US stocks experienced fluctuations today as the markets entered a relatively quiet calendar week. The prevailing trend of slight dovishness remains, with markets increasingly pricing in a higher likelihood of a Federal Reserve rate cut closer to the start of Q3. The dollar index held steady at 105.1, while the 10-year US Treasury yield dipped below 4.5% for the first time since early April. In other news, Eurozone retail sales surpassed expectations in March, climbing by 0.8%, the fastest growth in 18 months, suggesting improved consumer sentiment despite the region's recent economic challenges.

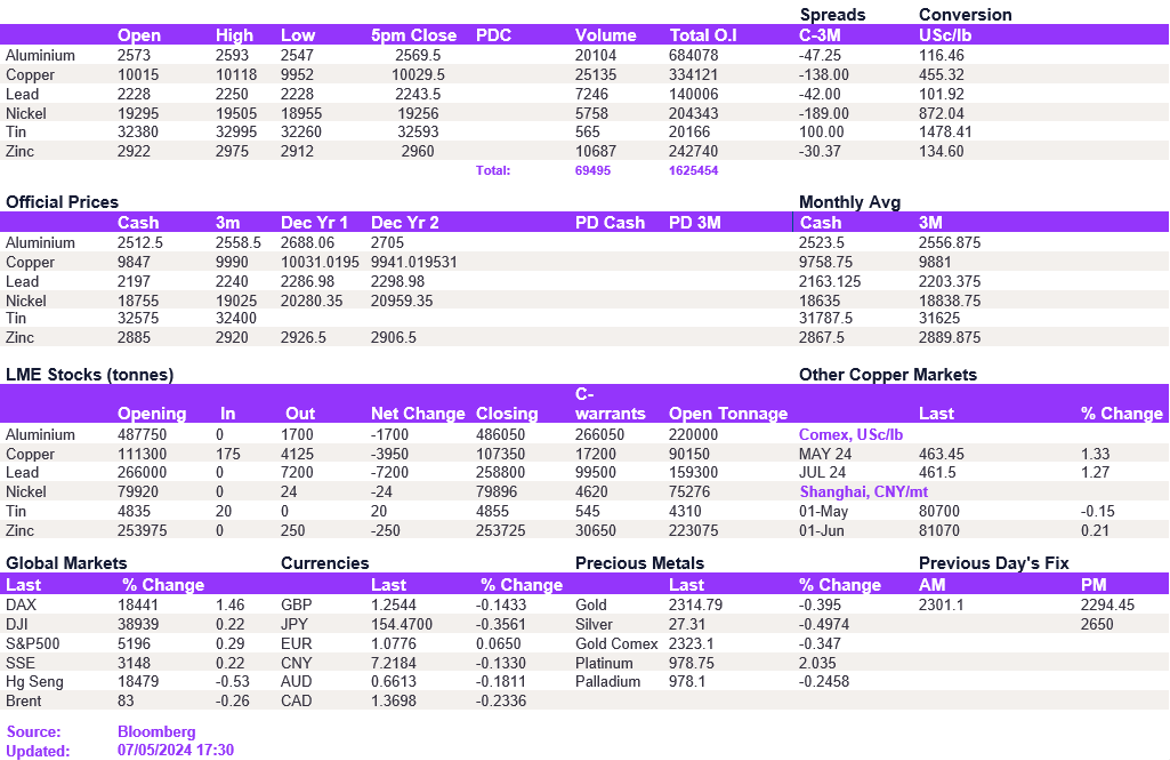

It's a quiet start to the week in trading as markets return from holiday. Copper once again captured the market's attention, fluctuating around the $10,000/t level due to prevailing market uncertainty, which prevented it from making a significant breakthrough. The market is lacking the incentive to push prices significantly higher in the meantime, and we expect copper to strengthen marginally instead. At the time of writing, copper closed at $10,029.50/t. Likewise, aluminium held below the $2,600/t level once again at $2,569.50/t. Lead and zinc gapped higher on the open, strengthening to $2,243.50/t and $2,960/t.

Following yesterday's gains, precious metals were largely unchanged, with gold at $2,320/oz and silver at $27.4/oz. Oil prices trended lower, with WTI at $77.9/bl and Brent at $82.7/bl. We anticipate increased volatility in the oil market due to ongoing discussions of a ceasefire in the Middle East.

All price data is from 07.05.2024 as of 17:30