US stocks experienced a slight pullback at the opening today, following yesterday's record-setting rally, as anticipation builds around the Federal Reserve's monetary policy direction. This sentiment was further fuelled by the Fed's statement on Wednesday, hinting at three potential rate cuts this year. The expectations of a first rate cut in June have been factored in by the forward swap markets with over an 80% probability, leading to an increase in the 10-year US Treasury yield today to 4.2%. Similarly, investors are now heavily betting on a 92% chance of the ECB implementing its first rate cut in June. Yesterday's PMI data highlighted the robust performance of the world's largest economy, in contrast to the Eurozone, which is still grappling with the challenges posed by a prolonged period of high interest rates. As investors and market watchers closely monitor these developments, the anticipation around central bank policies and their impact on global markets continues to shape investor sentiment and market movements.

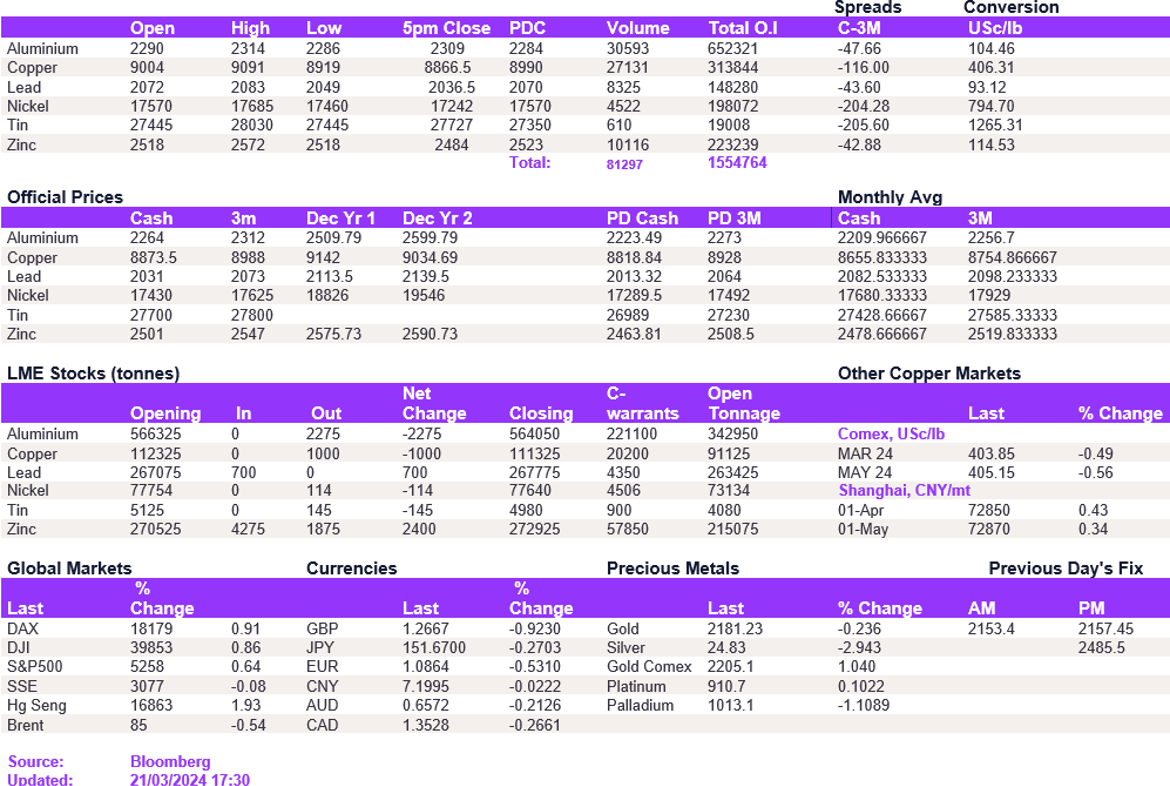

While this week has been packed with plenty of macroeconomic announcements, including central bank speeches and inflation readings, macro itself had little bearing on base metals' performance. Instead, speculative, technical and fundamental appetite has been driving the momentum within the complex. Copper prices have slightly corrected today, and the robust trend support at $8,850/t has held firm, keeping prices elevated. This level is crucial in determining the near-term path of copper prices. Even if prices breach this level, our longer-term outlook remains moderately bullish, with support at $8,300/t holding firm. Elsewhere, nickel prices corrected back to $17,242/t, which we believe to be close to the fundamental value. We expect nickel prices to remain on the back foot relative to recent highs in the near term. Aluminium held comfortably above the $2,300/t level. Lead and zinc weakened to $2,036.50/t and $2,484/t, respectively.

The dollar index strengthened, reaching 104.3 today, exerting downward pressure on precious metals. Gold saw a decline, dropping to $2,167.80/oz, which still remains 5% higher than at the start of the year. Silver also experienced a decrease, falling to $24.70 per ounce. Oil prices remained relatively stable, with WTI slightly adjusting to $80.85/bl and Brent crude to $85.60/bl.

All price data is from 22.03.2024 as of 17:30