EUR / USD

The EUR/USD currency pair is currently consolidating around the $1.05 level, influenced by strong U.S. retail sales data and stable Treasury yields that have strengthened the U.S. dollar. The Federal Reserve's anticipated 25-basis-point rate cut and its forward guidance are key factors affecting the pair's movement. Meanwhile, the European Central Bank's cautious monetary policy, including recent rate cuts, highlights ongoing economic challenges in the eurozone.

Technical analysis indicates the pair is range-bound between $1.047 and $1.06, with potential bearish momentum if it breaks below $1.047. The current price is below significant moving averages, suggesting a bearish market sentiment.

Overall, the EUR/USD remains sensitive to U.S. monetary policy and European economic developments, with market participants closely monitoring the Fed decision today.

USD / JPY

The USD/JPY currency pair has recently experienced a pullback due to a decline in U.S. Treasury yields, as traders take profits ahead of the Federal Reserve's decision. Despite this, the pair remains above key moving averages, suggesting a potential support zone and indicating a bullish outlook.

The yen's depreciation, driven by the Bank of Japan's ultra-loose monetary policy, contrasts with the Federal Reserve's tightening measures, contributing to the yen's weakness against the dollar. Market participants are closely monitoring central bank announcements, which will be pivotal in determining the pair's direction.

The technical outlook suggests potential volatility, with key support and resistance levels being watched, including a possible test of resistance at 154.268. Overall, the USD/JPY is poised for fluctuations, with central bank actions playing a crucial role in its trajectory.

GBP / USD

The GBP/USD currency pair is currently experiencing relative stability, with the British pound holding steady against the US dollar. Strong UK wage growth and steady inflation have reduced the likelihood of an imminent rate cut by the Bank of England, providing some support for the pound. Meanwhile, the US dollar is supported by strong retail sales and expectations of a hawkish Federal Reserve decision, which could further strengthen the dollar.

Technical analysis suggests that GBP/USD is trading near key resistance and support levels, with a bullish bias above the $1.26952 pivot point. The pair encountered resistance near 1.27273, while support was evident around 1.2685, suggesting a consolidation phase.

The upcoming Federal Reserve and Bank of England meetings are critical, as their outcomes could significantly impact the pair's direction.

EUR / CHF

The EUR/CHF currency pair is currently influenced by recent monetary policy decisions from the ECB and SNB, with the SNB's rate cut weakening the Swiss franc against the euro. This has potential implications for Swiss export competitiveness and inflation dynamics.

Meanwhile, the ECB's cautious rate cut reflects concerns over sluggish growth, aiming to stabilize inflation. Political uncertainties in major eurozone economies add complexity to the euro's outlook, which is already under pressure against the US dollar.

The pair's recent slight decline and limited volatility suggest a stable yet cautious trading environment, with key support and resistance levels at 0.93 and 0.9445, respectively. Overall, the EUR/CHF pair faces a dynamic landscape shaped by economic and political uncertainties in both regions.

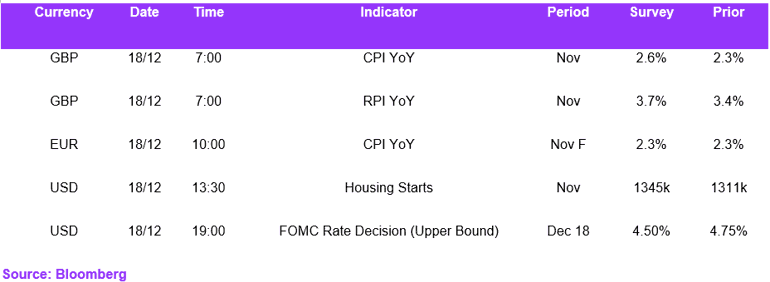

Economic Calendar