US stocks jumped higher at the open as voting for the US Presidential election commenced, with the outcome expected to be announced overnight, London time. Even on the day of the election, markets are filled with uncertainty as to who will emerge as the next president, which is likely to incite volatility on the announcement. Assets closely related to the US economy, such as the Mexican Peso and Chinese yuan, have been subject to fluctuations as investors assess how the new president's policies might impact these economies. The dollar experienced some volatility later on in the day but maintained above the support of 103.50. Additionally, the US 10-year Treasury yield continued to strengthen to 4.35%. We expect further volatility across the market tomorrow. From the economic standpoint, the ISM’s non-manufacturing PMI in the US jumped to 56.0, the highest level since July 2022. Likewise, China’s service activity expanded in October, marking the fastest pace of growth since July. The Caixin service PMI jumped to 52.0, a sign of a possible recovery in the consumer segment.

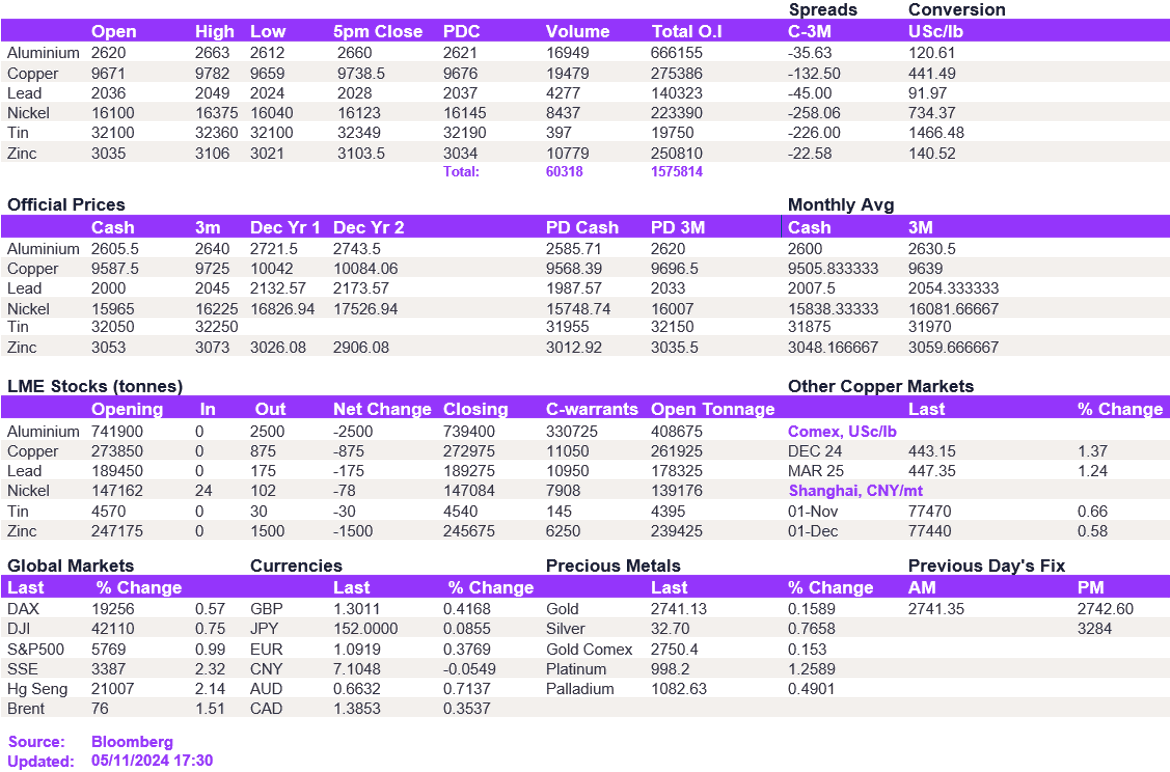

Due to a slightly weaker dollar, the base metals complex edged higher while remaining within last week's trading range. Aluminium and copper strengthened marginally to $2,660/t and $9,738.50/t, respectively. Nickel attempted to breach the $16,155/t resistance level today but struggled above it, prompting prices to close at $16,123/t. Other metals held steady.

Oil prices continued to climb as markets focus on the outcome of the election, prompting WTI and Brent to trade above $72/bbl and $76/bbl, respectively. Gold and silver wavered near the high, pricing in the impact.

All price data is from 05.11.2024 as of 17:30