Metals: The Latest Target of US Tariffs

Summary

- Renewed trade tensions following Trump's steel and aluminium tariffs have raised concerns over global trade disruptions and higher input costs for US manufacturers.

- Base metals’ reaction to a 25% US tariff on aluminium and steel was muted, given the lack of clarity on the tariff specifics.

- Gold surged to record highs as investors sought safe-haven assets amid economic uncertainty, while oil prices advanced steadily.

US stocks opened higher today, tracking gains in European markets despite renewed trade tensions following President Trump’s latest tariff announcement. On February 9, Trump announced plans to impose a 25% tariff on all steel and aluminium imports, with the measures taking effect on February 10. The European Commission responded swiftly, signalling its intention to introduce countermeasures to protect European industries. This move echoes the trade disputes of Trump's first term when similar tariffs imposed in 2018 led to EU retaliation and subsequent negotiations that resulted in a quota system. The new tariffs have sparked concerns over rising input costs for US manufacturers and potential disruptions to global trade. The dollar strengthened against major currencies, with the dollar index trading higher at 108.2. After a sharp increase on Friday, the 10-year US Treasury yield edged lower, settling at 4.47%.

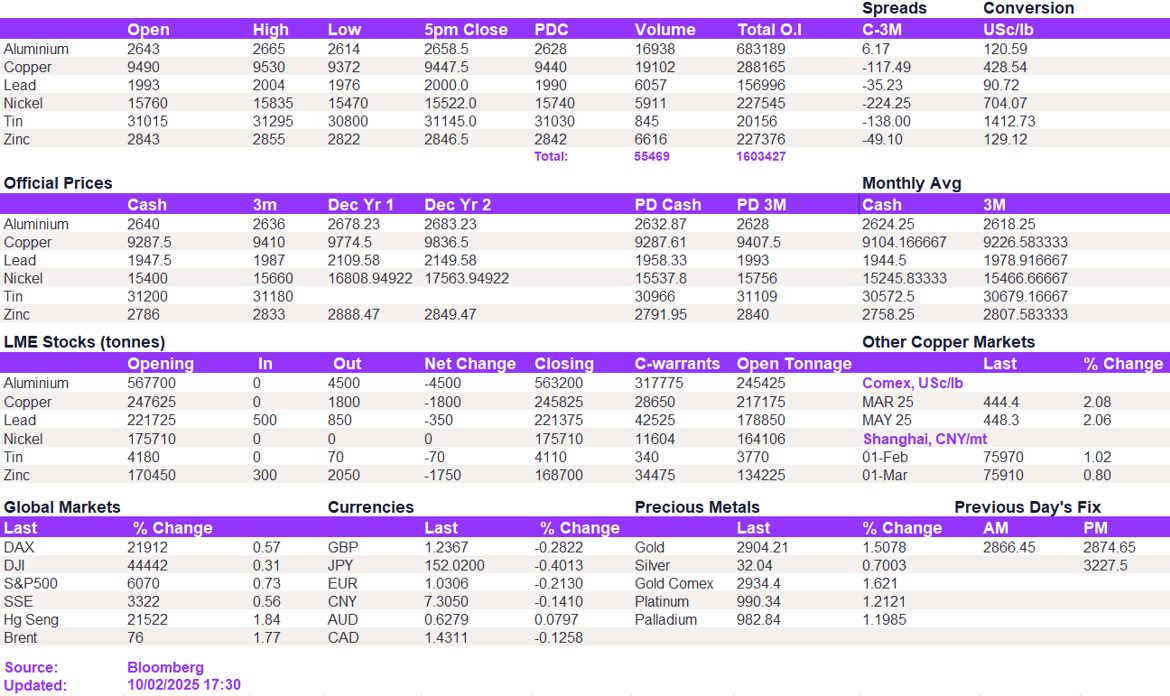

In the base metal space, despite a 25% tariff announcement on aluminium and steel, the price reaction was muted today, given the lack of clarity on the tariff specifics. Aluminium jumped above the $2,600/t resistance level but struggled above the previous high of $2,661/t. We believe that markets are becoming more desensitised to tariff threats unless they fully capture their implications. Copper, on the other hand, jumped higher on the open, testing the $9,500/t once again but struggling to break significantly above this level. At the same time, the support at $9,400/t held firmly, keeping copper in a narrow range. The COMEX/LME spread continued to widen, with COMEX pricing in tariff threats more heavily. While we believe a correction is due, it is likely to be marginal, with solid support forming at $9,200-9,300/t. Elsewhere, lead and zinc held their nerve at $2,000/t and $2,846.50/t, respectively. Nickel sold off, breaking below $15,600/t.

Gold extended its rally, reaching another record high above $2,909/oz as uncertainty surrounding the broader economic impact of trade restrictions drove safe-haven demand. Silver followed suit, rising to $32.2/oz. Oil prices advanced steadily, with WTI trading at $71.7/bbl and Brent at $75.3/bbl.

All price data is from 10.02.2025 as of 17:30