EUR / USD

The EUR/USD currency pair is currently experiencing volatility as it consolidates within a wide range, with market participants closely monitoring upcoming inflation data and central bank decisions. The pair has recently dipped, nearing the critical 1.0500 level, reflecting market caution ahead of the U.S. Consumer Price Index (CPI) release.

Analysts suggest limited upside potential for EUR/USD, with a bearish outlook prevailing due to potential tariff headlines and a hawkish tilt from the Fed. Technical analysis indicates that EUR/USD faces resistance around 1.06, with a break below 1.0500 possibly resuming the bearish trend.

The euro's weakness is partly attributed to economic challenges in the eurozone, including rising inflation in Germany. Speculators have increased their net short positions on the euro, indicating a bearish sentiment in the futures market.

Overall, the euro's outlook remains challenging, with economic and political uncertainties weighing heavily on its performance against the dollar.

USD / JPY

The USD/JPY currency pair is currently navigating a critical technical level, the 200-day moving average, following a bullish breakout. Over the past day, USD/JPY experienced a modest upward movement, closing at 151.96 after reaching a high of 152.16, with the price largely oscillating within a narrow range. The pair remains below key resistance levels, notably the 50-day moving average at 152.13, while finding support around 151.05, indicating a consolidation phase.

This movement is closely linked to the dynamics of U.S. Treasury yields, which have held steady, thereby supporting the dollar against the yen. The correlation between USD/JPY and U.S. Treasury yields remains strong, indicating that any shifts in U.S. inflation data could significantly impact the pair. A stronger-than-expected U.S. inflation print could lead to higher yields, further boosting USD/JPY, while a weaker print might cap gains and invite selling pressure.

Overall, the USD/JPY outlook remains bullish, contingent on U.S. economic data outcomes, with traders advised to watch for the U.S. inflation data and any shifts in Treasury yields for further cues on the pair's trajectory.

GBP / USD

The GBP/USD currency pair is currently trading near the $1.2740 mark, experiencing relative stability due to the Bank of England's cautious stance on interest rates, which are maintained at 4.75%. Technical analysis indicates the pair is slightly above its pivot point, suggesting potential for an upward move if it remains above this level, with immediate resistance at $1.27996. However, a break below the pivot could lead to declines towards support levels at $1.26870.

The U.S. Dollar Index's mild bullishness, supported by stable economic data and rising U.S. Treasury yields, adds complexity to the pair's dynamics. The anticipation of the US Federal Reserve's interest rate decision and upcoming US CPI data are key factors that could influence the pair's movement. Despite the pound's recent gains, overall sentiment remains cautious due to global economic uncertainties and potential geopolitical risks.

Traders should closely monitor developments, as future movements will depend on both domestic UK factors and broader global economic conditions.

EUR / CHF

The EUR/CHF currency pair is at a critical juncture, influenced by upcoming monetary policy decisions from both the Swiss National Bank (SNB) and the European Central Bank (ECB). Market participants are divided on the SNB's potential rate cut, which could introduce significant volatility and impact the Swiss franc's strength. Despite potential rate cuts, the Swiss franc remains robust, supported by its status as a safe-haven asset amid global uncertainties.

Technical indicators suggest potential bullish momentum for EUR/CHF, with resistance levels at 0.9334, 0.9446, and 0.9520, and support at 0.9256 and 0.9211. The ECB's anticipated rate cut could exert downward pressure on the euro, contrasting with the SNB's more stable approach. Traders should be prepared for potential volatility and consider these technical levels when evaluating their strategies.

Overall, the EUR/CHF pair appears poised for significant movement, driven by both domestic and international monetary policy developments.

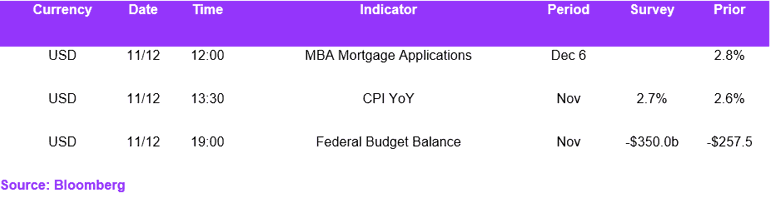

Economic Calendar