EUR / USD- Lacklustre Sentiment Persists

EURUSD continued to consolidate yesterday, trading near the $1.04 mark once again. Despite a slight improvement in Euro Area Consumer Confidence, the overall trend remains bearish due to stronger U.S. economic performance and higher interest rates favouring the dollar. Technical analysis indicates resistance around the 1.0420 – 1.0435 range, with potential declines towards the 1.03 level, suggesting limited upward momentum for the euro.

The ECB's anticipated continuation of its rate-cutting campaign may exert additional downward pressure on the euro, while the U.S. dollar remains strong amid expectations of steady U.S. interest rates. The ECB's monetary policy trajectory, including potential rate cuts, is largely priced into the market, minimizing the likelihood of significant surprises in the near term. Meanwhile, the Fed's cautious approach to interest rate changes suggests that the dollar may maintain its current levels without significant fluctuations.

We expect that the EUR/USD will remain under pressure unless there is a significant shift in economic fundamentals or policy outlooks.

USD / JPY - Cautious Outlook Ahead of Expected BOJ Rate Hike

USD/JPY weakened slightly yesterday, maintaining the current trading range around 156.20. Higher-than-expected initial jobless claims weighed on the dollar slightly; however, a bigger focus is on tomorrow's BOJ meeting, which is expected to increase interest rates from 0.25% to 0.5%.

The anticipated BoJ rate increase is supported by rising wage growth and sustained inflation, with Japan's core inflation rate reaching 3% growth year-on-year. If USD/JPY breaks below the 155.00 level, it could move towards the next support range of 153.50 – 154.00, indicating potential for further declines.

Overall, market sentiment remains cautious, with the BoJ's meeting outcome crucial for the yen's trajectory. Despite the BoJ's anticipated actions, the U.S.-Japan interest rate differential continues to exert downward pressure on the yen. Tomorrow's decision will be key; however, policymakers' notes regarding future interest rate expectations are likely to be given greater importance.

GBP / USD- Stability Above Key Pivot Point

GBP/USD held its nerve yesterday, maintaining its position above the critical pivot point of 1.23017. Higher-than-expected initial jobless claims have impacted the dollar's performance. However, concerns over the UK's fiscal stability due to increased public sector borrowing continue to weigh on the pair.

Technical analysis indicates that if GBP/USD can sustain its position above the 1.2370 level, it may target the next resistance range of 1.2485 to 1.2500. The pair's current price is below the 200-day moving average of 1.28, suggesting a bearish longer-term trend, while it hovers around the 20-day moving average of 1.23, indicating potential short-term support.

Overall, while the pound's short-term outlook appears positive, the pair is likely to remain in the lower end of the trading range over the longer term.

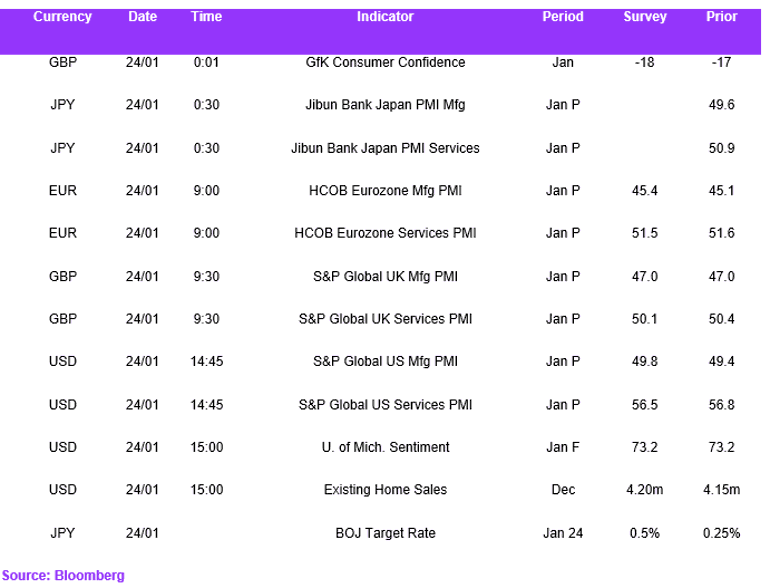

Economic Calendar