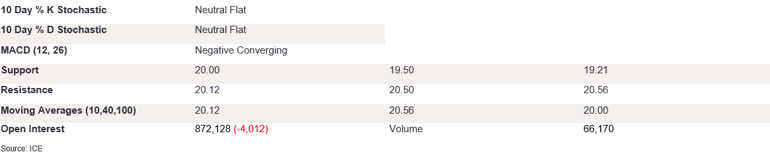

NY 2nd Month Sugar Futures

NY sugar futures held their nerve on Friday as intraday trading caused the market to close at 20.03. The stochastics are falling, with %K/%D about to converge on the downside, and the MACD diff just flipped into negative territory, suggesting growing selling pressures in the near term. To confirm the outlook for lower prices, futures need to close back below 20.00, which is also where the 100 DMA level is at the moment. On the upside, the rejection of prices below the 10 DMA at 20.12 could trigger gains back towards the 40 DMA at 20.56. A break above this level and a test of 21.00 would confirm the trend on the upside. Two narrow-bodied candles in the last couple of sessions point to market uncertainty, and the futures need to break out of current resistance/support to suggest the longer-term outlook.

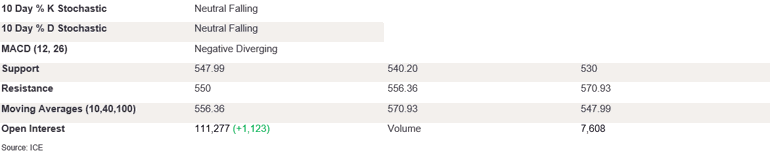

Ldn 2nd Month Sugar Futures

Ldn sugar futures opened lower but managed to close higher day-on-day at 550. The stochastics are falling, with %K/%D converging on the downside and now declining into the oversold territory. The MACD diff is negative and diverging. On the upside, futures need to break back above the robust resistance levels of 10 DMA at 556.36 and 40 DMA at 570.93 to trigger the momentum. Prices would then need to take out the 580 level to confirm the longer-term outlook on the upside. Conversely, appetite for prices below the 100 DMA at 547.99 could trigger a test of support of 540.20. A gravestone doji candle shows rejection of lower prices below the 100 DMA level. However, the indicators suggest further losses in the near term. To confirm this, we must first see a breach of the 100 DMA level.

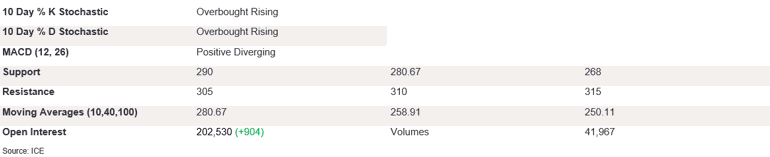

NY 2nd Month Coffee Futures

NY coffee futures skyrocketed in recent sessions, and on Friday, the protracted buying pressure triggered a close on the front foot at 302, the highest level since 2011. The %K/%D is diverging on the upside further into the overbought territory. The MACD diff is positive and diverging, outlining the recent market rally. On the downside, a breakback below the support level of 290 could trigger losses back towards the 10 DMA at 280.70; a break below the trend support level of 268 would confirm the outlook for a trend reversal. On the upside, the 302 close on Friday is at the trend resistance level, making it a robust level to breach on the upside. The market rally was strong, but to confirm further gains, the 305 level needs to be breached first.

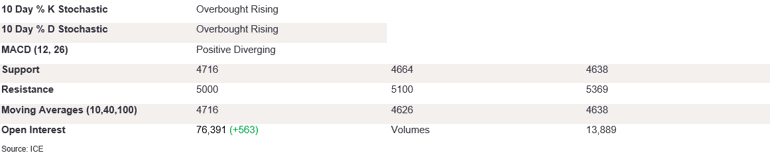

Ldn 2nd Month Coffee Futures

Ldn coffee futures rallied on Friday as protracted buying pressure triggered a close on the front foot at 4985. The %K/%D is diverging in the overbought. Likewise, the MACD diff is positive and diverging, confirming growing buying pressures. On the upside, a breach of 5000 could trigger gains through 5200 towards 5369 – a September high. On the downside, a break below the 10 DMA level at 4716 could trigger losses back towards 4664. The DMAs have been supporting futures prices, and a break of 5000 would send a strong buy signal. The close near highs that the buying pressure is growing, and the bullish outlook should continue to persist today.

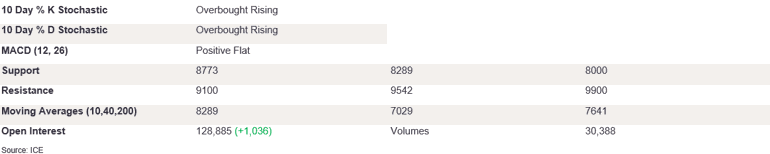

NY 2nd Month Cocoa Futures

NY cocoa futures jumped higher on Friday, breaking above the robust 9000 resistance level and closing higher at 9085. The stochastics are edging higher, with %K/%D overbought, and the MACD diff is positive and diverging. If support at 8773 holds, we would expect to see futures test the 9500 level before continuing higher in the longer term. If the near support level does not hold, this could signal a trend reversal back to 10 and 100 DMA at 8289 and 7641, respectively. The long candle body and the indicators confirm the appetite for higher prices in the near term, and we expect futures prices to edge higher.

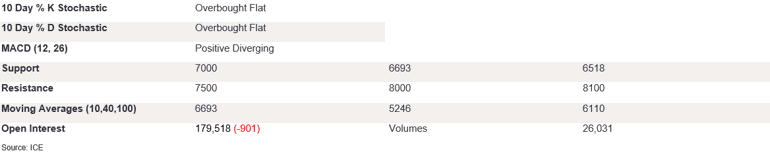

Ldn 2nd Month Cocoa Futures

Ldn cocoa futures rallied yesterday as protracted buying pressure triggered a close above 7348 at 7492, marking a June high. The %K/%D is overbought; however, the upside pressure is waning. The MACD diff is positive and flat, confirming a lack of appetite for further gains. On the downside, a break below the key support level of 7000 could trigger losses back towards 10 DMA at 6693, a break below which would confirm the outlook of lower prices in the longer term. On the upside, a complete break above 7350 could trigger gains towards 8000. A long candle body with a longer upper wick points to a weakening appetite for higher levels. We expect futures to remain elevated, but the upside momentum should stall in the near term.