US stocks were mixed on the open, as markets brace for the US election results tomorrow. Over the weekend, Harris’s probability of winning the Presidential race has increased, narrowing the gap between two candidates. As a result, the dollar, which has been subject to strong upside pressures given probability of Trump’s win and his possible inflationary narrative, has weakened to 103.75. With uncertainty regarding who will win over swing states growing, markets remain on standby, unable to clearly price in a winner. As a result, we expect that tomorrow’s outcome will translate into volatility across the markets on the Wednesday open. However, we do not anticipate a new price trend to emerge as a result of this, as it is yet unclear what policies the new president will introduce. This, coupled with the upcoming Fed and BOE meetings later on in the week, should add greater volatility to most macroeconomic-related assets this week.

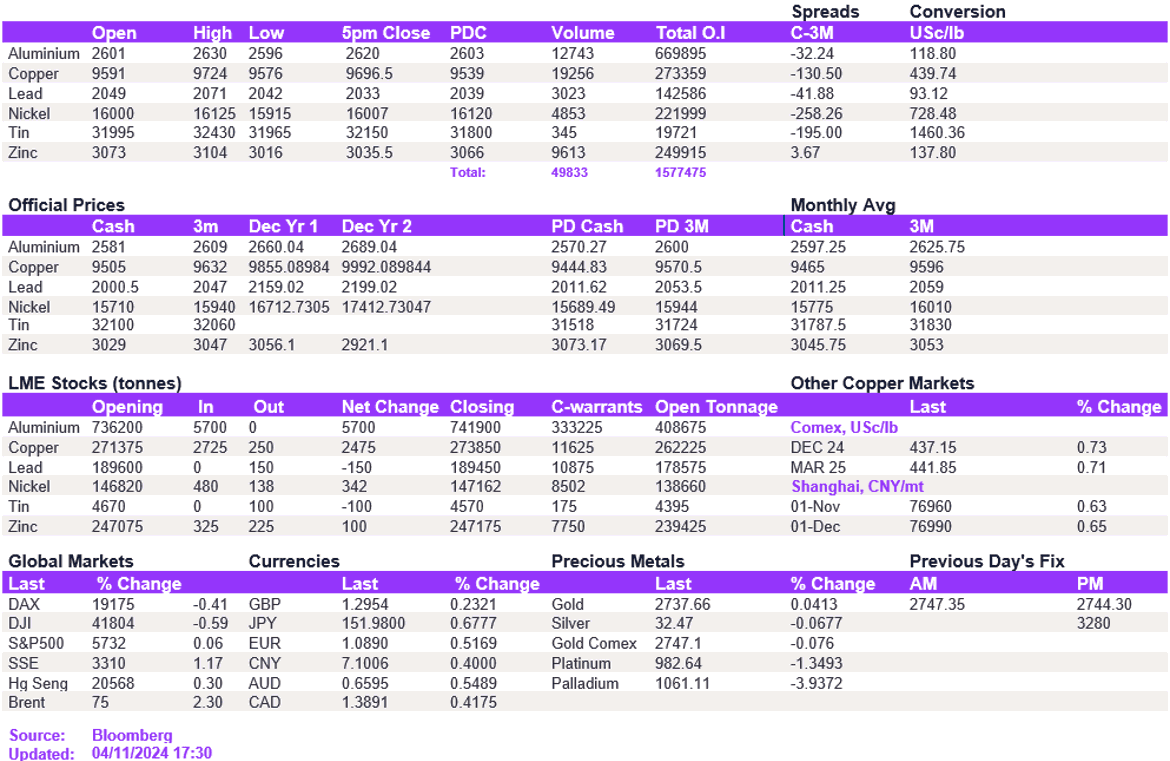

As a result of a weaker dollar, base metals saw marginal risk-on appetite today. While we do not expect the outcome of the US election to drive the complex pricing, the dollar moves will have a strong impact on the intraday momentum on the Wednesday open. In the meantime, aluminium and copper edged higher, closing at $2,620/t and $9,696.50/t. Despite strong downside pressure in recent weeks, lead and nickel’s gain today were relatively muted, prompting prices to close at $2,033/t and $16,007/t, respectively.

Oil rose following the OPEC’s decision to delay output hikes, with WTI and Brent strengthening to $71/bbl and $74/bbl, respectively. Gold and silver remained elevated at $2,737/oz and $32/oz.

All price data is from 4.11.2024 as of 17:30