Diverging Central Bank Dynamics

EUR / USD - Resistance Amid Diverging Economic Strengths

EUR/USD weakened yesterday, struggling to breach the robust 50 DMA resistance, currently standing at 1.0410. Despite stronger-than-expected initial jobless claims, the US Dollar remained resilient, indicating that the market is confident in the relative economic strength of the US compared to the Eurozone. Additionally, weaker-than-expected retail sales data from the Euro Area has further dampened the economic outlook for the region.

Market participants are closely monitoring upcoming economic indicators, particularly the US Non-Farm Payrolls report, as expectations suggest another month of strong labour performance. Positive figures would weigh on the EUR/USD prospects. In the longer term, the growing divergence in interest rate policies between the Fed and the ECB is dampening the pair's outlook.

The technical outlook for EUR/USD remains subdued in the short term, with the pair facing resistance around the 1.0440 level and support near 1.0335. However, a breach above the 50 DMA level could trigger strong buying pressure from a technical perspective.

USD / JPY - Oversold Conditions Suggest Possible Reversal

USD/JPY continued to decline, dropping to 151.53, despite a resilient US dollar yesterday. This downtrend has pushed the pair below several key moving averages, including the 50-day, 200-day, and 100-day averages, underscoring a risk-off sentiment. USD/JPY remains under pressure, largely due to growing expectations of a more hawkish stance from the BOJ, supported by strong economic indicators in Japan, including positive wage growth and robust services sector performance.

However, from the technical standpoint, the indicators point to waning selling pressure in the near term. USD/JPY is approaching a key support level of 150.78, a close below, which could signal further downside potential, with the psychologically important 150.00 mark. The oversold conditions on shorter-term charts suggest the possibility of a pullback.

Overall, we anticipate moderate softness leading to the next key support level; however, markets would need another trigger to push the pair significantly below this level.

GBP / USD - Pound Struggles After BoE Rate Cut

GBP/USD fluctuated during the day, struggling above the key 50 DMA resistance of 1.2497 once again. The BoE's decision to cut interest rates by 25 basis points to 4.5% was widely anticipated, marking the third reduction since August 2024. More importantly, the central bank slashed its 2025 UK growth forecast from 1.5% to just 0.75%, signalling concerns about economic stagnation. The dovish tone and concerns about economic growth contributed to the pound's weakness against the dollar.

We expect GBP/USD to struggle above the 50 DMA level. Today's US jobs report release may support the US dollar's long-term strength, putting pressure on the pair.

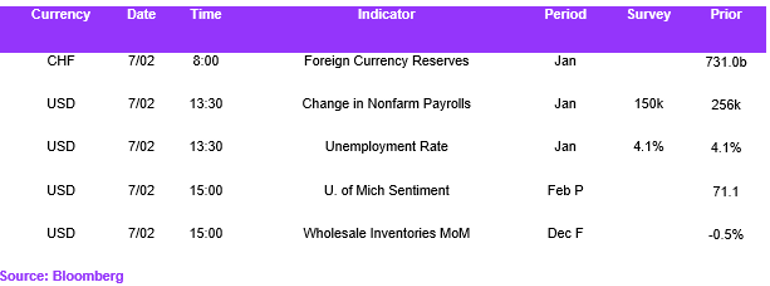

Economic Calendar