Summary

The third quarter of this year was marked by significant volatility. The central banks began their interest rate cutting cycles, with the Fed initiating a 50bps cut at its first meeting. The ECB is on a similar path, but it is facing strong pressures to cut due to the weakening performance of the Eurozone, which is creating a larger yield differential compared to the US.

In China, authorities are aiming to stimulate the economy through fiscal and monetary policy measures; however, they are struggling to restore market confidence, particularly in the construction sector. These factors, combined with the upcoming US elections in November, create a strong likelihood of increased volatility.

Interestingly, base metals appear to be diverging from these trends, as speculative markets lack clarity to guide the trend. In this report, we will examine the potential trajectories for base, ferrous, and precious metals in the final months of the year.

Watch our Q4 2024 Metals Market Webinar

Aluminium

Aluminium continues to face moderate upside pressures, driven by a combination of increased confidence following announcements from China and ongoing supply disruptions in alumina production. We anticipate these factors may lead to short-term volatility spikes in Q4 2024. However, due to subdued overall performance in China and an oversupply of refined aluminium, subsequent mean-reversion strategies will likely offset these gains. The support at $2,450/t should hold in the meantime.

Copper

Copper, like the broader metals complex, saw a notable boost from Chinese stimulus measures, prompting it to temporarily breach the $10,000/t mark. However, this momentum was short-lived, as the government failed to introduce more concrete measures for the construction segment. In Q4, we expect prices to soften moderately as markets adjust to China's subdued growth outlook. Nevertheless, we expect prices to gain momentum again in December, fuelled by renewed hopes for the country's recovery in 2025.

Lead

Lead prices continued to fluctuate in Q3, mirroring zinc's moves at times of strong directional appetite. This was particularly evident due to increasing optimism about a recovery in the construction segment following the recent fiscal announcement. However, with no significant changes in fundamentals expected for the remainder of the year, lead prices will likely continue fluctuating within their current ranges, with limited potential for upward movement due to ample lead supply.

Nickel

Nickel experienced strong upside pressures in Q3, boosted by concerns over potential Russian export curbs. However, due to significant supply challenges, this upward trend was not sustained, and prices fell back below $17,000 per tonne. As we head into Q4, we see several headwinds for nickel. In particular, ongoing output expansion at Indonesian mines and weak construction demand from China significantly impact metal prices. We expect that nickel will struggle to stay above $18,000/t as we approach the year-end.

Tin

Moving into Q4, tin’s performance remains constrained by liquidity issues. While some supply improvements from Congo and Indonesia provide stability, broader economic signals from China are likely to guide prices within a $30,500/t to $34,000/t range.

Zinc

Zinc prices have remained elevated in Q3 2024, breaching the $3,000/t resistance level. The tight supply of zinc concentrate is contributing to these elevated prices, leading to a reduced surplus of refined material this year. We anticipate that demand dynamics will have a more significant impact on zinc prices than supply constraints. Therefore, we expect prices to remain high in the final months of 2024.

Iron Ore

After months of subdued performance, iron ore prices soared to $110/mt, fuelled by announcements of fiscal and monetary support from China. However, we do not anticipate the construction segment to improve in the coming months, limiting the upside potential for iron ore in the fourth quarter of 2024. The supply and demand fundamentals also indicate an oversupply of material, which should keep iron ore prices muted as we approach the year-end.

Gold

As we enter Q4 2024, further Fed easing and inflationary concerns linked to upcoming US elections are expected to sustain gold's appeal. Demand from central banks, especially in countries with regional instabilities like Poland and Turkey, strengthens the metal’s upward momentum. Overall, gold appears well-positioned to surpass $2,800/oz by year-end.

Silver

Silver is set for continued gains in Q4 2024, trading above $34/oz due to strong safe-haven demand and tightening supply from mining constraints. Rising industrial demand, especially from China’s solar sector, adds to its bullish outlook. Given these drivers, silver is likely to break above $35/oz.

Platinum

Platinum prices are under pressure entering Q4 2024, held below $1,000/oz by weak automotive demand and limited ETF interest. Despite minor supply challenges from South Africa, low automotive production limits demand growth, keeping prices subdued, barring any significant market shifts.

Palladium

Palladium is facing downward pressure as we enter Q4 2024. Weak automotive demand, boosted by stricter emissions targets and BEV adoption, limits demand growth. While temporary supply constraints in South Africa may provide minor support, prices are expected to stay within $900–$1,100/oz due to ongoing demand challenges.

Macroeconomic Outlook

Global Economy

As we enter Q4 2024, the global economic landscape remains varied, with some regions showing resilience despite broader challenges. The IMF's most recent projections anticipate global GDP growth of 3.2% this year, with a dip to 3.1% expected in 2025. While growth is moderating in major economies, several emerging markets are exhibiting positive momentum. India continues to lead global growth, driven by robust domestic consumption and expanding manufacturing sectors. Southeast Asia, particularly Vietnam and the Philippines, has also shown strong economic resilience, with Vietnam’s PMI returning to expansion territory and the Philippines experiencing steady growth in manufacturing and services.

Elsewhere, Japan's economy has benefitted from an uptick in exports, particularly to the US and Southeast Asia, as well as an increase in government spending to revitalise domestic demand. Australia, too, has shown improvement, bolstered by strong commodity exports and increased investment in its mining and energy sectors. Latin America, however, remains mixed, with Brazil and Mexico experiencing stable growth, while Argentina faces economic struggles due to inflationary pressures and political instability.

Globally, central banks are increasingly focused on accommodating weaker growth and low inflation. The Bank of Canada has signalled further rate cuts to support economic recovery, while in the UK, the Bank of England is weighing further easing to mitigate the impact of slowing business activity. As global inflation pressures ease, policymakers are shifting toward supportive monetary policies, but uncertainty surrounding geopolitical tensions and trade dynamics continues to cloud the broader outlook for Q4 2024.

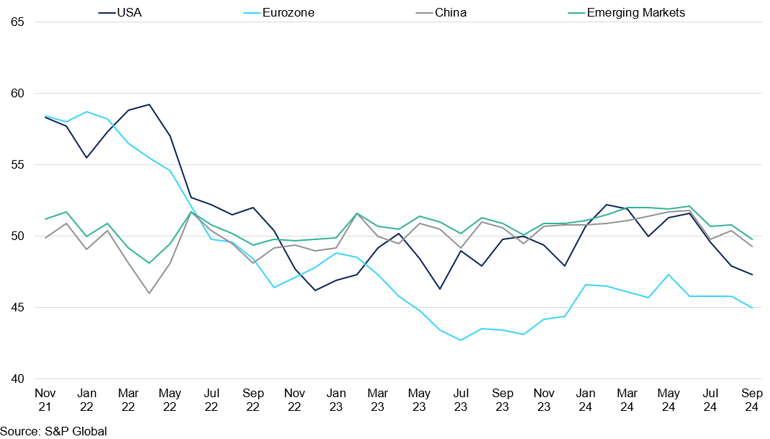

Manufacturing Purchasing Managers’ Index (PMI)

The Eurozone’s factory activity lags behind other major economies.

Oil

The oil market is entering Q4 2024 with a bearish outlook, driven primarily by weaker demand expectations from China and an easing of supply concerns in the Middle East. As the world's largest crude oil importer, China's economic slowdown is exerting significant downward pressure on prices. Both the International Energy Agency and OPEC have revised their oil demand forecasts downward for 2024. OPEC cut its estimate for China's oil demand growth to 580,000 bpd from a previous forecast of 650,000 bpd. The IEA projects global oil demand growth to slow to just 900,000 bpd next year, highlighting concerns about a potential oversupply in the market.

Geopolitical tensions in the Middle East have diminished, which had previously propped up oil prices due to fears of supply disruptions - particularly surrounding Israeli-Iranian relations—have diminished. Reports indicating a reduced risk of immediate conflict impacting oil infrastructure have alleviated some of the market's anxieties, removing the ‘war premium’ that had been factored into prices. With supply outstripping weaker demand, the market sentiment remains bearish. Unless there are significant changes - such as stronger economic data from China or unexpected supply disruptions - the outlook suggests that oil prices may remain subdued in the near term, potentially testing lower support levels in the coming weeks.

US

As the Presidential elections approach, US politics and the economy are set to dominate the news in the final quarter of 2024. So far, the world’s largest economy has demonstrated remarkable resilience despite elevated interest rates. Recent data indicates that this trend will continue into Q4 2024, positioning the US for a soft landing. The final GDP report for Q2 2024 was revised upward, showing growth at 3% QoQ, supported by strong consumer spending and business investment. Key sectors like technology and healthcare continue to thrive, contributing to overall economic stability. In addition, August saw record-high exports, underscoring the strength of US manufacturing and strong foreign demand for American goods and services. The stock market, driven by optimism around corporate earnings and solid economic fundamentals, has consistently reached new highs. Both the S&P 500 and Dow Jones indices have set record levels, reflecting investor confidence in the US economy's sustained growth.

Retail sales in September exceeded expectations, rising 0.4% MoM compared to 0.1% in August. Despite months of elevated borrowing costs, US consumers have shown remarkable resilience, dispelling fears of a potential recession. The US labour market remains a key driver of this resilience, with the latest non-farm payrolls report showing an increase of 254,000 jobs in September, the highest since March. While labour market momentum has slowed, layoffs remain at historically low levels, supporting wage growth and boosting consumer confidence. These factors suggest the US economy is well-positioned to maintain its growth trajectory in the coming months.

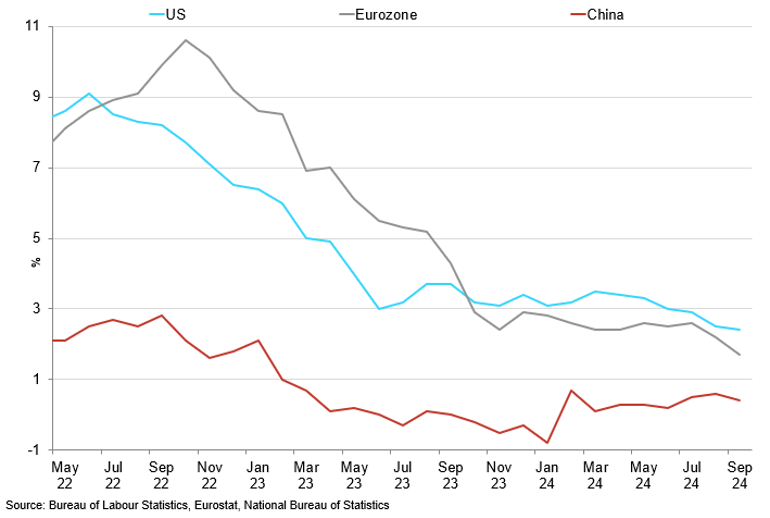

The US economic resilience is also reflected in the dollar, which surged to 103.83 in mid-October despite the Fed’s initiation of monetary easing in September. The Fed cut the federal funds rate by 50 basis points in September, and as of October 21st, markets are pricing in a 92% chance of a 25bps cut at the next meeting on November 7th. Inflation has been softening, with August’s PCE at 2.2% YoY, marking the smallest annual rise in prices in over three and a half years. While it is too early to declare a complete victory over inflation, low oil prices are aiding the Fed’s efforts.

Given the US economy's robust performance and easing price pressures, there is no need for the Fed to implement aggressive rate cuts. We anticipate a total of 50bps cuts over the next three meetings, with a 25bps cut expected at the November meeting. The US economy remains on solid footing as we head into the last quarter of 2024.

Major Economies Headline Consumer Price Index (CPI)

Inflationary pressures have softened further in September.

China

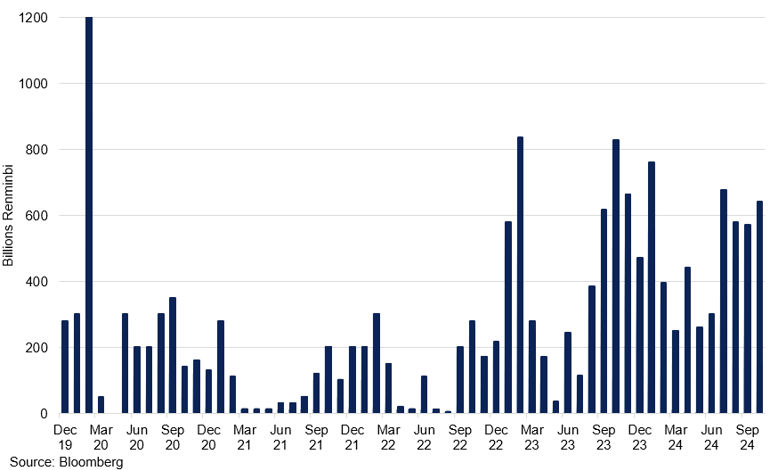

The end of September brought a wave of optimism with the announcement of a substantial fiscal stimulus package in China, reflecting the impatience of investors eager for signs that the world’s second-largest economy might finally regain its footing. This package, the largest since the pandemic, included cuts to interest and mortgage rates, along with measures aimed at boosting the stock market by encouraging institutional investors to increase their holdings. The strategy sought to shift household investment away from the troubled property market. Additionally, the fiscal intervention included the issuance of 2 trillion yuan in bonds, half of which was allocated to support local governments, many of which are teetering on the brink of default due to the collapse of the property sector. This portion aimed to maintain critical infrastructure projects and public services. The other half was directed at stimulating household consumption through incentives like the "cash-for-clunkers" scheme and a monthly child allowance of 800 yuan to address China's population decline.

At LME Week in early October, it was challenging to find anyone who shared our indifferent approach to the stimulus news. Investors saw the package as a potential turning point for the economy. The consensus was that this would finally kickstart growth after months of sluggish performance. However, despite the enthusiasm, we remain cautious about the actual impact, especially considering the deeper structural challenges that persist within China’s economy, primarily stemming from the ongoing real estate crisis. The past two years have demonstrated that the confidence crisis caused by the property slump is deeply entrenched and will only be reversed if the real estate sector stabilizes. In China, real estate remains the primary store of household wealth. No matter how much liquidity is injected into the broader economy, the flow of money will likely be halted by individuals who would typically invest in property but are now hesitant due to the ongoing real estate crisis. In such a scenario, consumers are more likely to save rather than spend or invest, limiting the impact of stimulus measures. Without a stable property market, the wealth effect that drives consumer spending diminishes, preventing the broader economy from gaining the necessary momentum to recover.

Repurchase Agreements (Repos) Denominated in Chinese Yuan

October marked an increase in liquidity injections by the PBOC.

China’s economic hurdles are increasingly difficult to overcome. In September, new home prices fell at the fastest rate in nearly a decade, with little sign of stabilization. Local governments, heavily reliant on land sales for revenue, are under immense financial pressure. As a result, many have resorted to punitive taxation measures, further burdening businesses and entrepreneurs. Meanwhile, youth unemployment has skyrocketed, with the unemployment rate for 16-24-year-olds reaching record highs this year. On top of this, escalating tensions with major trade partners, including the United States and Europe, are casting doubt on the sustainability of China’s export-driven growth model. As 2024 draws to a close, achieving the government's 5% growth target appears increasingly unattainable, especially as domestic challenges persist and external demand continues to falter.

Eurozone

The Eurozone’s economic outlook remains bleak as 2024 draws to a close, with growth showing clear signs of deceleration. In Q3, the region’s GDP expanded by a mere 0.1%, driven by stagnation in its largest economies, Germany and France. Germany, the bloc's economic powerhouse, is on the brink of a technical recession after posting consecutive quarters of contraction, while France is facing its own set of challenges with declining industrial output. In September, Eurozone inflation dropped to 1.7%, marking its first fall below the ECB’s 2% target in three years. At the same time, the region's Composite PMI fell to 48.9, signalling the first contraction in business activity since February. These developments reflect broader economic challenges, with consumer and business confidence weakening amid slowing wage growth. As domestic demand remains subdued and investment momentum stalls, the Eurozone faces mounting headwinds, compounding its struggle to sustain growth in the final quarter of 2024.

In response to weakening growth and declining inflation, the ECB shifted to a more accommodative monetary stance in the second half of 2024, cutting its key interest rate by 25bps to 3.25% in October. This was the third consecutive rate reduction, highlighting the central bank's deepening concerns about the faltering economy. ECB President Christine Lagarde expressed confidence in the disinflationary trend but noted that inflation remains unanchored. With inflation below target and business activity contracting, another 25bps cut is expected in December. Swaps markets are pricing in an additional four to five quarter-point cuts by mid-2025 as the ECB maintains a cautious, data-driven approach.

Despite these efforts, the Eurozone’s economic outlook remains grim. The structural challenges of low productivity, demographic decline, and faltering investment continue to undermine the region’s growth potential. With domestic demand weak and external demand unlikely to provide significant support, the Eurozone is set to face ongoing stagnation in the final quarter of 2024, leaving little optimism for a meaningful recovery.

Aluminium

Key Points

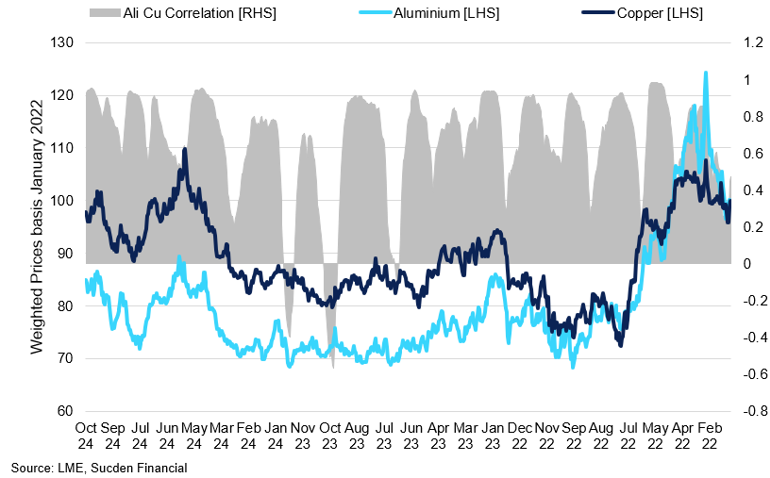

- For much of this year, most metals in the complex saw simultaneous movements as speculative traders drove synchronised trading patterns across the market.

- Any alumina disruptions might lead to short-term upside risk for LME.

- However, muted demand from end-users is unlikely to cause any sustained price in-creases, thereby limiting their upward potential.

Aluminium faced continued upside pressure, surpassing the $2,600/t level, mirroring copper's performance in the third quarter of 2024. Indeed, for much of this year, most metals in the complex saw simultaneous movements as speculative traders drove synchronised trading patterns across the market. There has been a growing disconnect between global macroeconomic factors and individual metals' supply-demand dynamics, resulting in speculative players having a higher influence on metals' moves. Aluminium is no exception.

The correlation between copper and aluminium has strengthened significantly this year, consistently staying above the 60% mark for the last six months. On multiple occasions, the correlation level soared to 90-95%, indicating both metals are being influenced by similar factors. This is further evidenced by the differing supply-demand dynamics for copper and aluminium. Although aluminium is more abundant in supply, it has seen sharper price gains in recent months. Notably, alumina futures have surged, reaching record highs of CNY5,000/mt on SHFE, as China's production is failing to keep pace with rising demand, particularly coming from aluminium smelters in Chinese provinces. Similarly, Australian FOB alumina prices surged to CNY693/mt in October, reflecting the tight alumina supply outside of China. This trend suggests that market participants are more focused on the shorter-term supply issues than the longer-term narrative of the global surplus in refined materials.

Aluminium and Copper Correlation

Both copper and aluminium are being influenced by speculative appetite.

China's leading aluminium producer, Yunnan, has resumed production after a period of inactivity caused by drought conditions that restricted the availability of hydropower needed for smelting operations. This aided the expansion of alumina capacity in the region, with the refinery's operating rate reaching 85%, near full operating capacity. However, tight bauxite supply remains the primary constraint on capacity growth. Environmental regulations implemented in many provinces in recent years have continued to restrict bauxite mining, and there has been no significant recovery thus far. As a result, over 70% of China's bauxite needs have been met with imported material this year, a trend that we expect to increase in the coming year.

As of now, Guinea remains China's primary bauxite supplier, accounting for 72% of total imports during the first nine months of 2024. During this period, Guinea supplied China with a total of 78 million tonnes of bauxite, marking a 12.5% increase YoY and setting a new monthly import record. However, shipment delays are anticipated in Q4 due to the rainy season, which could exacerbate concerns over bauxite availability for Chinese smelters. There have been talks of an Indonesian bauxite ban lift, but we do not expect this to happen anytime soon. This situation could further disrupt the supply-demand balance for alumina, potentially leading to higher aluminium prices across the LME.

The alumina market in China is currently facing a deficit of 100,000 tonnes as of September. With continued smelting production scheduled to be maintained into Q4 2024, the tightness is likely to be exacerbated. Alumina typically represents 30 to 40% of the production costs. If aluminium prices fail to increase in line with the rising costs of alumina, profit margins will be squeezed. If this gap widens further, smelters might be forced to cut production.

Q4 Outlook:

Overall, refined material is set to remain in a delicate balance for 2024. Any alumina disruptions might lead to short-term upside risk for LME. However, subsequent mean-reversion strategies are likely to persist and nullify the impact of these gains. The absence of significant demand from China over the long term is expected to prevent any sustained price increases in the coming months, thereby limiting their upward potential.

Copper

Key points

- China's stimulus announcements have been key in driving copper prices in recent months.

- CTAs have had the biggest influence on copper sentiment, a trend we expect to hold for Q4 2024.

- Given continued concentrate shortages and the possibility of further announcements from China, we see little downside for the market below the $9,400/t level.

Copper has experienced fluctuations in recent months, with a notable increase prompted by the release of Chinese stimulus measures, pushing prices to breach the $10,000/t level in September. However, this momentum was short-lived, as follow-up announcements from the Finance Ministry failed to bring more concrete measures targeting the construction industry. From a longer-term perspective, market sentiment has already priced in the region's subdued growth, meaning that subsequent announcements are unlikely to spark longer-term revival in the construction sector. This is weighing on market performance.

In line with the rest of the complex, the copper market has been notably influenced by developments in China. This focus has led to a growing disconnection with the broader fundamental and macroeconomic trends outside of China. Interestingly, the historically observed inverse relationship between the dollar and copper prices has been weakening. This suggests that traditional indicators are losing their predictive power over copper prices. Instead, the momentum for copper recently seems to be driven more by CTAs, a trend we expect to hold for Q4 2024. Likewise, from the physical side, an unexpected squeeze in May caught many suppliers by surprise, making participants wary of committing to larger short positions. We believe many physical players will stay on the sidelines, selling moderately into high prices.

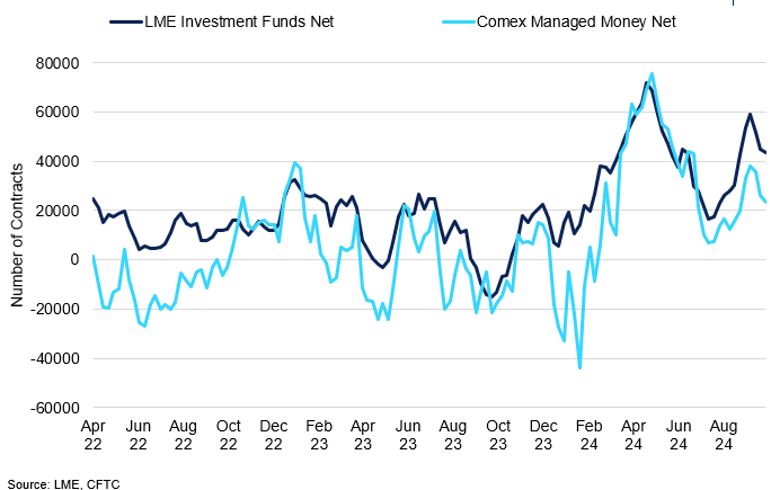

LME and COMEX Investment Side COT Net Positioning

LME and COMEX performance continued to align as copper is influenced by developments in China.

From the fundamental perspective, the concentrate supply remains tight. TCs have fallen drastically, reflecting this, reaching new lows of $7.50/mt, way below the $80/mt benchmark set for 2024. While this situation puts pressure on some smelters, we do not believe this will be an immediate concern for the rest of this year. Many of China's major smelters have long-term contracts that ensure steady concentrate supply at higher TC/RCs based on the 2024 benchmarks. This has helped cushion them against the severe drop in spot TCs this year, ensuring relatively high operating rates and enabling refined copper production to grow by 7% in the first half of 2024.

The situation is likely to change in 2025. There is a growing trend in China where suppliers are considering cuts to smelting operations to keep prices high and expand profit margins. This strategy, combined with the anticipated lower TCs for 2025, suggests that numerous closures might occur next year. Further curtailments seem more probable, with the projected shortfall in concentrate supply not meeting the 1.1m tonnes mark.

This situation supports the metal; however, it is insufficient to suggest a longer-term upside trend. The reason for this is that the production of refined materials has remained largely unchanged. To offset domestic shortfalls, China has increased its imports of copper concentrates from other regions, especially Africa and Latin America. Refined metals are mostly in oversupply, which has weighed on prices this year, challenging bullish forecasts. However, we advise caution regarding any announcements of smelter cuts in Q4 2024.

Q4 Outlook:

Overall, the copper narrative will likely remain dominated by the China story. Given a combination of continued concentrate shortages and the possibility of further announcements from China, we see little downside for the market, with support at $9,450/t holding firmly. Any upside will likely materialise in short-term volatility spikes, with mean-reversion strategies likely to follow suit, keeping the metal within the longer-term range in the coming months. We see robust resistance levels at $10,000/t and $10,200/t, respectively.

Lead

Key points

- We expect lead to mirror zinc’s moves during periods of strong directional appetite, particularly in response to China's additional fiscal or monetary policy announcements.

- However, the prevailing narrative of abundant lead supply limits the upside for prices above the $2,200/t level.

- We do not expect lead to break out of the established ranges in Q4 2024.

Lead prices continued to fluctuate in recent months, keeping mostly within the $1,900-2,200/t range. Lead moves often mirrored those of zinc since both metals are by-products of the same ore deposit, with lead tracing zinc's moves at times of strong directional appetite. However, the lead's outlook has lacked a significant fundamental narrative for most of this year, preventing major trends outside the current ranges. At times of quiet market activity, lead tended to be guided by technical indicators, with established support and resistance levels proving reliable. Meanwhile, the demand for zinc has been buoyed by the construction industry in China. Recent stimulus measure announcements have given zinc a more significant boost, causing the price gap between the two metals to expand to $1,000/t – the widest difference since March 2023.

The stability of both Chinese lead production and the demand for lead-acid batteries indicate that the supply/demand dynamic is unlikely to change rapidly in Q4 2024. Both primary and secondary lead production has remained broadly unchanged year-on-year, with output figures of 304,500mt and 308,300mt, respectively. In particular, the lead market remains oversupplied, with a global surplus of 59,000t recorded from January to July 2024, in stark contrast to a deficit of 36,000t during the same period last year. This surplus is reflected in a deep contango for LME cash to 3-month contract spread, at -$40/t as of October. Additionally, lead stocks on the LME have been on a slow decline, now at 191,000 metric tons, due to a gradual decrease in the demand for refined lead material.

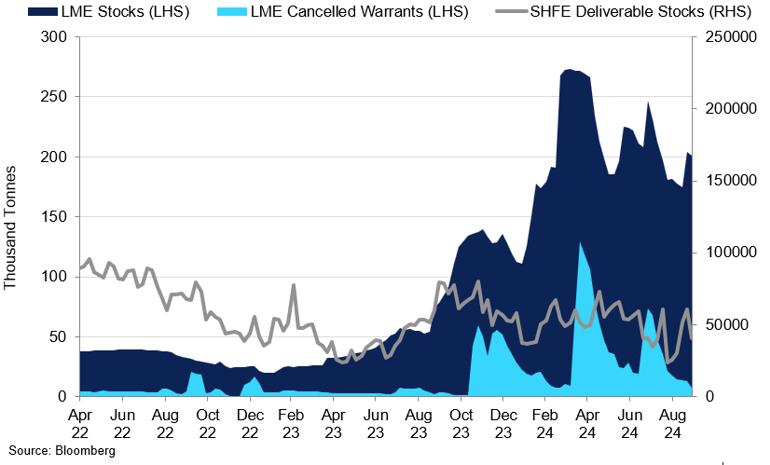

LME and SHFE Stocks

Abundant LME stocks indicate sufficient supply in the lead market.

In August, the import window for lead concentrate opened up, leading to increased imports and, in turn, higher raw material inventories for some lead smelters. Notably, China experienced a significant surge in unwrought lead imports during this period, with more than 80,000mt of material being delivered. This further reaffirms that China's supply is sufficient to meet demand despite growing concentrate shortages. We expect that any flare-ups in supply will likely result in higher SHFE premiums over the LME, which should incentivise smelters to import additional material.

Traditionally, battery manufacturers accumulate stockpiles of lead-acid batteries towards the end of the year, leading to a moderate increase in demand for refined lead. While the narrative around shortages is less pronounced for lead than for zinc, the continued shortages of mined materials could exert strong upward pressures on prices in 2025. This could incentivise prices to break out of these ranges. However, for the fourth quarter of 2024, we do not anticipate this factor to significantly impact the market.

The current trend in car market demand is not showing any signs of improvement, with sales remaining stagnant across major consuming countries. In Europe, new car registrations rose by only 0.6% YTD through September 2024, reaching nearly 8 million units. This follows a decline of 6.1% MoM in September alone, marking the second consecutive month of contraction. Major markets such as France, Germany, and Italy all reported YoY declines in new car sales for the month, with Germany seeing a 7% drop. This ongoing slowdown is expected to adversely affect the demand for lead-acid batteries.

Q4 Outlook:

As a result, we expect lead to mirror the base metals market's moves during periods of strong momentum, particularly in response to China's additional fiscal or monetary policy announcements. However, the prevailing narrative of abundant lead supply limits the upside for prices above the $2,200/t level. Therefore, it is unlikely that lead prices will break out of the current ranges in the final months of the year.

Nickel

Key Points

- The lack of price movement in recent months has left nickel investors craving volatility, creating sharper price fluctuations than the broader base metals complex

- However, the ongoing oversupply of NPI from Southeast Asia suggests that these spikes are unlikely to be sustained in the long term.

- Overall, we expect nickel prices to remain historically low, with the $18,000/t re-sistance level being key.

Nickel prices have remained relatively subdued for much of this year, driven largely by an overwhelming supply of mined ore and lacklustre demand from key regions. However, in Q3, the trend reversed temporarily as nickel faced a notable price gain, driven by geopolitical risks, particularly concerns over potential Russian export curbs. Additionally, stimulus measures from China and more dovish monetary policies from the US and Europe contributed to this rise, allowing prices to briefly exceed the $18,000/t mark. As this momentum begins to fade, we anticipate that nickel prices will stabilise around the mean level of $16,500-$17,000/t.

Given the significant supply pressures, nickel appears to be relatively ‘oversold’ compared to the broader base metals complex. This discrepancy creates a stronger potential for upward spikes in nickel prices. As a result, we anticipate that any external market signals will likely have a more pronounced impact on nickel's performance than on other metals. The lack of price movement in recent months has left nickel investors craving volatility. As noted in our key trends section, any external signals are likely to be exaggerated, and we believe nickel stands to benefit the most from this phenomenon.

However, the ongoing oversupply of NPI from Southeast Asia suggests that these spikes are unlikely to be sustained in the long term. Indonesia continues to play a major role in global supply dynamics, dictating the longer-term outlook for nickel prices. Indonesian producers have ramped up output, particularly of NPI, which exerted pressure on nickel prices earlier in 2024 as the market faced a Class II glut. Following the disruptions in mined production in Q2, Q4 will likely create further downward pressure on nickel.

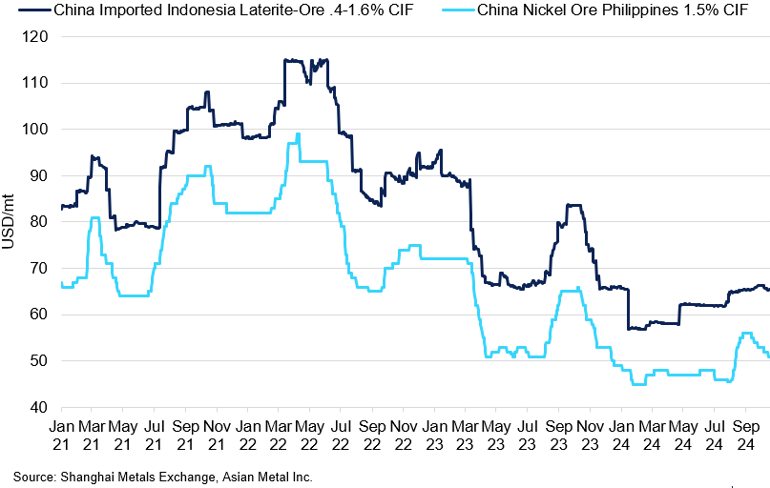

Nickel Ore Prices: Indonesia vs the Philippines

Indonesian and Philippine nickel prices remain historically subdued in the face of global oversupply.

In particular, as of October, Indonesia announced the increase of its supply quota to 32m wmt to further boost laterite production. This will likely lead to a lower premium on Indonesian domestic ore pricing when it comes to negotiations between ore purchasers and suppliers, which should weigh on LME pricing closer to the year-end. Meanwhile, the Philippines' production is likely to remain stable, with some limitations for shipment during the rainy season. Still, we do not believe this is enough to offset the downward pressure on prices. As a result, we expect any upward moves will likely be met with sharp and quick corrections.

From the demand perspective, China's NPI production remained broadly unchanged, falling by 0.95% MoM in September, given the decline in low-grade production and falling prices of the 200-series stainless steel. The global oversupply of nickel is clearly reflected in LME stocks, which have continued to climb, reaching the October 2021 high of 143,000 tonnes in October this year. We expect the global nickel surplus to widen this year, which will likely keep any price rally in check, limiting a break above the $18,000/t mark.

Q4 Outlook:

Overall, we expect nickel prices to remain historically low, with the $18,000/t resistance level being key. Increased production from Indonesia will continue to weigh on nickel prices in the longer term. However, there is potential for short-term volatility on the upside, mainly due to possible announcements of mining cutbacks or additional support from China. These upward moves are expected to be short-lived, as mean-reversion strategies will likely come into play shortly after, given the lack of a sustained long-term trend.

Tin

Key Points

- Tin’s low liquidity makes the market prone to sharp price volatility. Despite a net long positioning of 3,300 contracts in early October, this does not indicate sustained bullish sentiment.

- LME inventories remain stable, with approximately 4,500 tonnes on warrant, signalling sufficient near-term supply.

- Indonesia’s tin exports are rebounding, with 5,043 tonnes shipped to China in September. This, combined with Alphamin’s Congo production increase, will help offset any supply constraints.

After a sharp correction in mid-July, which briefly pushed the price of tin below $30,000/t, the metal traded within a range for the rest of Q3 2024, reaching $34,000/t at the start of October. The 30-day correlation between tin and copper has remained very high in recent weeks, around 90%, indicating a strong relationship likely fuelled by speculative activity and shared market fundamentals, particularly expectations of a solid boost to the Chinese economy from fiscal measures. In line with other base metals, tin prices rose at the beginning of Q4 2024 on optimism surrounding these measures but retreated as the outcome failed to meet expectations. Given tin's relatively low liquidity, the market remains prone to sharp price volatility when investor sentiment shifts.

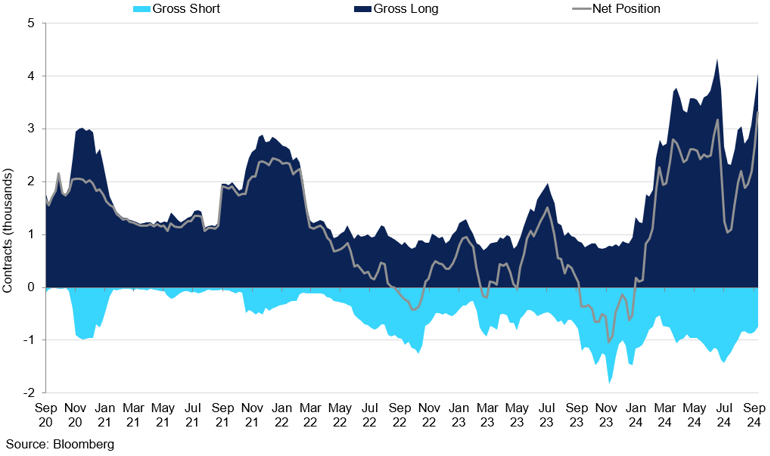

Tin LME Managed Money COT Positioning

Net long positioning has risen to the highest level in years.

The outlook for tin remains cautious despite the net long position of managed money in the LME tin market reaching 3,300 contracts in the first week of October, one of the highest levels in years. While this high net long positioning might suggest bullish sentiment, it does not guarantee sustained upward momentum. With below-average open interest and trading volume, the market's overall liquidity is low, making it easier for speculative investors to quickly unwind their long positions if conditions turn unfavourable. This could trigger a sharp price drop, especially in a thinly traded market like tin. Additionally, the price is hovering near the 50-day and 100-day moving averages, key technical levels that often act as support or resistance. The market appears to be in a wait-and-see mode, with participants likely holding back for clearer signs from broader economic factors, such as Chinese demand or global supply conditions.

In October, tin spreads on both the LME and SHFE widened, with the cash-to-3-month spread at $250/t contango, a level similar to that seen during July’s correction. LME inventories have remained stable at around 4,500 tonnes on warrant, signalling sufficient near-term supply. Although SHFE stocks have declined since May, this is not viewed as a sign of tightening fundamentals, as China had previously accumulated significant inventory following the closure of Myanmar’s Man Maw mine. While the Man Maw mine remains closed, Alphamin's expanded operations in the Democratic Republic of Congo are helping offset supply constraints. The Mpama Project is boosting production capacity from 12,500 to 20,000 tonnes annually, positioning Alphamin as a key player in global tin supply. In Q3 2024, Alphamin reported a 22% production increase, reaching 4,917 tonnes, with a significant portion of Congolese tin concentrate exported to China, accounting for 30% of China's tin imports. Meanwhile, Indonesia’s tin exports, previously disrupted by government approval delays, have started to recover. In September, 5,043 tonnes were shipped to China, reflecting a rebound despite a slight dip from August.

Q4 Outlook:

Heading into the last quarter of 2024, tin’s performance is expected to be muted, largely influenced by China’s economic struggles, as reflected in its strong correlation with copper. Low liquidity in the tin market makes it prone to sharp volatility, but any upside will likely be limited by ongoing supply recoveries from Alphamin’s expansion in Congo and Indonesia’s export rebound. Additionally, any signs of the Man Maw mine reopening could put further pressure on prices. We believe that fundamental demand, such as semiconductor purchases plays a minimal role in shaping tin's pricing narrative. We expect tin to continue trading rangebound between 30,500/t and 34,000/t.

Zinc

Key Points

- We believe that this excitement regarding China's rebound lacks the supporting real-life data necessary for sustained confidence improvement in the construction sector.

- We expect zinc to remain in a thin balance this year before the surplus of both raw and refined materials expand in 2025 and beyond.

- We expect zinc prices to hold above the $3,000/t mark in the fourth quarter.

Zinc prices have seen increased buying pressure in recent months, largely fuelled by optimism surrounding fiscal and monetary stimulus from China. This has pushed prices above the $3,000/t. However, the recent price rally is primarily a result of the oversold status of Chinese assets rather than genuine confidence in the market recovery. Although the policy shift has energised equity markets, it fails to tackle the underlying issues affecting the long-term outlook. We believe this excitement regarding China's rebound lacks the supporting real-life data necessary for sustained confidence improvement. The aim of regulators is to stabilise rather than rejuvenate the housing market, making real economic indicators crucial for assessing the true performance of China's economy.

September's factory activity continued to contract, indicating that the economy remains sluggish even as officials announced a broad package of measures aimed at reviving growth. We believe that similar announcements will only boost market confidence, serving more to create solid support for asset prices rather than suggest a new trend. As a result, we believe that support announcements will emerge at times of poor economic data releases in hopes of preventing a complete loss of confidence.

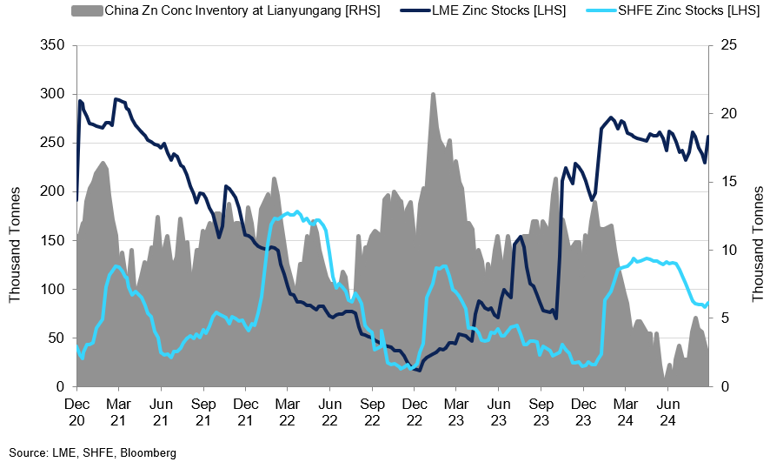

Zinc Refined Inventory for LME, SHFE vs Concentrate in China

The availability of zinc concentrate in China continues to diminish.

Much like aluminium, zinc is being supported due to concentrate supply pressures preventing significant price declines. A lack of concentrates in the market has driven TCs to lows of -$40/t. Although current prices could incentivise miners to restart production, it is unlikely to alter the global availability of zinc concentrate. Despite this, the record low TCs are squeezing smelter profit margins, weighing on overall capacity. Recently, key smelters in China have made adjustments to their planned maintenance, postponing the commissioning of new capacity to preserve operating margins. Meanwhile, low demand for finished materials has led to decreased output in Canada, South Africa, and Peru.

The global zinc surplus is poised to tighten this year, with the first seven months recording 250,000 tonnes, relative to 460,000 recorded the same time last year. In particular, refined zinc is facing greater pressure, with a projected deficit of 160,000 tonnes for this year, according to ILSZG. However, weak overseas consumption throughout the year has weighed on zinc prospects, indicated by excess capacity finding its way to LME inventories, which remained high at 250,000mt in recent months. We expect zinc to remain in a thin balance this year before the surplus of both the raw and refined materials expand in 2025 and beyond. Despite this predicted surplus, it is important to note that zinc production is susceptible to short-term supply disruptions, making prices more likely to experience upward movements under these conditions.

Q4 Outlook:

While markets focus on the narrative surrounding raw materials supply, demand has remained quite weak. Consequently, we believe that demand dynamics will play a more significant role in influencing zinc prices than supply constraints. For instance, if China announces stimulus measures aimed at revitalising the construction sector or if there are clear signs of recovery in that market, this could support prices above the $3,000/t threshold. However, positive developments on the demand front are essential to complement the optimistic supply outlook sustaining this upward trend.

Iron Ore & Steel

Key Points

- After months of subdued performance, iron ore prices soared by more than $14/mt to $110/mt, fuelled by announcements of fiscal and monetary support from China.

- We do not anticipate the construction segment to improve in the coming months, which will limit the upside potential for iron ore in the fourth quarter of 2024.

- The supply and demand fundamentals indicate an oversupply of material.

Early October was marked by market volatility brought on by the upcoming announcements from Chinese policymakers. After months of subdued performance, iron ore prices soared by more than $14/mt to $110/mt, fuelled by announcements of fiscal and monetary support from China. As mentioned in our previous report, iron ore maintains its status as China’s economic gauge, with prices heavily influenced by market sentiment regarding the nation’s construction outlook rather than the metal’s actual fundamentals. We expect this trend to hold in the coming months, where Chinese fiscal and monetary policy support will have a greater impact on iron ore prices compared to the base metals complex. Therefore, paying close attention to the nation’s policy releases is crucial.

The hopes for a boost in the construction segment have supported market confidence in the demand for steel. However, a lack of clarity from policymakers that followed added uncertainty for the path of Chinese economic recovery. We believe that the regulators are focused on stabilising the housing market rather than rejuvenating it. Easing mortgage rules and injecting funds into the sector is unlikely to facilitate recovery in the meantime since consumer confidence is the key driver of spending decisions, which directly affects new house purchases. China’s issues are more complex and interconnected, indicating that there is no quick fix to revive the economy in a few months. As a result, we anticipate that subsequent announcements will likely be made at times of economic weakness to prevent further loss of confidence.

We believe that markets are aware of that. However, given that Chinese assets have been largely oversold for most of this year, any signs of optimism will likely be exaggerated on the upside as investors look to capitalise on short-term volatility. The market seems to be more focused on volatility than on any established trends, especially after months of sideways trading activity. There is still potential for further announcements and monetary policy easing to ensure continued action. As a result, iron ore prices may be more prone to short-term upside volatility spikes in response to positive news from China.

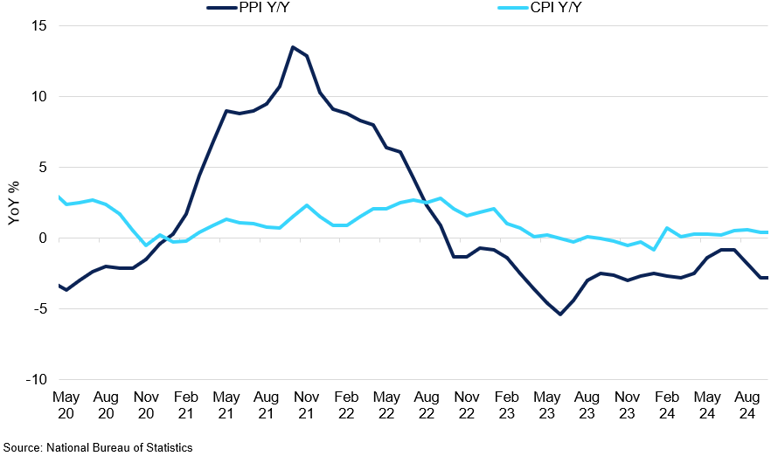

China CPI and PPI Performance

Chinese inflation performance continues to point to economic weakness.

From the physical standpoint, weaker domestic demand continues to weigh on the supply side in China. Steel mills have halted production due to low margins, soft demand for construction materials and the government’s decarbonisation efforts. We expect this trend to continue in the coming months. There has also been an increasing trend of stainless steel mills switching to 400-series production in order to recover their profit margins. Despite some mill closures, China still faces high inventories and weak steel prices, exacerbating the financial struggles of many steel mills. Several mills have continued to operate despite low profitability, as local governments have been hesitant to enforce strict output cuts, keeping the overall steel supply high. Consequently, this has led to an increase in the export of stainless steel to overseas markets.

Q4 Outlook:

Overall, iron ore prices are likely to soften slightly into the year-end, reaching $100/mt as market optimism regarding China’s outlook wanes. We anticipate that more announcements from the government will lead to significant volatility in the market. However, without the improvement of real data, any resulting rally is likely to be short-lived. At times when there are no major announcements, markets are likely to focus on the supply and demand fundamentals, which indicate an oversupply of material. In particular, we do not anticipate the construction segment to improve in the coming months, which will limit the upside potential for iron ore in the fourth quarter of 2024.

Gold

Key Points

- Monetary easing is bound to support gold prices, and the ongoing rate cuts are expected to drive the metal higher through Q4 2024.

- Geopolitical tensions in the Middle East and Ukraine continue to boost safe-haven demand for gold.

- Strong central bank demand will continue to support gold’s price, with expectations of surpassing $2,800/oz by the end of the year.

After a strong performance in Q3, gold is now trading well above the $2,700/oz level, supported by a mix of geopolitical tensions, safe-haven demand, and the Federal Reserve's recent initiation of a rate-cutting cycle. As we move through Q4, these factors are expected to further underpin gold’s upward momentum. The focus remains on the Fed’s monetary policy and global economic conditions, which are likely to play a critical role in shaping gold’s trajectory. With central bank demand still robust and ongoing geopolitical uncertainties, gold remains positioned as one of the best-performing assets in the market.

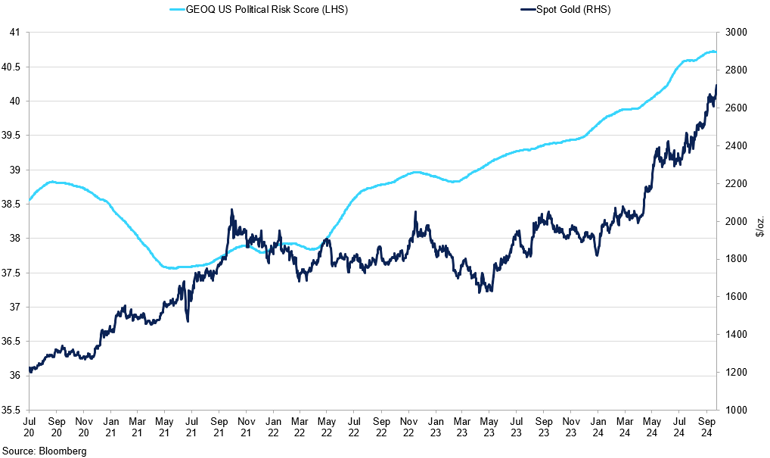

GeoQuant’s US Political Risk Score vs Spot Gold

Election uncertainty drives gold prices higher.

The US economy remains a critical driver of gold prices as we head into Q4 2024. The Fed cut the federal funds rate by 50 basis points in September, and as of October 21st, markets are pricing in a 92% chance of a 25bps cut at the next meeting on November 7th. We anticipate a total of 50bps cuts over the next three meetings (incl. January 2025), with a 25bps cut expected next month. Historically, gold tends to perform well in such an environment, as lower interest rates reduce the opportunity cost of holding non-yielding assets, making them more attractive to investors. Furthermore, the upcoming US presidential election adds another layer of uncertainty to the economic landscape. Although gold has typically been less reactive to election outcomes compared to the dollar, the post-election environment could still provide additional support for the metal. Both candidates, Donald Trump and Kamala Harris, are unlikely to advocate for fiscal austerity, which could increase inflation risks and further bolster gold’s appeal. While election-related volatility could offer some short-term opportunities, the more decisive factor influencing gold’s performance will be the Federal Reserve's actions.

Geopolitical tensions continue to drive safe-haven demand for gold, as crises in the Middle East and Ukraine show no signs of resolution. The ongoing conflict in Ukraine, particularly, has prompted fears of further instability in Eastern Europe, leading countries like Poland to increase their gold reserves as a hedge against geopolitical and economic shocks. In Q2 2024, the National Bank of Poland became one of the largest buyers of gold, acquiring 19 tonnes of the metal amid concerns over the potential spillover effects of the Russian war. The central bank aims to increase its gold holdings to 20% of total reserves, up from the current 14.7%, as part of its strategy to safeguard against regional instability. Other central banks, such as the Reserve Bank of India and the Central Bank of Turkey, have similarly boosted their gold purchases to diversify reserves and protect against global uncertainties. Gold’s role as a highly liquid, default-free asset, and its ability to act as an inflation hedge and shield countries from sanctions has further increased its appeal among central banks.

Q4 Outlook:

Overall, we expect gold to continue its upward momentum through Q4 2024, supported by a combination of geopolitical tensions, rising central bank acquisitions, and persistent safe-haven demand. As geopolitical crises in the Middle East and Ukraine show no signs of resolution, and central banks, such as Poland and Turkey, increase their gold reserves to hedge against uncertainty, gold's appeal as a stable asset remains robust. Additionally, with the Fed expected to cut interest rates further, lowering real yields, the metal becomes even more attractive to investors. We foresee limited downside risk and expect gold to maintain its upward trajectory, surpassing $2,800/oz by the end of the year.

Silver

Key Points

- Silver's 30-day correlation with gold remains exceptionally high at over 90%, reflecting strong investor sentiment overlap between the two metals. Silver, like gold, is benefiting from safe-haven demand and geopolitical uncertainties.

- Investment interest in silver is rising, with 829 tonnes flowing into silver-backed ETFs in Q3 2024, the highest level since early 2021.

- The Silver Institute forecasts a 1% supply contraction in 2024, while demand is expected to rise by 2%, driven by the solar industry in China, which may create a supply deficit and push prices higher.

After a strong performance in Q3, silver has surged to a 10-year high, now trading above $34/oz, primarily driven by its status as a precious metal amid heightened geopolitical uncertainty and strong safe-haven demand. The metal’s 30-day correlation with gold has been exceptionally high, hovering above 90%, underscoring its close relationship with the yellow metal. In Q4, silver is poised to continue its upward trajectory, benefiting from both its investment appeal and expanding industrial applications, particularly in the technology and renewable energy sectors. The macroeconomic environment, including expectations of further monetary easing, remains supportive for precious metals. With gold also trading near record highs, silver’s momentum is expected to persist into the next quarter, bolstered by the strong overlap in investor sentiment between the two metals.

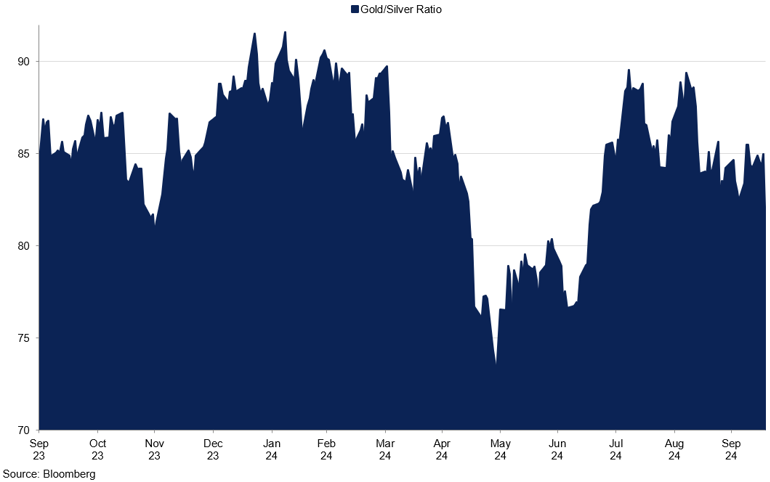

Gold-To-Silver Ratio

The recent decrease in the gold-to-silver ratio signals silver’s rising attractiveness relative to gold.

Investment interest in silver has surged this year, reflected in robust inflows into silver-backed ETFs. In Q3 alone, these inflows totalled 829 tonnes, marking the highest level since early 2021 when holdings were at their peak. This surge highlights silver’s impressive outperformance compared to gold, with the gold-to-silver ratio dropping to 80 in mid-October. Year-to-date, silver has risen by 40%, compared to gold’s 32% increase. However, despite the significant price appreciation, silver ETF holdings remain relatively subdued compared to previous highs. Currently, holdings sit around 730 million ounces, close to 2023 levels, despite silver trading at a decade high. At the peak of ETF holdings, silver prices were 15% lower than today. This relatively muted response suggests that investors may still be waiting for a more decisive breakout above $35/oz to significantly increase their positions. As we look into Q4, lower real interest rates and continued stimulus efforts from China are expected to support industrial demand for silver, creating a conducive environment for further price gains. These dynamics, combined with the potential for higher ETF inflows, could push silver prices even higher in the coming months.

Silver mining production globally has experienced modest declines in 2024, largely due to operational challenges across the sector. With roughly 60% of silver being sourced as a by-product of base metal mining, the tightness in zinc and copper concentrate markets is exerting pressure on silver supply. Smelter treatment charges for copper and zinc concentrates have dropped into negative territory, underscoring the severe market tightness. This supply constraint is exacerbated by the ongoing decline of primary silver mines in regions like Peru, where output has steadily decreased since 2017. On the demand side, silver consumption continues to rise, particularly driven by the solar industry in China, which is expected to set a new record for the third consecutive year. According to The Silver Institute, silver demand is forecasted to grow by 2% in 2024, reaching 1,219 million ounces, while supply is projected to contract by 1%. This widening gap between supply and demand creates the conditions for a potential supply deficit, which could further elevate silver prices in the months ahead.

Q4 Outlook:

Overall, silver remains well-positioned to continue its upward trajectory in Q4 2024, driven by a combination of safe-haven demand, robust industrial growth, and tightening supply. The metal has surged to a 10-year high, and with geopolitical tensions and expectations of further monetary easing, silver’s appeal as both a precious and industrial metal is likely to grow. We expect silver to break above the $35/oz level by the end of the quarter, potentially heading towards $36/oz if supply constraints intensify.

Platinum

Key Points

- Platinum is trading below $1,000/oz in Q4 2024, pressured by weak demand from the automotive sector.

- Automotive production forecasts have been downgraded by major manufacturers like Volkswagen, further weakening the demand outlook for platinum and likely capping any significant price recovery.

- Supply constraints, including the halted Two Rivers Merensky project in South Africa, may provide mild support, but operational inefficiencies are limiting production growth.

After a mixed performance in Q3, platinum remains under pressure, trading below $1,000/oz, primarily due to weaker demand from key industries and shifting investor sentiment. The 30-day correlation between gold and platinum has fallen to 60% in mid-October, a significant divergence from their closer relationship earlier this month. While gold has surged to record highs on safe-haven demand, platinum’s price has been constrained by its industrial role, especially in the automotive industry. The divergence between the two metals underscores the different market drivers influencing each. As we move into Q4 2024, the outlook for platinum remains closely tied to the performance of the global car market, where ongoing softness could continue to limit price growth. With major automotive manufacturers cutting production forecasts, the demand outlook for platinum is likely to remain weak in the near term. Without a recovery in automotive production, this demand-side weakness could exert further downward pressure on prices.

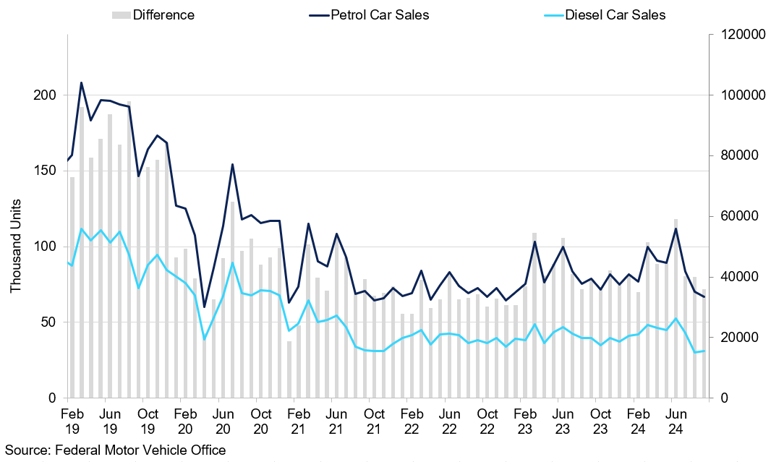

Diesel and Petrol Car Sales in Europe

The car industry has weakened in the second half of the year.

Investment interest in platinum-backed ETFs has been relatively subdued. Holdings currently sit around 3.1 million ounces, reflecting limited growth despite recent price fluctuations. Inflows of over 920,000 ounces were recorded in Q3, but this pales in comparison to earlier periods of higher industrial demand. Platinum’s reliance on the automotive sector, specifically for use in catalytic converters for internal combustion engines, remains a key driver. However, headwinds in the sector are becoming more evident. Volkswagen recently cut its 2024 outlook due to macroeconomic challenges, warning that ongoing economic headwinds could weigh on global vehicle production. Meanwhile, Cox Automotive downgraded its 2024 UK car sales forecast to 1.72 million, a 6.1% decline from previous expectations, citing market turbulence and supply chain issues. This slowdown in the automotive market is weighing heavily on platinum demand. If these trends persist, platinum’s price could face further challenges in Q4, particularly if automotive production remains constrained, further reducing demand for the metal.

Supply constraints in the platinum market have been less pronounced compared to other precious metals in 2024, but challenges remain. South Africa, which accounts for nearly 70% of global platinum production, faces challenges related to operational inefficiencies, which have recently become a growing concern for the PGM industry. African Rainbow Minerals (ARM) has halted the development of its Two Rivers Merensky project, which had been expected to increase platinum production by 30% by 2026. The mine, initially forecast to produce 128,000 ounces in 2024, is now on hold due to rising costs and the need for a 22% increase in the 6E basket price to ZAR26,500/oz to make the project viable. While this mine accounts for only 3% of South Africa's platinum production, the decision underscores wider industry struggles. With lower PGM prices, producers are increasingly relying on by-product revenues like chrome, which now makes up 34% of the sector's total revenue. Given these operational challenges and the potential for further production slowdowns, we expect supply tightness to persist. Still, it may not be enough to provide significant upward momentum for platinum prices in Q4.

Q4 Outlook:

Overall, we expect platinum prices to remain under pressure throughout Q4 2024. Weak demand from the automotive sector, coupled with constrained but stable supply, suggests limited potential for significant price increases. While some supply constraints may provide mild support, the broader market conditions are unlikely to spark a major rally in prices. The impact of weakening demand could outweigh the effects of supply limitations, keeping prices suppressed. We anticipate platinum will struggle to break above $1,500/oz in Q4 2024, barring any major shifts in demand or unexpected disruptions in supply.

Palladium

Key Points

- Palladium rebounded to $1,014/oz in mid-October, recovering from an August low of $832/oz, but continued BEV adoption and oversupply expectations weigh on long-term prospects.

- European car sales declined MoM by 6.1% in September, and stricter EU emissions targets for 2025 present a significant risk to palladium demand in catalytic converters.

- South African production setbacks, including delays in the Two Rivers Merensky project and Sibanye-Stillwater’s cuts, may support prices in the short term, but the long-term outlook remains constrained.

Palladium faced significant downward pressure in 2024, trading around $1,014/oz in mid-October—still far from its record high of $3,442/oz in March 2022. After hitting a low of $832 in August, the metal has since rebounded, showing more resilience as we head into Q4, though downward pressures remain. The price recovery has been driven by a combination of short-term supply concerns and temporary boosts in automotive demand, but rising BEV adoption and surplus expectations continue to weigh on the long-term outlook. Despite some near-term positive momentum, we expect palladium's performance in Q4 to remain constrained by these broader challenges.

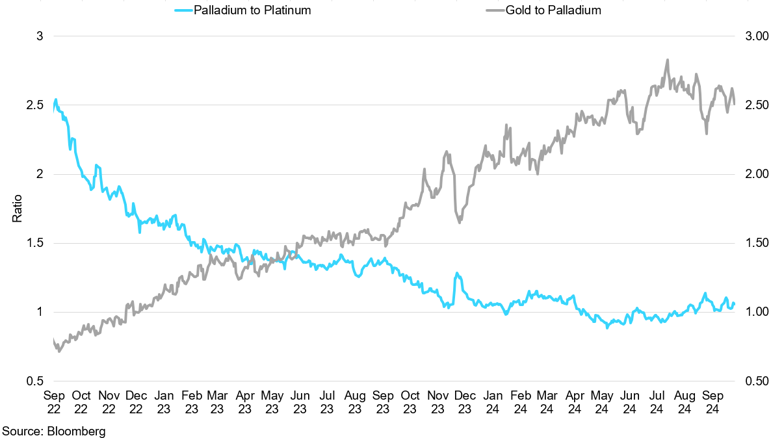

Palladium-To-Platinum vs Gold-To Palladium Ratio

The palladium-to-platinum ratio has stabilized around the 1:1 level this year.

Palladium's primary role in catalytic converters for internal combustion engines (ICE) makes it vulnerable to the ongoing softening in the automotive sector. In Europe, new car registrations rose by only 0.6% YTD through September 2024, reaching nearly 8 million units, according to recent data. This follows a decline of 6.1% MoM in September alone, marking the second consecutive month of contraction. Major markets such as France, Germany, and Italy all reported YoY declines in new car sales for the month, with Germany seeing a 7% drop. Adding to the challenges, the European Union’s passenger car emissions targets for 2025 are putting additional pressure on automakers to transition toward cleaner vehicles. Under the new regulations, emissions must drop to 93.6 g/km, which represents a 19% reduction from 2024 levels. Automakers that fail to comply will face hefty fines, calculated at €95 for every g/km of CO2 over the limit, multiplied by the number of cars sold. This financial penalty could amount to hundreds of millions of euros for large manufacturers. While hybrid vehicles continue to provide short-term support for palladium use, the ongoing transition away from ICE vehicles represents a significant long-term risk for palladium demand, particularly in key markets like Europe.

On the supply side, palladium production has faced multiple setbacks, potentially providing some price support in the near term. South African miners, responsible for a significant portion of global palladium supply, are grappling with rising costs. African Rainbow Minerals (ARM) has halted its Two Rivers Merensky project, which was set to boost PGM output by 30% by 2026. The project, expected to produce 128,000 oz of PGMs in 2024, was put on hold due to cost pressures. Although this may not directly affect palladium, it signals broader industry issues in South Africa. Additionally, Sibanye-Stillwater plans to cut production at its Montana mines, reducing palladium supply by 150,000 oz annually from 2025. This follows previous cuts that have already lowered 2024 output by 500,000 oz compared to the 2010–2019 average. Despite these reductions, the long-term outlook for palladium remains one of surplus due to BEV adoption and increased autocatalyst recycling. In the short term, however, constrained supply could prevent further significant price declines in Q4 2024.

Q4 Outlook:

Overall, palladium is expected to face continued pressure in the coming months. The ongoing shift towards BEVs, coupled with stricter European emissions targets, continues to weigh on long-term demand. While hybrids provide a temporary boost, palladium’s primary role in ICE catalytic converters is increasingly at risk. We anticipate palladium prices to remain constrained, with the potential for a modest uptick due to supply concerns, but further significant gains seem unlikely. We expect the metal to trade between $900-$1,100/oz.