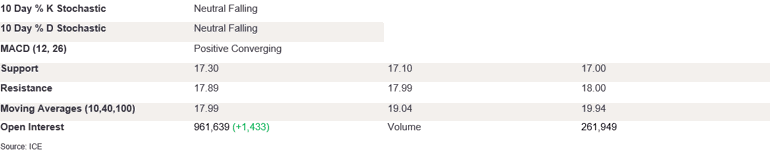

NY 2nd Month Sugar Futures

NY sugar futures sold off yesterday as a lack of appetite for prices above 18.00 prompted a sharp correction to new lows of 17.39. The stochastics are falling, and this could improve downside momentum; the MACD diff is starting to weaken, supporting the outlook for lower prices. A break of the current 17.35 support may pave the way for lower prices to the 17.00. On the upside, if prices can take out the 17.89, this would confirm the trend for a reversal, with the psychological level at 18.00. We believe that there is an appetite for lower prices in the near term.

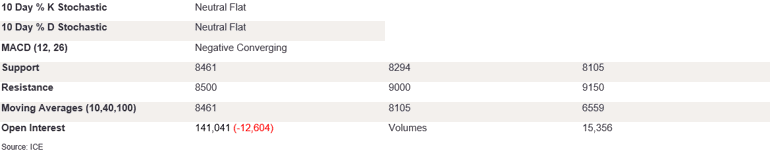

Ldn 2nd Month Sugar Futures

Ldn sugar futures sold off yesterday as protracted selling pressure prompted a break of support at 493.80 to close on the back foot at 485.40. The stochastics are falling, crossing into the oversold territory, and the MACD diff is negative and diverging, suggesting lower prices in the near term. The break of the key support levels at 500 and 493.82, respectively, suggests an appetite for lower prices. The current primary support level stands at 480. Conversely, if prices gain back above 493.80, this could prompt a recovery back above the 5000. In the medium term, we could see futures break above 10 DMA at 506.24. This level has provided strong resistance in recent weeks, and a close above this level would prompt prices to regain upside conviction. We anticipate prices will remain on the back foot in the near term.

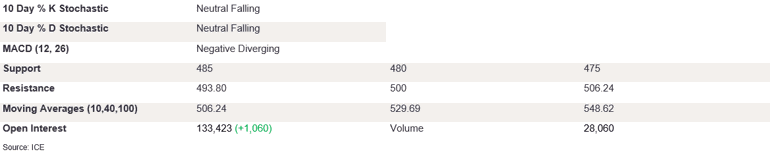

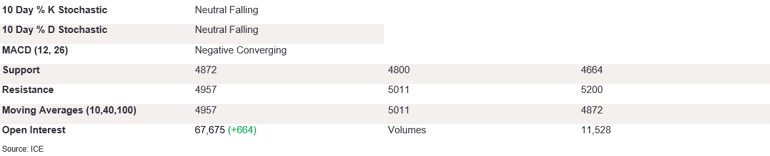

NY 2nd Month Coffee Futures

NY coffee futures held their nerve yesterday as intraday trading caused the market to close at 318. The stochastics are falling, with %K tailing off on the downside, as the MACD diff is negative and converging, painting a mixed outlook picture. To suggest the outlook for higher prices, futures need to close back above the trend resistance completely and then target 330. On the downside, the rejection of prices around above the 10 DMA at 317.20 could trigger losses back towards the 40 DMA at 313.75. A break below this level and a test of 300 would confirm the trend on the downside. Narrow-bodied candles with growing upper wicks in the last couple of sessions point to market uncertainty for higher prices, but futures need to break out of the current trading range to confirm the longer-term outlook.

Ldn 2nd Month Coffee Futures

Ldn coffee futures edged lower yesterday after futures tested 100 DMA to close at 4863. The stochastics are falling back towards oversold, and the MACD diff is negative and diverging, suggesting lower prices in the near term. To confirm the bearish indicators and rejection of prices above 10 DMA, futures need to take out support at 100 DMA completely and then target 4750. On the upside, futures need to close above 10 DMA at 4957 and then target 5000 in order to confirm the outlook for higher prices within the longer-term trend. A short candle body points to a lack of appetite for prices below the 100 DMA support level just yet. Prices need to take out current support to confirm the outlook for lower prices. We expect futures to weaken in the near term.

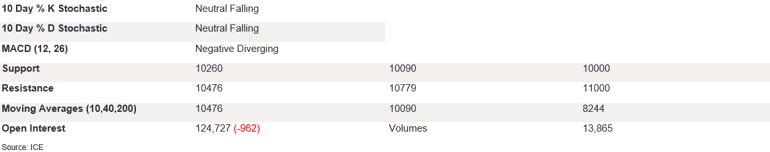

NY 2nd Month Cocoa Futures

NY cocoa futures held their nerve yesterday as intraday trading saw prices close at 10343. The %K/%D is converging on the downside, a sign that momentum is about to change in the near term. The MACD diff is negative and diverging, suggesting further appetite for lower prices, but futures need to break below the 40 DMA level at 10090 to trigger the momentum. A break below this level towards the support of 10000 would confirm the growing bearish momentum. Conversely, appetite for prices above the 10 DMA level at 10476 could trigger a test of resistance of 11000. A long-legged doji candle shows indecision about either direction; the length of the wicks also points to increased volatility during the day. The indicators point to a decline in prices in the near term, but futures need to close below 40 DMA to confirm this.

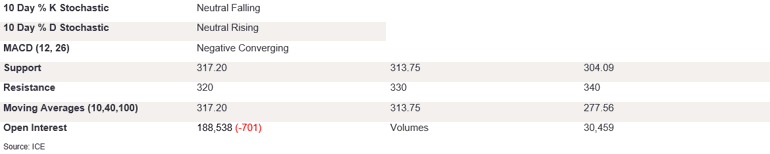

Ldn 2nd Month Cocoa Futures

Ldn cocoa futures opened higher yesterday, but resistance at 8500 caused futures to close marginally lower on the day at 8493. The stochastics have just crossed on the downside and are now falling, sending a strong sell signal. The MACD diff is negative and converging. On the downside, a break of 8294 could trigger losses through 40 DMA at 8105, with the tertiary level at 8000. On the upside, a break above 8500 could set the scene for bullish momentum towards 9000. The candle closing lower on the day could be a sign that futures are to break above the 10 DMA level completely; however, the indicators point to accelerating upside momentum. To confirm this, the robust level has to be taken out first.