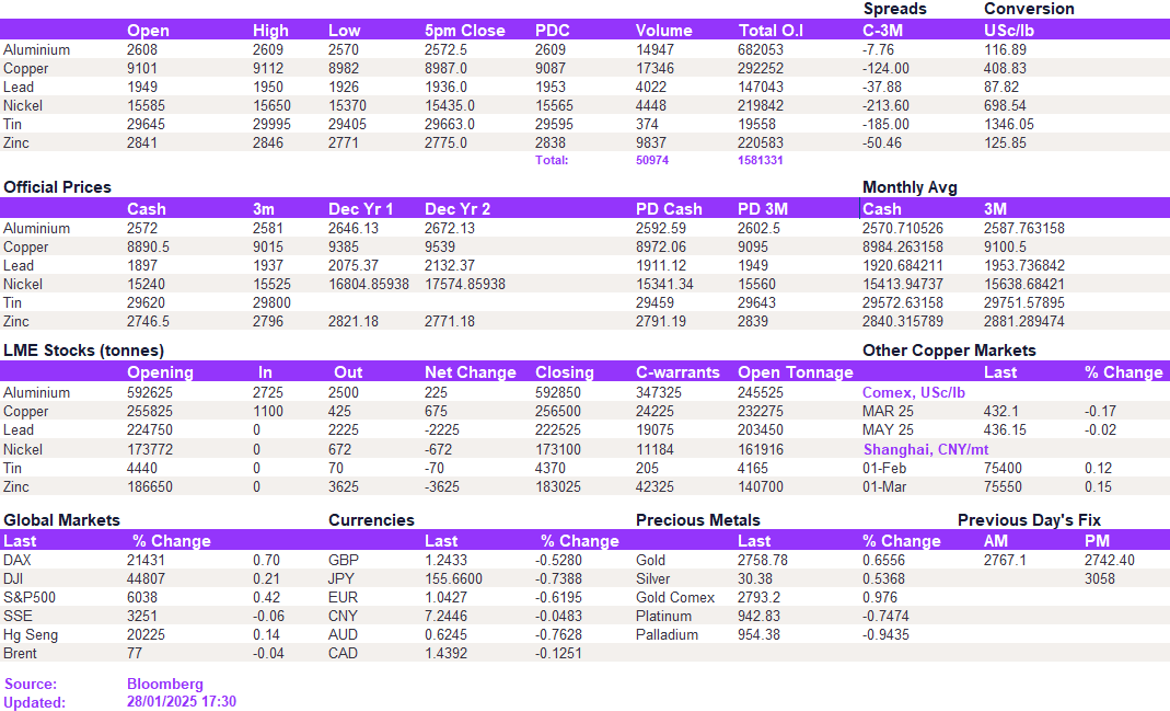

The uncertainty surrounding the scale of changes weighed on LME metals performance. A lack of market participation due to Chinese holidays also further added to the muted sentiment. However, the COMEX market has shown a stronger reaction to these threats. While LME copper weakened to $8,982/t, COMEX copper ticked slightly higher, further widening the premium between two exchanges. There has been a notable trend where tariff and policy uncertainty has been reflected more on COMEX, given greater influence of speculative players. We expect this differential to remain volatile in the coming months given trade policy uncertainty.

In the meantime, aluminium weakened below the $2,600/t mark to $2,570/t. Zinc breached a key support level of $2,800/t, breaking below it to $2,771/t – a September 2024 low. Nickel is trading below $15,500/t at the time of writing.

Gold continued to rise, trading at $2,757/oz, despite higher Treasury yields and a stronger dollar. The recent divergence between traditionally negative correlations of gold and yields suggests increasing demand for the metal as a hedge against geopolitical and economic uncertainties. Silver edged slightly higher, standing at $30.2/oz. Oil prices gained steadily throughout the session, with WTI rising to 73.3/bbl and Brent crude climbing to 77.2/bbl.

All price data is from 28.01.2025 as of 17:30