EUR / USD

The EUR/USD currency pair has recently shown some resilience, climbing above the 1.0550 level despite weak German consumer confidence data. This rise is partly due to a weakness in the US dollar, which has provided support to the euro. However, the overall sentiment remains bearish, influenced by persistent economic challenges in the Eurozone, particularly in Germany. The European Central Bank is under pressure to address these issues, with potential interest rate cuts being considered.

On the technical front, the EUR/USD is struggling to break above key resistance levels, with the 200-day EMA reinforcing bearish pressure. The pair's movement is closely tied to upcoming economic data releases, which could introduce further volatility. Despite recent gains, the euro's overall weakness against the dollar this year is driven by concerns over Eurozone economic performance.

The EUR/USD pair's future trajectory will likely depend on the interplay between US economic performance and Eurozone economic sentiment.

USD / JPY

The USD/JPY currency pair has recently experienced significant fluctuations, influenced by falling US Treasury yields and expectations of a potential rate hike by the Bank of Japan (BoJ). The decline in US yields has weakened the dollar, reducing its interest rate advantage and contributing to the yen's strength. This strength is further supported by the yen's safe-haven status amid geopolitical tensions and global economic uncertainties. The BoJ's potential rate hike in December is a key focus, as it could narrow the interest rate differential and push the USD/JPY pair below the 150 level.

Technical indicators suggest bearish momentum, with the pair nearing key support levels around the 50-day SMA at 150.60. Despite these pressures, there is potential for a short-term rebound if support holds.

Market participants are closely monitoring central bank communications and economic indicators, particularly any shifts in US fiscal policy. Investors should remain vigilant, as liquidity conditions and upcoming US economic data releases could introduce further volatility.

GBP / USD

The GBP/USD currency pair is currently in a consolidation phase, edging higher to 1.2650. However, over the longer term, GBP is struggling to break significantly higher given dollar resilience. The British pound faces additional pressure from weak UK retail data, including declines in the BRC Shop Price Index and CBI Realised Sales Index.

Technical analysis shows resistance levels at 1.2683, 1.2719, and 1.2768, with support at 1.2618, 1.2567, and 1.2506. A break below 1.2618 could lead to further declines while surpassing 1.2683 might indicate a bullish reversal. The RSI suggests a neutral stance, and the 30-day VWAP at 1.28 serves as nearby resistance.

Upcoming Bank of England events and US economic data releases could trigger a breakout from the current range. The outlook remains cautious, with potential downside if economic data continues to disappoint, influenced by both US and UK economic developments.

EUR / CHF

The EUR/CHF currency pair is currently influenced by macroeconomic factors, including the European Central Bank's cautious approach to interest rate adjustments, which suggests potential stabilisation of the euro. Geopolitical tensions, such as US trade tariffs and the Russia-Ukraine conflict, have added volatility to the euro, impacting its performance against the Swiss franc. The euro's recent gains against the dollar, driven by hawkish ECB comments, may provide some support against the Swiss franc.

However, the broader economic outlook remains uncertain, with weak consumer confidence in Germany adding complexity. The Swiss franc, often seen as a safe-haven currency, may strengthen amid global economic uncertainties.

Technical indicators show the EUR/CHF pair trading below key moving averages, indicating potential resistance around 0.94 to 0.96. The RSI suggests the pair is nearing oversold territory, implying a potential rebound if buying interest increases. Overall, the EUR/CHF pair is likely to experience fluctuations as market participants react to these multifaceted economic and regulatory developments.

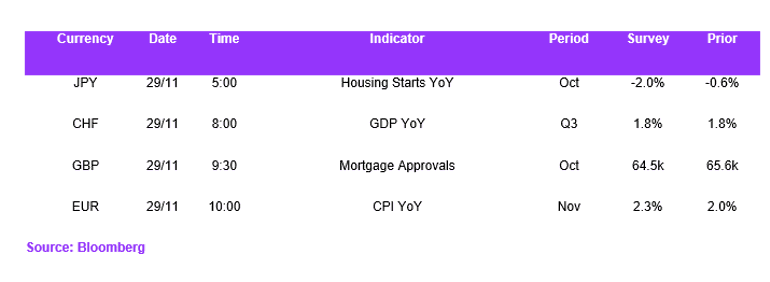

Economic Calendar