EUR / USD

The EUR/USD currency pair has been experiencing a downward trend, with the Euro losing 0.62% against the US Dollar over the past week, reflecting broader challenges in the Eurozone. The European Central Bank's dovish stance and expectations of further interest rate cuts add pressure on the Euro, while the US Dollar remains strong due to its global reserve currency status.

The anticipation of a Federal Reserve interest rate cut could potentially weaken the USD slightly but given the expectations of a shallower cutting path for the Fed for 2025, the dollar is likely to maintain its resilience against the EUR in the longer term. The upcoming Fed meeting is crucial, as any deviation from expected policy changes could cause volatility in the EUR/USD pair.

Additionally, economic contractions in key Eurozone economies like Germany and France, along with political instability, further weigh on the Euro. The EUR/USD pair's movement will hinge on central bank decisions and evolving economic and political factors, with key support and resistance levels at 1.04263 and 1.07, respectively.

USD / JPY

The USD/JPY currency pair has been experiencing a strong upward trend, recently reaching a high of ¥153.60, driven by expectations surrounding interest rate decisions from both the Federal Reserve and the Bank of Japan. The Federal Reserve is anticipated to cut rates by 25 basis points, while the Bank of Japan is expected to maintain its current rates, contributing to the dollar's strength against the yen.

This divergence in monetary policy is widening the interest rate differential between the US and Japan, favouring the dollar. Rising short-term U.S. Treasury yields are further supporting the dollar, pushing the USD/JPY pair higher.

Technical indicators suggest bullish momentum, with the pair breaking through key resistance levels and moving averages. However, potential surprises in the Bank of Japan's policy, such as a rate hike, could strengthen the yen and potentially reverse the current trend.

GBP / USD

The GBP/USD currency pair is currently under pressure due to the Bank of England's decision to maintain its policy rate at 4.75%, reflecting concerns over inflationary pressures. Meanwhile, the US dollar is strengthening, driven by a rise in US Treasury yields, which have increased by 25 basis points recently. This strengthening of the dollar typically exerts downward pressure on the GBP/USD pair.

Additionally, the Federal Reserve's anticipated 25 basis point rate cut could further influence the dollar's strength and impact the exchange rate. The pair has been trading below key moving averages, suggesting potential resistance around 1.27 and 1.28, with support near 1.251. Overall, the GBP/USD pair's movement will depend on developments in US and UK monetary policies and broader geopolitical factors.

EUR / CHF

The EUR/CHF currency pair is currently influenced by contrasting monetary policies, with the Swiss National Bank's focus on price stability supporting the Swiss Franc, while the European Central Bank's dovish stance pressures the euro. Key support levels are around 0.93, with resistance near 0.944, indicating potential trading scenarios.

The eurozone's economic challenges, including weak growth and political instability, further weigh on the euro's outlook against the Swiss Franc. Despite a recent slight decline in the pair, trading within a narrow range, the Swiss Franc's role as a safe-haven currency may attract investors during market volatility.

A bullish breakout could occur if the pair surpasses the 0.944 resistance, while a bearish trend might push it towards 0.924. Overall, the EUR/CHF outlook remains cautiously optimistic, with risks balanced by opportunities, as market participants monitor ECB policy developments and eurozone economic data.

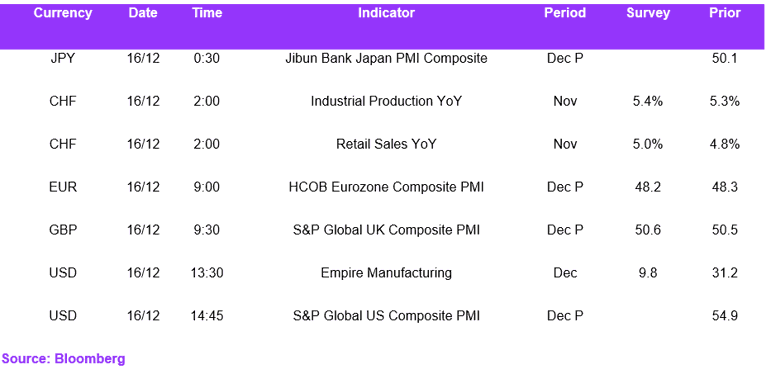

Economic Calendar