All Eyes on the Jobs Data

Summary

- The Bank of England continued its rate-cutting cycle, leading to a weaker pound and reinforcing expectations of further monetary easing.

- Base metals saw mixed performance, with aluminium and copper trading flat, while zinc and nickel posted gains amid shifting market dynamics.

- Gold retreated from record highs, while silver remained resilient above key support levels, reflecting ongoing investor interest despite recent price corrections.

US stocks opened mixed today, with the Dow Jones declining while the S&P 500 and Nasdaq edged higher. Market attention was on the Bank of England’s decision to cut interest rates from 4.75% to 4.50%, in line with expectations. This marks another step in the BoE’s easing cycle as it navigates slowing economic growth and moderating inflation. The pound weakened following the announcement, with USD/GBP reaching 0.808. Meanwhile, the dollar index traded higher at 107.8 at the time of writing, while the 10-year US Treasury yield recovered slightly to 4.45% after yesterday’s decline. Markets are closely watching the nonfarm payroll data tomorrow, which is expected to increase from 175,000 to 256,000, further solidifying the strength of the US labour market. This should bolster the dollar in the meantime.

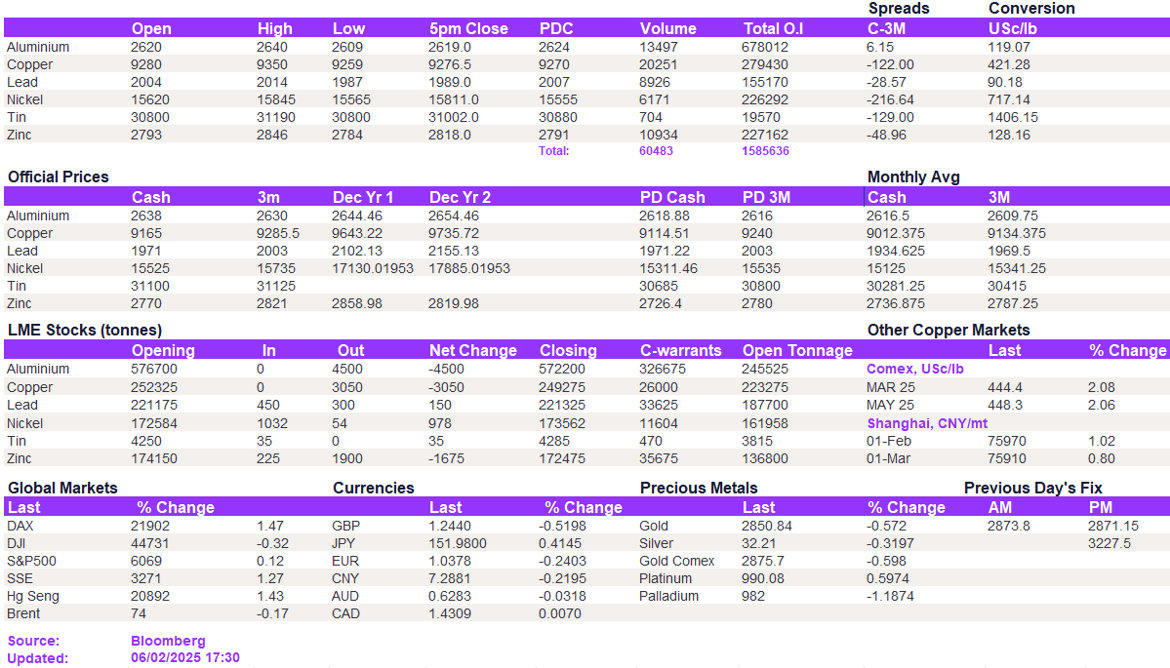

In the base metals market, aluminium and copper showed little movement, with aluminium trading nearly flat at $2,619/t and copper edging higher to $9,281/t. Lead declined to $1,987.5/t, while zinc climbed above the $2,800/t level, closing at $2,818/t. Nickel also posted gains, rising to $15,811/t.

Gold retreated from record highs, giving up most of yesterday’s gains to trade at $2,851/oz, though it remains elevated. Silver also declined but managed to stay above the $32.0/oz level, trading at $32.12/oz at the time of writing. Oil prices were little changed, with WTI at $71.2/bbl and Brent crude at $74.8/bbl.

All price data is from 06.02.2025 as of 17:30