NY 2nd Month Sugar Futures

NY sugar futures saw the upside momentum stall after yesterday’s candle tested the resistance level near 26.00 before closing slightly lower at 25.76. The stochastics are now overbought, and upside momentum is seen slowing, as RSI is tailing off on the downside near overbought. The MACD diff is positive and diverging. This suggests that while the longer-term momentum remains on the upside, the appetite should calm slightly in the near term as futures retest strong resistance levels. If prices break above the 26.00 level, this could set the scene for higher prices to 26.37. Alternatively, weakness down below 25.00 would trigger further losses to the moving average levels, which are holding firm. We expect futures to retest the 26.00 level today.

Ldn 2nd Month Sugar Futures

Ldn sugar futures broke above the robust resistance of 700 yesterday whilst also breaching the 711.60 level to close at 713.40. The next robust resistance level stands at 718.20, which is also the April high, and a break above it could suggest further strength to 725. The indicators point to further gains in the near term, with the %K/%D seen diverging on the upside into the overbought, while the MACD diff is positive and diverging. To confirm this momentum, futures must first supersede the 711.60 level completely. On the downside, the support at 700 has formed, and the next robust level on the downside remains at the moving average at around the 675 level. We expect to see further gains in the near term; however, given the scale of yesterday’s move, the upside is likely to be marginal.

NY 2nd Month Coffee Futures

NY coffee futures continued to trade sideways in recent days, with smaller-bodied candles and longer wicks pointing to a lack of appetite in either direction. This move is also accompanied by low volumes. Still, the indicators suggest a marginal upside in the near term: %K/%D is gaining ground out of the oversold while the MACD is positive and diverging marginally. This could suggest that futures will hold above the 10 DMA level of 151.77 while also struggling above 155.80, a firm level on the upside. We expect to see further range-bound trading in the near term.

Ldn 2nd Month Coffee Futures

Ldn coffee gained marginal ground yesterday, closing above 2440 at 2449. A longer upper wick, however, suggests that futures struggled to breach the 2450 level, given a lack of strong appetite for higher prices. The stochastics are pointing to further gains in the near term, as %K/%D diverges on the upside out of the oversold, and the MACD diff is positive and diverging; the RSI is also rising. We expect to see slight gains in the near term, but resistance levels at 40 and 100 DMAs at 2502 and 2514, respectively, should cap any strong upside momentum. Alternatively, the support at 10 DMA 2399 is holding firm, and prices are likely to fluctuate between the moving averages in the near term.

NY 2nd Month Cocoa Futures

NY cocoa rallied yesterday, jumping above the 3483 resistance to retest the recent highs of 3600. Futures closed slightly below at 3588. The indicators are pointing to strong upside pressures in the near term, with %K/%D strengthening on the upside as the MACD diff is positive and diverging. To confirm this, futures must first break above the 3600 level before targeting 3618 – the July high. On the downside, futures must first break below the 3483 support level before testing the 10 and 40 DMAs at 3465 and 3428, respectively. Given the scale of yesterday’s jump, we expect futures to retest the 3600 level today.

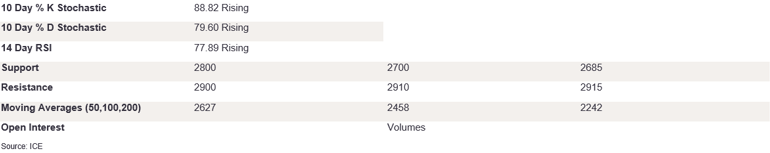

Ldn 2nd Month Cocoa Futures

Ldn cocoa jumped higher yesterday, breaking above 2800 to close at 2886, marking the 46-year high. We now see two solid resistance levels forming, one at 2900 and one at the trendline level. If futures break above these levels, it could trigger further historic gains to 3000. This appetite is also highlighted by the three white soldiers’ formation. Alternatively, futures would need to weaken back to 2800 and 2700, respectively, to suggest the end of the uptrend. The indicators are continuing to gain ground in the overbought, highlighting the recent uptrend. We expect futures to retest the 2900 highs today.