US stocks continued to rise, reaching another record high as markets await the Fed meeting tonight. Both the dollar and the US 10-year yield have returned to levels seen before the US election results, setting the stage for the Fed to cut rates by 25bps. Investors will closely watch for further insights from Jerome Powell regarding the Fed's direction under President Trump.

In the meantime, US initial jobless claims rose to 221,000 in the week ending November 2nd, representing a marginal increase compared to previous months. Additionally, US labour costs grew at a 1.9% annualised rate in Q3 2024, significantly stronger than originally anticipated, further highlighting labour market resilience. Nevertheless, pressure is building for the Fed to cut by 25bps tonight, partly in response to today's BOE decision to reduce its key interest rate by 25bps to 4.75%, despite an earlier Budget announcement.

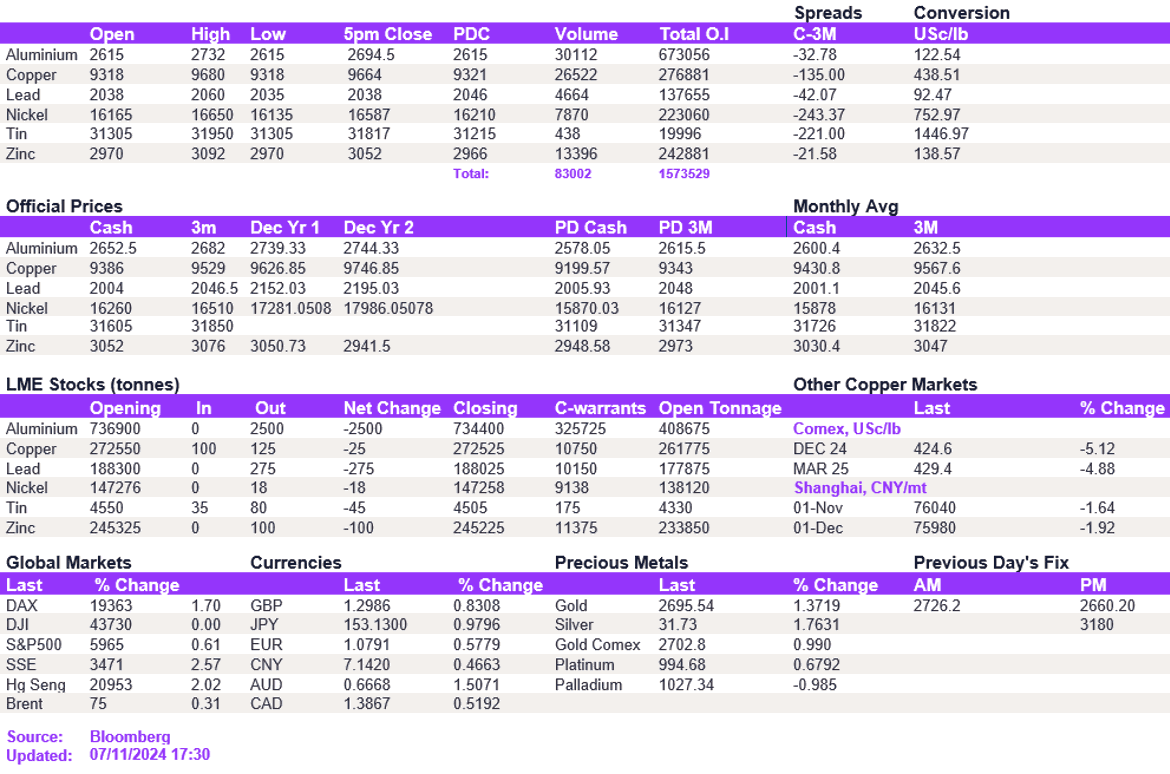

Base metals jumped higher on the open, recovering from yesterday's decline following Trump's presidential win. Copper, which saw the sharpest rate of decline yesterday, fully recovered the losses and is now back above the $9,600/t level. Likewise, zinc prices, which fell below the $3,000/t level, reversed their trend and returned to yesterday's opening levels. Other metals also followed this upward trend despite experiencing moderate losses yesterday. Aluminium followed copper higher, testing the key resistance of $2,700/t. Nickel jumped above the $16,500/t level.

As mentioned in our Quarterly Metals Report, we believe that the markets are more susceptible to sharp moves on the upside than the downside. Additionally, with the conclusion of the China's National People's Congress tomorrow, investors are on the lookout for positive news out of the region regarding additional stimulus measures. We expect the markets to finish the week on a positive note tomorrow.

Oil futures fluctuated once again, but remained mostly in range, with WTI and Brent holding above the $71/bbl and $74/bbl levels, respectively. Today's dollar weakness resulted in strong gains across the precious metals space; however, not enough to offset yesterday's losses, prompting gold and silver to trade at $2,694/oz and $31.70/oz at the time of writing.

All price data is from 07.11.2024 as of 17:30