EUR / USD - ECB's Interest Rate Cut is Weighing on the Euro

EUR/USD weakened yesterday due to the ECB's decision to implement a 25bps rate cut, which contrasts with the US Fed's decision to maintain its interest rates. This divergence in monetary policy weighed on the euro. The technical analysis supports this bearish outlook, with the pair testing key support levels and remaining below significant resistance levels, such as the 50-day moving average at 1.0420.

Market sentiment is further influenced by the possibility of US tariffs on the eurozone, adding to the euro's downside risks. The eurozone's economic challenges, including political instability and low consumer confidence, contribute to the euro's vulnerability.

A bullish scenario could emerge if the pair breaks above the 1.047 resistance, potentially targeting the 1.053 level. However, we anticipate that EURUSD will remain on the back foot, given the widening differential between US and European interest rates.

USD / JPY - Technical Indicators Favour Moderate Softness

USD/JPY continued to fluctuate around the key 155 level, retesting the previous low at 153.80. Technical indicators such as the RSI and MACD suggest a loss of bullish momentum. A breach of the 50-day moving average indicates potential for further downside movement.

The Bank of Japan's potential for further rate hikes, supported by recent board changes and a shift towards more conventional monetary policy, is bolstering the yen. However, the gap between the BOJ's and the Fed's rates remains robust, weighing on the yen's longer-term prospects.

Short-term technical indicators suggest moderate softness in USD/JPY; however, the yen's longer-term strength is being capped by robust US dollar performance.

GBP / USD - Pound Continues to Face Challenges

GBP/USD continued to weaken, trading just above a key support level at 1.2400. The Fed's decision to maintain interest rates at 4.50% has kept the US Dollar stable, while the British Pound faces challenges due to policy uncertainty and fiscal concerns in the UK. The BOE's anticipated interest rate cuts in early February, reflecting economic stagnation and mixed inflation signals, are likely to keep the Pound under pressure in the short term.

Technical analysis indicates that GBP/USD is struggling to break above the $1.24584 pivot. The 50-day EMA acts as a crucial resistance level at $1.2500 that must be breached to confirm an upward breakout.

Given the prevailing US dollar strength, technical indicators will be key in gauging the pair's near-term outlook.

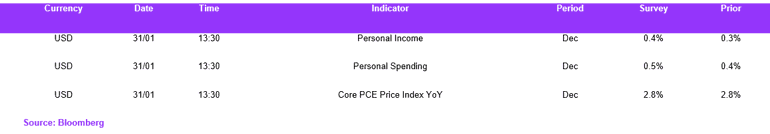

Economic Calendar