EUR / USD

The EUR/USD currency pair is currently experiencing bearish pressure, trading below the key pivot point of 1.05230, influenced by weaker-than-expected manufacturing PMIs from France and Germany. The Euro has shown some resilience due to stronger services PMIs, but overall, the Eurozone's economic outlook remains uncertain. The US dollar remains strong, supported by robust services PMI data and a bullish Dollar Index, despite weaker manufacturing figures.

Technical analysis suggests that a break above 1.05230 could shift sentiment to a more bullish outlook for the euro, while failure to breach this level may see the pair targeting lower support levels around 1.04739. The pair remains below key moving averages, including the 20-day, 50-day, and 200-day SMAs, which are acting as resistance levels, indicating a prevailing bearish sentiment.

Overall, the EUR/USD remains under pressure, with market participants awaiting further economic cues to determine the next directional move.

USD / JPY

The USD/JPY currency pair has been on an upward trend, driven by rising U.S. short-term Treasury yields and diverging monetary policies between the Federal Reserve and the Bank of Japan (BoJ). The pair recently climbed above the 154.00 level, with market participants anticipating further gains ahead of upcoming central bank meetings. The BoJ's decision to maintain its current interest rate policy would contribute to the yen's weakness.

Technical indicators show strong bullish momentum, with the possibility of the USD/JPY testing resistance levels around 156.00. However, a surprise rate hike by the BoJ could significantly strengthen the yen, potentially reversing the current trend.

Overall, the USD/JPY remains sensitive to central bank actions and global economic developments, with the potential for volatility in the near term.

GBP / USD

The GBP/USD currency pair currently shows a slight bullish bias, trading above the pivot point of $1.26663, supported by stronger-than-expected UK wage growth of 5.2% in October. This wage growth complicates the Bank of England's potential rate cut decisions, suggesting inflationary pressures that may lead the BoE to maintain its current interest rate of 4.75%. The UK labour market's stability, with an unchanged unemployment rate of 4.3%, further strengthens the Pound.

However, the pair's movement is also influenced by the strength of the US Dollar, bolstered by robust US services data. Immediate resistance for the GBP/USD is at $1.27375, with further upside potential capped at $1.27977, while support is seen at $1.26046, with a deeper floor at $1.25255.

The interplay between the Bank of England's cautious policy stance and the Federal Reserve's rate cut expectations, along with upcoming US Retail Sales data and UK inflation figures, will be key in shaping the currency pair's trajectory this week.

EUR / CHF

The EUR/CHF currency pair is currently under downward pressure due to several macroeconomic factors. The European Central Bank's ongoing rate cuts, aimed at addressing slowing economic growth and easing inflationary pressures, are contributing to a bearish sentiment on the Euro. This dovish stance, coupled with a softening labour market in the Eurozone, suggests further weakening of the Euro against the Swiss Franc.

Geopolitical uncertainties, such as potential US trade tariffs, add additional risks to Eurozone growth, potentially impacting the Euro's strength. Meanwhile, the Swiss Franc is benefiting from its safe-haven status, attracting increased demand amidst these uncertainties.

Overall, the EUR/CHF pair may continue to face challenges as the Euro weakens and the Swiss Franc remains resilient.

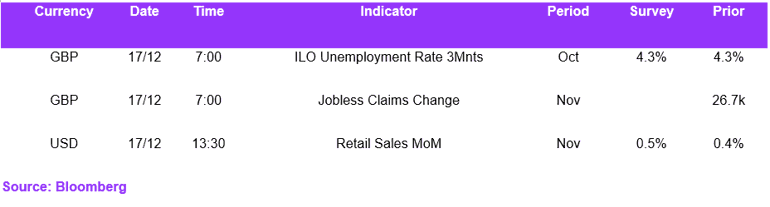

Economic Calendar