US stocks started the day on a positive note following a sell-off in the dollar, which was triggered by retail sales data indicating a more significant-than-anticipated drop in consumer spending for the month. Although spending trends tend to vary seasonally, with February often experiencing a dip following a robust January, the recent retail sales figures prompted investors to offload the overbought dollar from Monday. The dollar index declined to 104.40, while the 10-year US treasury yield edged lower to 4.23%. We expect the greenback to depreciate further in the coming days and stabilise around the 104.0 level. Elsewhere, the UK GDP print pointed to a stronger-than-expected contraction in economic activity, with the Q4 figure at -0.2% YoY compared to 0.3% recorded in the previous quarter. While the economy has entered a technical recession, persistently elevated inflation leads investors to stick to their expectations of no interest rate cuts before H2 2024.

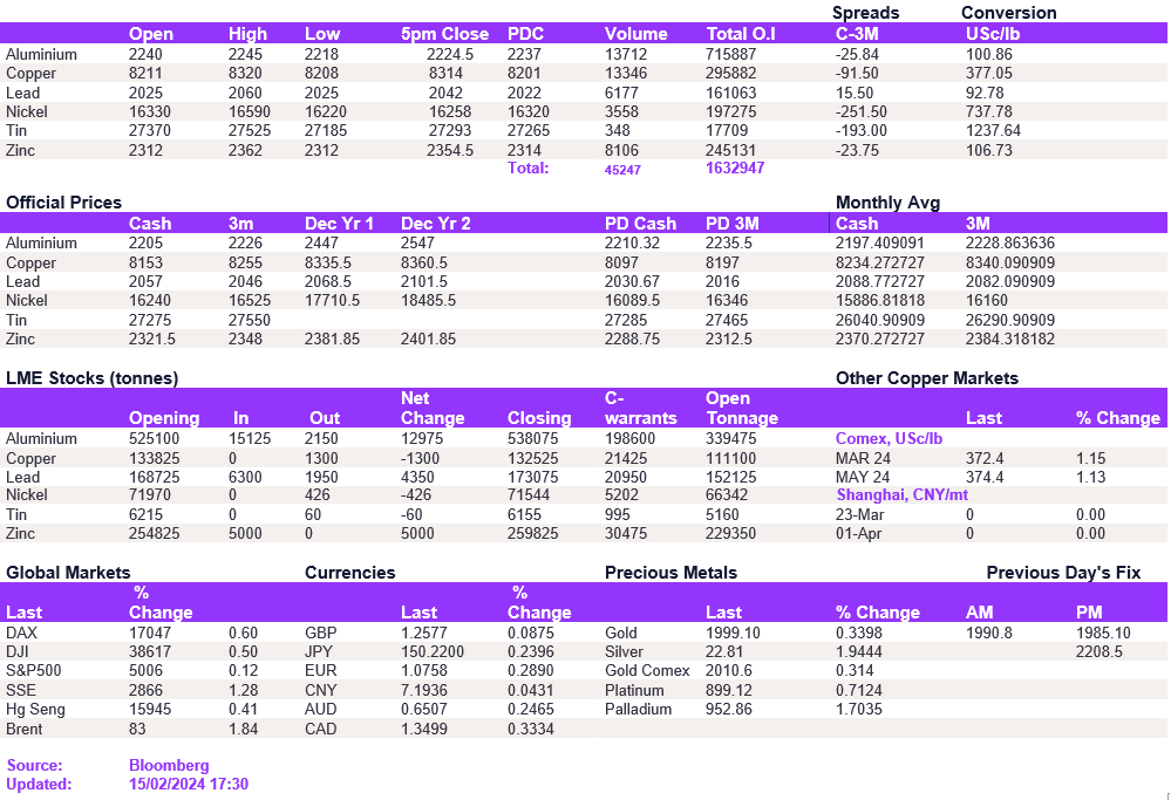

Base metals performance was a mixed bag once again, with prices that deviated outside of the trading range in recent days now seen coming back in line with the mean. In particular, mean reversion and a softer dollar prompted copper prices to jump back above the $8,300/t level; we expect prices to edge higher to the $8,380-8,400/t area as prices equalise. Likewise, lead and zinc are now edging higher following the recent sell-off, breaking above the recent resistance at $2,050/t and $2,350/t, respectively. Aluminium remained rangebound at $2,226/t, and nickel struggled above the $16,500/t level.

The softening dollar provided a boost to precious metals, causing gold to climb above $2,000/oz once again. Silver, mirroring gold's performance, surged to approach the $23/oz mark. Despite the International Energy Agency's forecasts of a surplus in 2024, oil prices remained unaffected. Both WTI and Brent crude saw gains, reaching $77.9/bl and $82.7/bl, respectively.

All price data is from 15.02.2024 as of 17:30