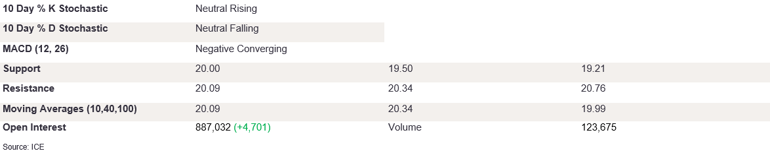

NY 2nd Month Sugar Futures

NY sugar futures held their nerve yesterday as intraday trading caused the market to close at 20.01. The stochastics are rising, with %K%D about to converge on the upside, which would send the buy signal. Likewise, the MACD diff is negative and about to converge on the upside, which would confirm the change of trend on the upside. To confirm the outlook for higher prices, futures need to close back above the 10 DMA at 20.09 and then target the 40 DMA at 20.34. On the downside, the rejection of prices around 20.00 could trigger losses back towards 19.50. A break below this level and a test of 19.21 would confirm the trend on the downside. Two narrow-bodied candles with opposite wicks in the last couple of sessions point to market uncertainty, and the futures need to break above the current resistance to confirm the longer-term outlook on the upside.

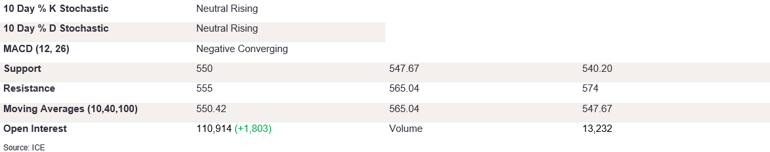

Ldn 2nd Month Sugar Futures

Ldn sugar futures gained ground yesterday but struggled above the trend support of 553, prompting a close at 551.60. The stochastics are beginning to rise, with the %K/%D edging higher out of the oversold, as the MACD diff is negative and converging on the upside. This suggests we could see further bullish momentum in the near term, with prices edging towards 555, before testing the 40 DMA at 565.04. To confirm the complete momentum change and the longer-term outlook on the upside, futures need to break above trend resistance at 570. On the downside, the candle found support at 550, and if the prices break through this level, we could see prices retreat back through the 100 DMA at 547.67. The bullish candle with a narrow body and longer upper wick after a dragonfly candle points to uncertainty in breaking out of the current support and resistance. To confirm the indicators’ momentum on the upside, futures must take out the 550 level first.

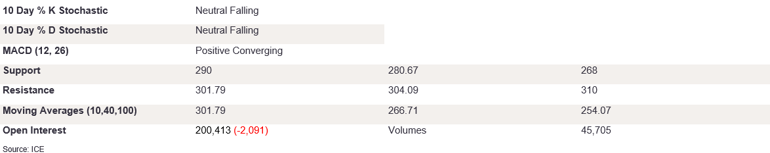

NY 2nd Month Coffee Futures

NY coffee futures opened below Monday’s close but managed to gain marginal ground yesterday as moderate buying pressure prompted a close below the 10 DMA at 295.50. The stochastics are falling out of the overbought, and the MACD diff is positive and converging, suggesting downside momentum in the near term. The prices have fallen back into the trend channel after days of robust gains above the 300 level. However, to confirm the continuation of the weakness of recent days, futures must take out the regression line at 285 before 280. On the upside, a breach back above the 10 DMA at 301.79 would bring into play the recent firm resistance at the upper trendline at 311, confirming an inverse hammer formation. Futures need to take out this level in order to confirm the continuation trend on the upside.

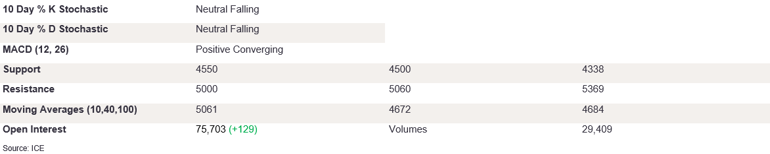

Ldn 2nd Month Coffee Futures

Ldn coffee futures lost ground yesterday as selling pressure intensified; prices closed just above the trend support of 4550 at 4604. The MACD diff is positive and converging, and the %K/%D is falling out of the overbought, highlighting the recent weakness. To help confirm further selling pressures from the stochastics, prices need to break below the 4550 level before 4500. On the upside, if futures can find support back above the 10 DMA at 5061, this could set the scene for higher prices back above 5369 before targeting 5500. The selling pressure has been robust in recent trading sessions; however, yesterday’s longer lower wick and a close above the trend support suggests that downside appetite might be waning. We expect prices to remain on the back foot but struggle to break the 4500 level in the near term.

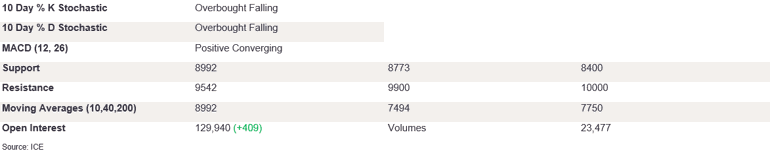

NY 2nd Month Cocoa Futures

NY cocoa futures weakened yesterday as protracted selling pressure triggered a close on the back foot at 9038. The stochastics are converging on the downside, and %K/%D gave a sell signal; the MACD diff is positive and converging, confirming growing selling pressure. This could set the scene for lower prices below 10 DMA at 8992, but futures need to break below 9000. A break below this level would confirm the outlook of lower prices down to 8000. On the upside, a break above 9542 could set the scene for 9900. Two-line strike formation and a close above the key support of 9000 points to a lack of appetite for lower prices, and we expect a continuation of an uptrend in the near term.

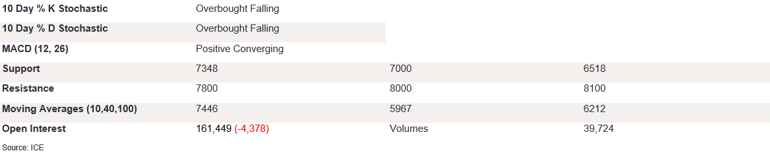

Ldn 2nd Month Cocoa Futures

Ldn cocoa futures weakened yesterday, but support at 7348 caused the market to close at 7376. The stochastics are falling, with %K/%D in the oversold territory, and the MACD diff is positive and converging, suggesting lower prices in the near term. To suggest the outlook for lower prices, futures need to close back below 7348 and then target 7000 and 6518. On the upside, the 8000 resistance is now key and has to be breached to suggest further gains. The long candle body with short upper and lower wicks points to a growing appetite for lower prices. However, to confirm this, the 7348 level needs to be broken below first.