US stocks opened lower today, following declines in European and Asia-Pacific markets after Donald Trump imposed new tariffs last Saturday. However, in a late development, Trump agreed to pause the planned 25% tariffs on goods from Mexico just hours before they were set to take effect. Tariffs on Canadian goods remain in place at 25%, alongside a 10% levy on Chinese imports. Energy products from Canada face a reduced tariff rate of 10%, reflecting the strategic importance of cross-border energy trade. While the pause on Mexican tariffs eased some concerns, higher import costs from other regions are still expected to fuel inflationary pressures in the US, particularly in sectors reliant on foreign goods, complicating the Federal Reserve's efforts to manage price stability. In Canada, the tariffs are likely to weigh on business confidence and disrupt supply chains, especially in industries like automotive, agriculture, and energy. The 10% tariff on Chinese goods is relatively modest compared to the previously announced 60%. The dollar surged against major currencies at the start of the day, with the index reaching 109.8, but later softened, trading below 109.0 at the time of writing. The 10-year US Treasury yield dropped to 4.5%.

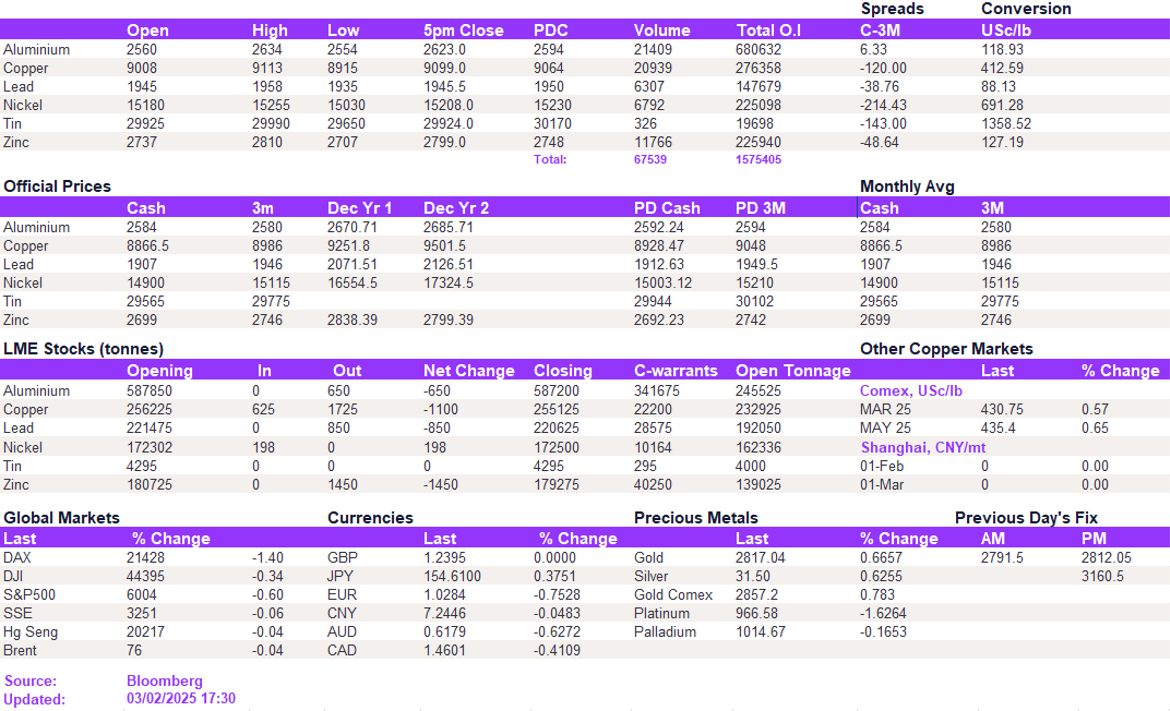

In line with our previous comment, the weekend announcement from the Trump administration about a 10% increase in tariffs on China generated positive sentiment across the market. Notably, aluminium, which is highly concentrated in production geographically and therefore more vulnerable to supply chain disruptions, experienced the most significant increase, rallying back above $2,600/t to reach $2,623/t. While LME copper prices remained subdued at $9,099/t, the COMEX/LME spread stayed elevated, reflecting the speculative impact of the tariffs more accurately through COMEX. Meanwhile, gains in other metals were moderate. While lead and zinc strengthened today, they remained below their respective resistance levels of $1,950/t and $2,800/t. Nickel remained above the $15,000/t support level.

Gold's safe-haven appeal lifted its price to a new record high, reaching $2,830/oz. Silver traded lower at $31.3/oz, continuing its recent trend of behaving more like an industrial metal than a traditional safe-haven asset. Oil prices rose at the start of the trading session but declined later in the day, with WTI and Brent crude trading at $72.7/bbl and $75.6/bbl, respectively.

All price data is from 203.02.2025 as of 17:30