Dow Jones opened higher, while S&P 500 and Nasdaq declined as investors positioned ahead of the Federal Reserve's interest rate decision. Policymakers maintained the federal funds rate at 4.25%-4.50%, emphasising that there is no urgency to reduce rates. On the macroeconomic front, preliminary wholesale inventories for December declined by 0.5%, missing expectations of a 0.2% increase. Wholesale inventories provide insight into supply chain trends and business demand, and a sharper-than-expected decline suggests that businesses are reducing stockpiles, potentially in response to cautious spending amid economic uncertainty. Despite the weaker economic data, the dollar appreciated against most major currencies, except the yen, with USD/JPY holding the 155.0 support level. The dollar index climbed back above 108, supported by investor positioning ahead of the Fed's announcement and expectations of a steady policy stance.

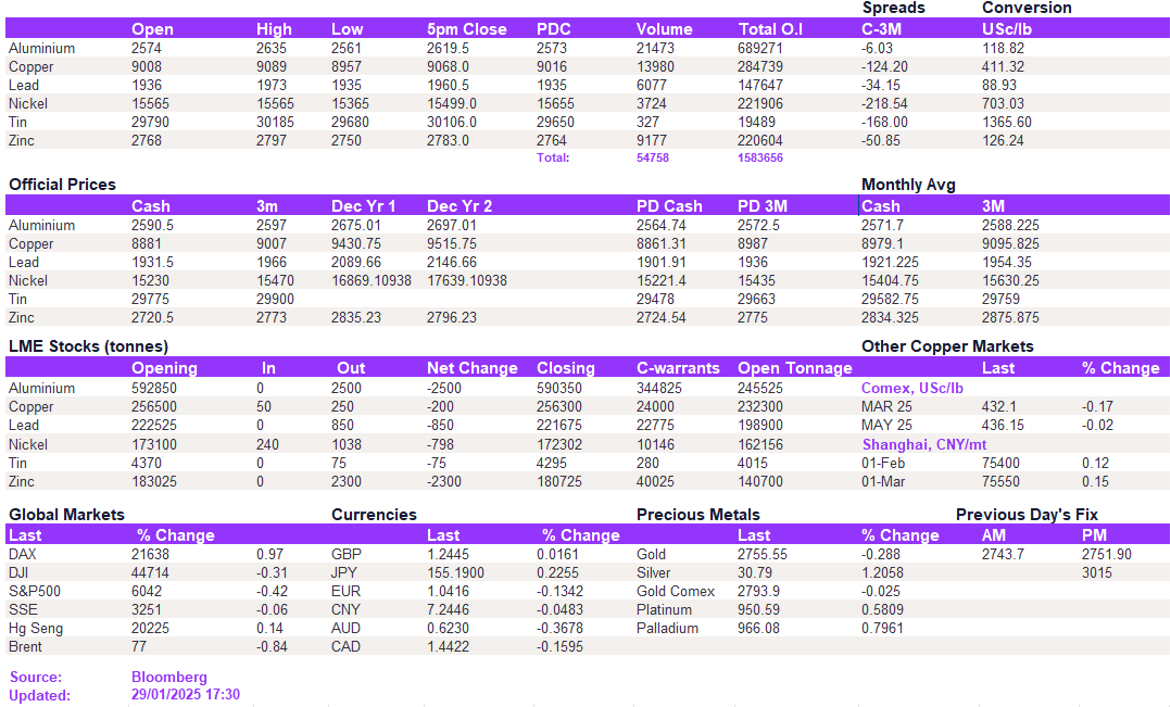

Following the EU's announcement of a ban on Russian aluminium, LME prices strengthened marginally today. Despite delays in implementing the ban, which had previously raised concerns about immediate market tightness, aluminium prices rose to $2,619.50/t. Copper struggled above the $9,000/t, closing at $8,957/t, while lead started to show signs of recovery, jumping above the $1,950/t mark. Zinc solidified support at $2,760/t.

Gold edged slightly lower, trading at 2,753.7/oz, while silver surged to 30.9/oz, reflecting stronger demand from its industrial applications. Silver has shown a strong correlation with copper over the past month, with the 30-day average correlation exceeding 0.85, indicating that broader trends in the industrial metals space continue to influence its price movements. Oil prices fluctuated throughout the session but stood lower at the time of writing, with WTI at 73.2/bbl and Brent crude at 77.1/bbl.

All price data is from 29.01.2025 as of 17:30