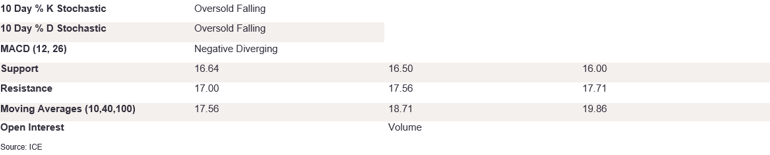

NY 2nd Month Sugar Futures

NY sugar futures gapped lower yesterday, opening below the robust 17.00 level, but support at 16.64 caused the market to close at 16.83. The stochastics are falling, with %K/%D diverging on the downside in the oversold territory, and the MACD diff just flipped on the downside – a strong sell signal. To confirm this momentum, a break below support at 16.64 could set the scene for 16.50 and then 16.00 – a September 2022 low. On the upside, to suggest the outlook for higher prices, futures need to close back above 17.00 and then target the 10 DMA at 17.56. A narrow candle body with long upper and lower wicks points to a lack of appetite out of current ranges. Support at 16.64 is crucial, and a break above it could set the scene for a longer-term decline.

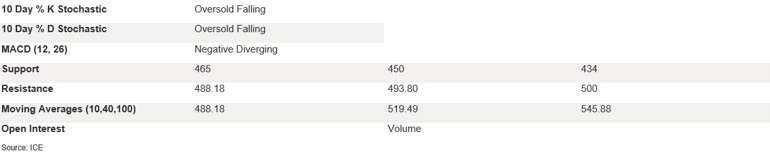

Ldn 2nd Month Sugar Futures

Ldn sugar futures weakened once again yesterday as protracted selling pressure triggered a close at 466.90. The stochastics are falling further into the oversold, and the MACD diff is negative and diverging, suggesting we could see prices continue to weaken in the near term. The close just off the support at 465, and the bearish indicators suggest we could see prices fall further and test 450. If prices can find support below this level, then this could prompt a test of 434, a 2020 low. The bulls need to close above 10 DMA at 488.18 in order to gain a foothold in the market and pave the way for higher prices to 493.80. Selling pressure was strong yesterday, and this could trigger further losses in the near term.

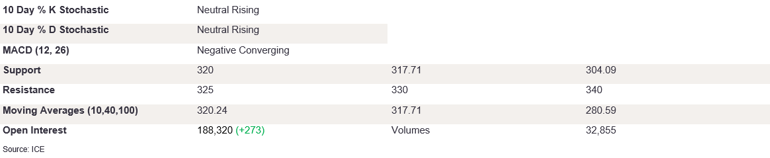

NY 2nd Month Coffee Futures

NY coffee futures failed above trend resistance yesterday as intraday trading caused futures to close at 323.95. The stochastics strengthened, with %K/%D diverging on the upside towards the overbought, and the MACD diff is about to converge on the upside, suggesting further rising pressures. However, the rejection of prices above the trend resistance has formed a candle with a narrow body and a long wick on the upside, pointing to a lack of conviction to break above the near-term resistance. If prices were to break above this level, this could trigger a test of 340. To confirm the shooting star formation, futures need to take out 10 and 40 DMA at 320.24 and 317.71, respectively, and then robust support at 300. Indicators need to confirm the change of trend before we can see prices edge higher. In the meantime, we expect prices to be capped by the trend resistance level.

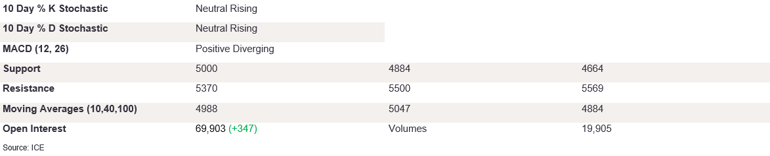

Ldn 2nd Month Coffee Futures

Ldn coffee futures gained ground yesterday as buying pressure triggered a close on the front foot just below the regression line of 5300 at 5269. The stochastics are rising with the %K/%D entering the overbought area, as the MACD diff is positive and diverging on the upside. This suggests we could see higher prices in the near term towards 5500, but the market needs to take out immediate resistance of 5370. On the downside, the candle found support above all the DMAs, and if the prices break below these levels – now around the 5000 mark - we could see prices retreat further. The three-white soldier formation is a bullish signal, but futures need to take out 5369 in order to confirm the outlook on the upside.

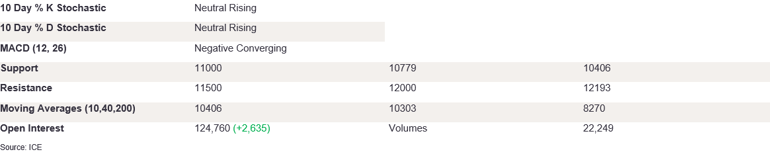

NY 2nd Month Cocoa Futures

NY cocoa gapped higher yesterday, with protracted buying pressure triggering a close above 11000 at 11224. Yesterday’s long candle with a longer upper wick suggests that prices are attempting to retest the recent highs. The stochastics have converged on the upside, sending a strong buy signal, and the MACD diff is negative and converging. The indicators point to growing upside pressures, and for that to materialise, the 115000 resistance has to be breached before we see some gains to 12000 and 12193. Alternatively, if upside momentum fails, this could trigger a trend reversal below 11000 to the short-term DMAs of 10350. We expect to see some strength today as support at 11000 holds.

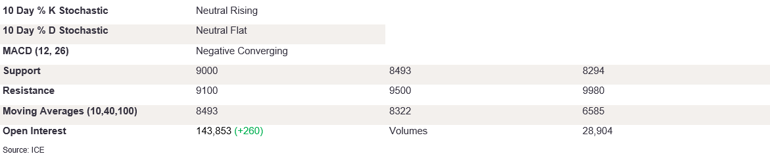

Ldn 2nd Month Cocoa Futures

Ldn cocoa strengthened yesterday as buying pressure triggered a close on the front foot at 9071. The stochastics are rising, with %K/%D diverging on the upside into the overbought. The MACD diff is about to converge on the upside, which will send a strong buy signal. A bullish candle body with short wicks suggests growing buying pressures; this could set the scene for higher prices to break above the resistance at 9100. This would confirm the trend for rising prices, up to the 9500 level. On the downside, a breach of support at 10 DMA at 8493 would strengthen the bearish momentum. This could also trigger losses towards the 8322. Indicators point to higher prices, but as futures approach the recent highs, we believe that gains are likely to be capped in the near term.