China Under the Spotlight: Retaliations Unfold

Summary

- US stocks rose as trade tensions eased with Mexico and Canada, while new tariffs on China sparked retaliation.

- Metals had a moderate reaction, as they were not directly impacted by the latest tariff developments.

- Gold and silver hit record highs on safe-haven demand; oil prices remained stable.

US stocks opened higher today, recovering from Monday’s volatile session triggered by concerns over escalating trade tensions. Market sentiment improved after the US agreed to postpone the implementation of 25% tariffs on imports from Mexico and Canada following last-minute negotiations. Mexico committed to providing additional border support, securing a one-month delay to allow further discussions, while Canada signalled its willingness to engage in talks, easing fears of an imminent trade war.

On the macroeconomic front, factory orders for December disappointed, falling by 0.9% MoM, worse than expected and following a -0.4% decline in November. This larger-than-anticipated drop signals a setback in manufacturing activity, likely influenced by reduced demand in key sectors towards the end of the year. The final print for durable goods orders confirmed a sharp decline of -2.2% in December, largely driven by a drop in transportation equipment orders, which can be volatile and significantly impact the headline figure. Despite this decline, broader manufacturing trends have shown resilience in other sectors, indicating that the weakness may be temporary rather than part of a sustained downturn. The US dollar softened against major currencies, notably the British pound and the euro, as easing trade tensions reduced safe-haven demand. The dollar index edged lower, hovering just above the 108.0 level. Meanwhile, the 10-year US Treasury yield remained relatively stable at 4.55%.

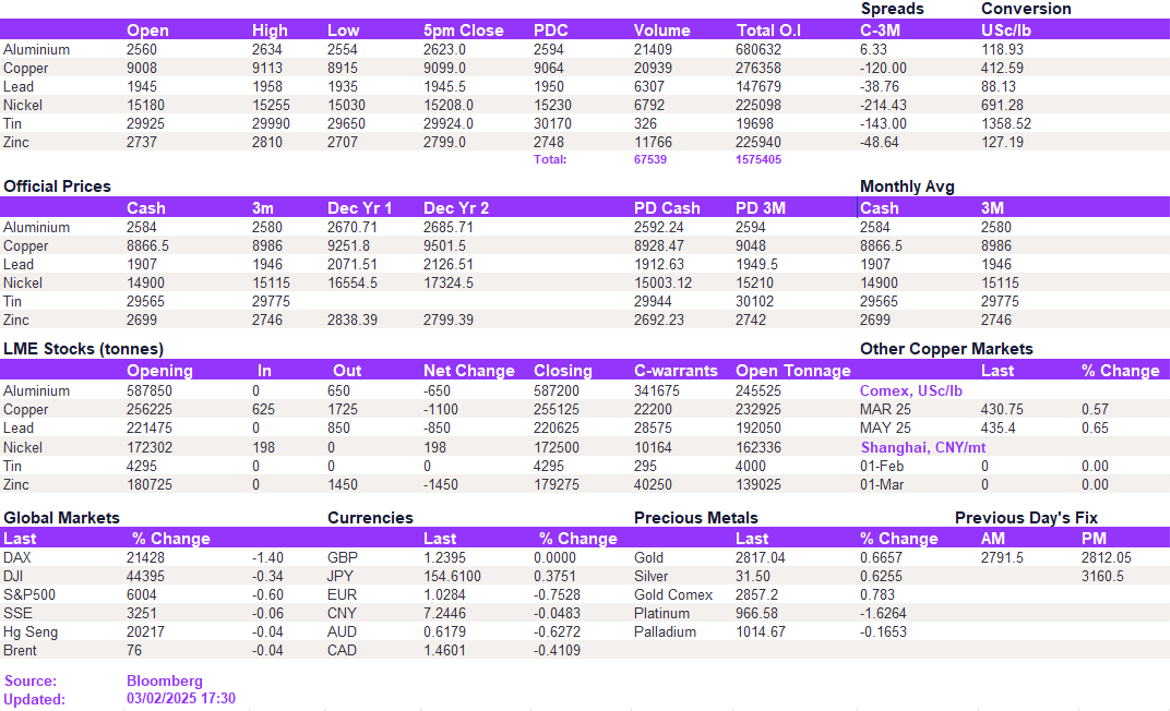

While tariffs on Mexico and Canada were postponed, an additional 10% tariff on China was implemented today. In response, Beijing retaliated by targeting several American companies and proposing their own levies on US goods, including a 15% levy on coal and LNG, as well as a 10% fee on American oil and agricultural equipment, which will take effect next week. Additionally, China announced export restrictions on metals essential for defence, clean energy, and various industries; however, none of the base metals was included on this list. Given the moderate tariff increases from both sides, markets are hesitant about the protracted impact on both economies, provided that the situation does not escalate further. As a result, the market reaction was moderately positive today; a softer dollar supported the risk-on appetite. Aluminium and copper remained above the key support levels of $2,600/t and $9,000/t, respectively. Lead remained broadly unchanged as zinc closed just below the robust $2,800/t resistance level. Nickel held its nerve at $15,208/t.

In the precious metals market, gold continued its rally, breaking new record highs at $2,835/oz, driven by persistent safe-haven demand amid geopolitical uncertainty. Silver also gained, surpassing the $32.0/oz resistance level to trade at $32.1/oz, supported by its recently strong correlation with base metals like copper. Oil prices were relatively flat, with WTI trading at $73.0/bbl and Brent crude at $76.4/bbl.

All price data is from 04.02.2025 as of 17:30