EUR / USD

EURUSD struggled to break out of the recent ranges yesterday, prompting it to stabilise around the 1.03 level. This is despite recent data indicates a cooling trend in US core inflation, which has led to a decline in US Treasury yields and a weakening of the dollar. Continued robustness of the USD and persistent economic and fiscal challenges within the Eurozone are weighing on the pair's momentum in the longer term.

The European Central Bank's inclination towards further monetary easing suggests potential downward pressure on the euro, while the Federal Reserve is expected to maintain its current interest rate policy, with potential rate cuts later in the year if inflation continues to ease. Today's inflation figures out of the Eurozone are expected to come in line with market expectations, likely resulting in limited moves in EURUSD.

USD / JPY

USD/JPY weakened due to declining US Treasury yields and expectations of a potential interest rate hike by the Bank of Japan (BoJ). Recent hawkish comments from BoJ officials, coupled with a softer US core CPI print, have strengthened the yen against the dollar, with the pair testing new lows of 155.20 – not seen since mid-December. The yield spread between the 10-year US Treasury note and the Japanese Government Bond suggests further downside potential for USD/JPY.

Market anticipation of a BoJ rate hike, driven by sustained inflation and strong wage growth in Japan, has heightened expectations for yen appreciation. This potential policy shift could narrow the interest rate differential with the US, further supporting the yen. Markets are bracing in for the impact of a hike from the BOJ while expecting the Fed to hold interest rates firmly in their first meetings of the year.

GBP / USD

GBPUSD fluctuated due to economic factors from both the UK and the US, with weaker-than-expected GDP growth and a slowdown in inflation in the UK raising concerns about economic stagnation. This has led to speculation about potential dovish shifts in the Bank of England's monetary policy, contributing to a bearish sentiment for the GBP/USD. The anticipation of potential rate cuts by the Bank of England could further weaken the pound, adding to the volatility of GBPUSD in the near term.

The divergence in monetary policies between the Bank of England and the Federal Reserve has contributed to fluctuations in the currency pair, with market participants anticipating both central banks to hold their rates unchanged in the meantime.

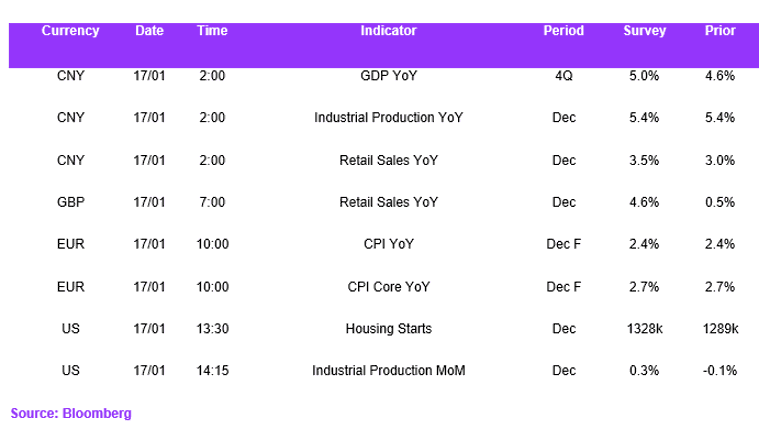

Economic Calendar