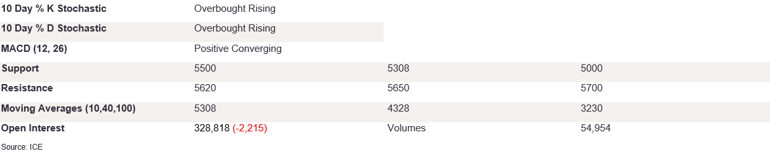

NY 2nd Month Sugar Futures

NY sugar futures held their nerve on Friday as intraday trading saw futures test appetite at 21.00 once again. This level held firm, and futures closed at 20.93. The stochastics are rising, with %K/%D about to converge on the upside out of the oversold, a strong buy signal. The MACD diff is negative and converging on the upside, signalling waning selling pressures. To confirm the outlook for higher prices, futures need to break above the robust resistance at 21.00, which could set the scene for futures to take out the 10 DMA level at 21.43. On the downside, the market needs to take out support at 20.50 and then support at 20.00. The 10 DMA level has crossed below 40 DMA recently, suppressing the upside in the long term. In the meantime, we expect futures to edge higher, up to the 10 DMA resistance level.

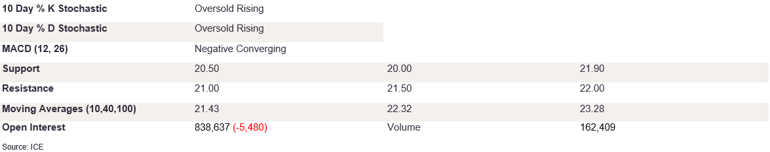

Ldn 2nd Month Sugar Futures

Ldn sugar futures edged lower on Friday after futures struggled above the 10 DMA to close at 595.03. The stochastics have converged on the upside and are now rising out of the oversold; the MACD diff is negative and diverging, suggesting higher prices in the near term. To confirm the bullish indicators and rejection of prices below 580.70, futures need to target the 10 DMA at 595.03. On the downside, futures need to close below 580 in order to confirm the outlook of lower prices towards 575. A narrow candle body in recent sessions points to a lack of appetite for lower prices. Prices need to take out current resistance at 10 DMA to confirm the outlook for higher prices.

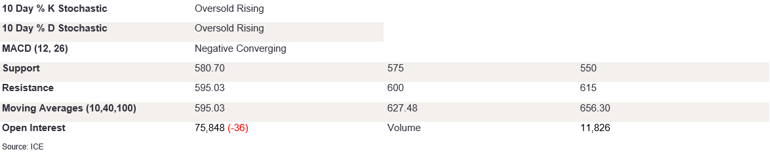

NY 2nd Month Coffee Futures

Prices weakened on Friday as moderate selling pressure triggered a close at 185.50. The stochastics are falling; the %K/%D are about to converge on the downside, signalling a potential change in trend. The MACD is positive and converging, suggesting we could see lower prices in the near term. Prices tested the shorter-term moving averages; however, a lack of conviction to break below these levels supports market indecisiveness for lower prices. On the upside, a break above 192.40 could see the test of the 200 level. We expect prices to edge lower today and remain on the back foot.

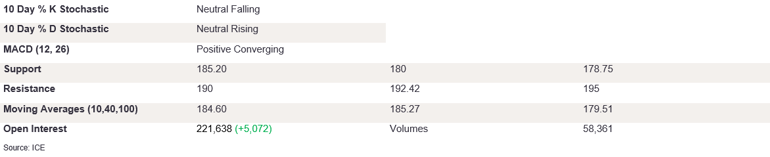

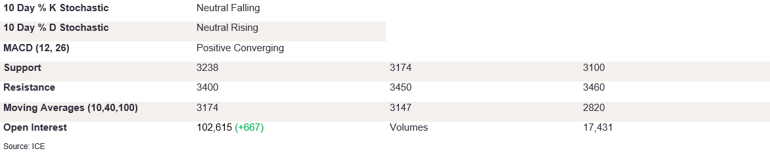

Ldn 2nd Month Coffee Futures

Ldn coffee futures softened on Friday after struggling above the recent high of 3400. The market closed at 3297. The stochastics are now softening, with %K about to cross below the %D line, and the MACD diff is positive and converging, suggesting we could see lower prices in the near term through support 3238. A break below this level would bring into play the 10 and 40 DMAs at 3250, which could set the scene for support at 3000 in the longer term. On the upside, futures need to gain back above 3400 – the recent high - in order to confirm upside momentum. A longer lower wick points to a strengthening appetite on the downside; however, futures must first break the moving average level to confirm the outlook.

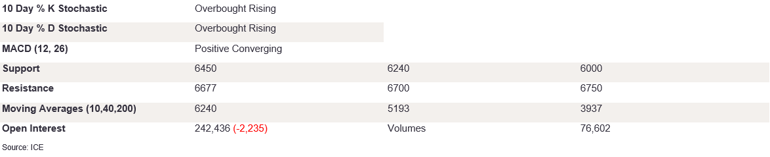

NY 2nd Month Cocoa Futures

NY cocoa futures softened on Friday after testing the support at 10 DMA. The market closed at 6396. The stochastics are falling, and the MACD diff just converged on the downside, suggesting we could see lower prices in the near term through the support of 10 DMA at 6382. A break below this level would bring into play the 6000 level. On the upside, futures need to gain back above 6500 in order to confirm upside momentum. Appetite for higher prices here could trigger gains towards the level at 6677; this could strengthen the trend in the long run on the upside. The longer lower wick points to an increased appetite on the downside, and we could see prices edge lower in the near term.

Ldn 2nd Month Cocoa Futures

Ldn cocoa weakened on Friday, as moderate selling pressure triggered a close on the back foot below the 10 DMA at 5231. The stochastics are falling, edging out of the overbought, and the MACD diff has converged on the downside. Bigger-bodied bearish candles in recent days suggest growing selling pressures; this could set the scene for lower prices to break below the 5134 support level. This would confirm the trend for falling prices, down to the 5000. On the upside, resistance at 10 DMA at 5375 is now in place, and a break back above that level would strengthen the bullish momentum. This could also trigger gains towards the 5500. The indicators suggest an impending market downturn, and we expect prices to continue to fall in the near term.