EUR / USD

The EUR/USD currency pair is currently under pressure due to the strengthening US dollar, driven by robust US economic data and the Federal Reserve's hawkish stance. The divergence in monetary policies between the Federal Reserve and the European Central Bank has widened the yield gap, further influencing currency movements. The euro's performance reflects ongoing economic challenges in the eurozone, including high inflation and geopolitical tensions, which have weakened consumer demand.

Over the past day, the EUR/USD pair experienced a slight decline, with the price moving from approximately 1.04063 to 1.0363, marking a modest decrease of around 0.37%. The current price of 1.03815 is below significant resistance levels, indicating a bearish sentiment. Traders are advised to monitor US economic data and central bank policies, as any signs of weakness in the US dollar could provide opportunities for the euro to recover.

Overall, the EUR/USD is likely to remain under pressure in the short term, influenced by strong US economic fundamentals and cautious monetary policy outlooks.

USD / JPY

The USD/JPY currency pair has recently experienced a significant rally, driven by the Bank of Japan's dovish stance and the U.S. Federal Reserve's hawkish policies. The BoJ's decision to maintain its interest rate at 0.25% has weakened the yen, making the USD more attractive, especially as the U.S. economy shows strong performance with a 3.1% GDP growth rate. This interest rate differential has favoured holding USD over JPY, pushing the USD/JPY pair above the 157 mark and testing new resistance levels between 158.50 and 160.

The pair's current price is significantly above the 20-day, 50-day, and 200-day moving averages, suggesting a robust upward trend, although the RSI is in overbought territory at 72.12, hinting at potential exhaustion. Despite rising inflation in Japan, the BoJ remains cautious about rate hikes, further pressuring the yen. The potential for Japanese government intervention exists if the yen's depreciation becomes excessive, but the overall trend remains bullish for USD/JPY.

Overall, the outlook for USD/JPY remains bullish in the near term, driven by the Fed's policy direction and the yen's relative weakness.

GBP / USD

The GBP/USD currency pair has recently faced significant downward pressure, reaching an eight-month low of $1.2470, driven by the Bank of England's decision to maintain interest rates. The US dollar's strength, supported by robust GDP growth and stable bond yields, has further pressured the pound. The UK's economic challenges, including contracting growth and persistent inflation, have exacerbated the pound's weakness.

Despite a modest rise in UK retail sales, the broader economic outlook remains grim, with inflation and labour market concerns persisting. The pair tested a support level around 1.250, which coincides with the 20-day moving average, indicating potential buying interest at this level. The RSI is currently at 34, suggesting the pair is approaching oversold conditions, which could lead to a short-term bounce.

Overall, the GBP/USD outlook remains cautious, with potential for further downside if economic conditions do not improve.

EUR / CHF

The EUR/CHF currency pair is significantly influenced by the monetary policies of the Swiss National Bank (SNB) and the European Central Bank (ECB). The SNB's focus on inflation control and economic stability has contributed to the Swiss franc's strength, despite interventions to prevent excessive appreciation. The franc's safe-haven status amid global uncertainties further supports its relative strength against the euro. Meanwhile, the ECB's gradual interest rate cuts, aimed at managing inflation, have impacted the euro's strength, especially in light of the Eurozone's economic challenges.

The recent slight decline in EUR/CHF, moving from approximately 0.933 to 0.931, reflects a minor downward trend, with resistance at 0.933 and support at 0.927. The pair's current position around the 20-day and 50-day moving averages suggests a consolidation phase, with the 200-day moving average at 0.95 acting as significant resistance.

Investors should monitor policy signals from both central banks and economic data releases, as these factors will likely contribute to the pair's volatility.

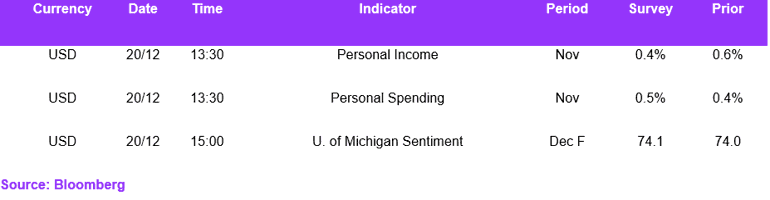

Economic Calendar