EUR / USD - Testing Key Resistance amid Trade Uncertainty

EUR/USD started to show signs of recovery, rebounding back above the 1.0400 level, thanks to improving investor sentiment figures and volatile dollar moves. Still, the pair faces significant resistance at the descending channel's trendline near 1.0425, which has been a key technical barrier since last August. A sustained break above this level could signal a reversal of the recent US dollar strength, potentially leading to further gains for the euro.

In the meantime, the US dollar continues to weigh on other currencies, supported by upcoming trade policies under President Trump. In particular, markets have been reacting to Trump's proposed tariffs on imports from countries like Mexico and Canada. This adds to the US's inflationary narrative, keeping the USD elevated. Further expectations from his administration will continue to drive the narrative for EURUSD in the near term, with higher emphasis placed on potential tariffs concerning the EU.

We believe the EUR to be undervalued at these levels; however, the uncertainty surrounding US tariff policies should keep the EUR/USD pair under pressure, with the potential for further downside if trade tensions escalate.

USD / JPY - Focus Ahead of BOJ Decision

USD/JPY softened yesterday, driven by falling US Treasury yields and narrowing interest rate differentials between the US and Japan. Now at a five-week low, the 155.00 support level is key. Market participants are closely watching the upcoming BoJ meeting, where a rate hike is anticipated, which could further drive the yen's strength. Further guidance from policymakers will be crucial; thus, we anticipate increased pair volatility on Friday.

From a technical perspective, a break below the 155.00 level could accelerate the downward trend, as resistance levels around 156.00-156.75 cap any upward movement. The RSI suggests the pair is approaching oversold territory, which could lead to a marginal rebound before the BOJ's meeting later on in the week.

The current sentiment is cautiously optimistic for the yen, contingent on the BoJ's forthcoming decisions. USDJPY is likely to remain rangebound in anticipation of Friday's interest rate announcement.

GBP / USD - Struggling to Find Direction

GBP/USD reflected the movements of the dollar and remained volatile yesterday, finishing the day with a moderately bullish outlook. Technical analysis indicates GBP/USD is struggling to break above the 1.2350 mark, as selling pressure persisted around the 1.234 level. The 20-day moving average at 1.23 has acted as a support level, with volumes peaking at the 1.229 level, suggesting significant buying interest around this price point. Meanwhile, the 50-day and 200-day moving averages at 1.25 and 1.28, respectively, indicate potential resistance in the near term.

Disappointing UK employment data is weighing on the GBP, with the unemployment rate rising to 4.4%. This has raised concerns about the stability of the UK labour market, contributing to the pound's weakness despite robust wage growth. This adds to the list of uncertainties the BOE must navigate in the coming months.

Technical indicators suggest that GBP/USD is in a neutral position, lacking clarity in the meantime. Markets remain cautious, and with no UK data releases tomorrow, greater focus will shift to the USD.

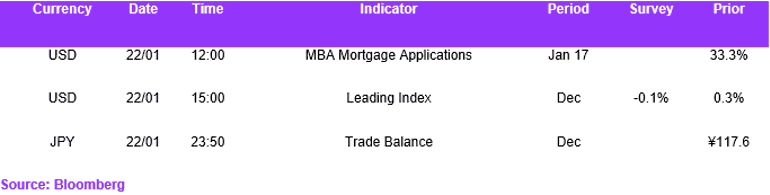

Economic Calendar