US stocks continued to reach new records, buoyed by favourable macroeconomic data that showed an improvement in consumer sentiment. The S&P 500 is edging closer to the 6,000 mark, a threshold that, if breached, could signal further upward momentum in equities. Following the Fed’s announcement yesterday to cut by 25bps aligned with market expectations, resulting in moderate performance across related assets. The dollar remained above the 104.50 level and the 10-year US Treasury yield edged lower to 4.29%. After the initial pricing of “Trump trades”, markets appear to be stabilising. We believe that significant announcements from incoming administration will not surface until Trump formally takes office in January. Until then, markets are expected to remain vigilant, closely monitoring any news or remarks from key players that could influence sentiment.

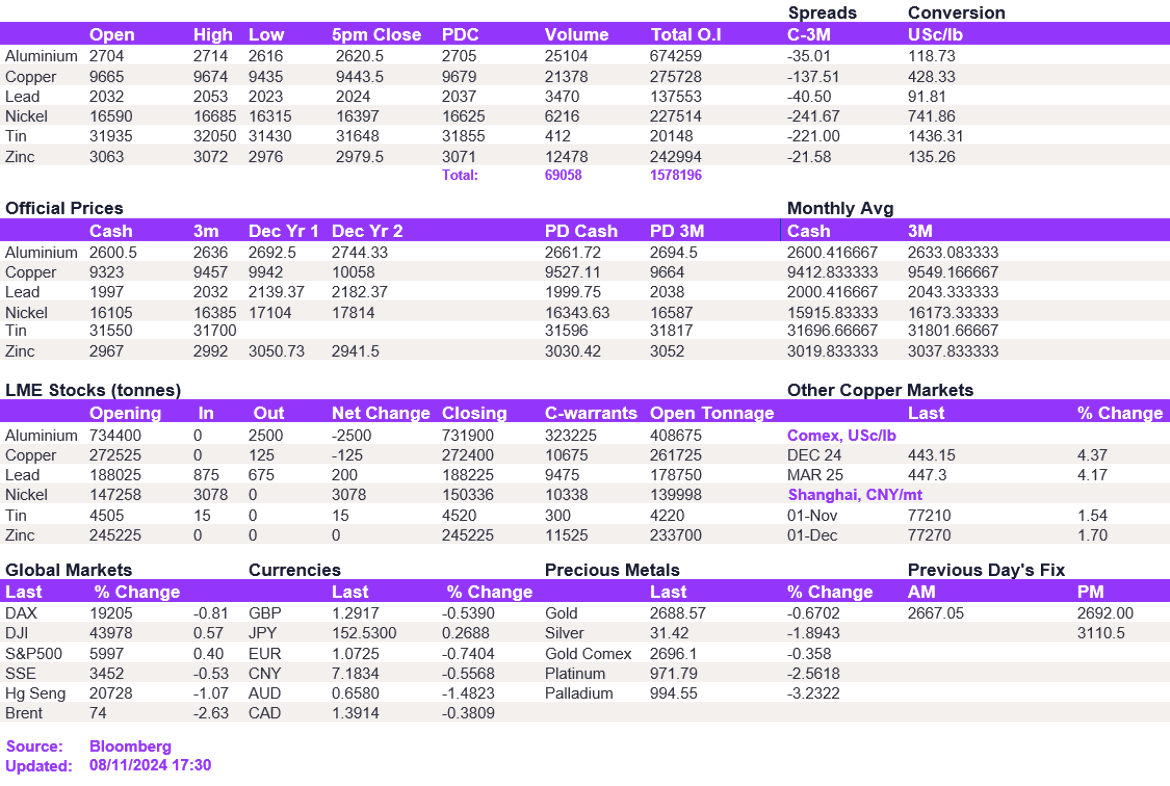

While little is currently known about the US tariff narrative, Trump’s decisive win has introduced significant volatility into the metals market this week. The dollar rally and the subsequent sell-off have been key in shaping the overall market narrative, with copper experiencing particularly sharp fluctuations. Today, metals opened on the back foot as prices attempt to stabilise around the pre-election mean level. We believe that volatility is calming down as the week comes to an end, and metals are poised to trade within a more stable range moving forward. Indeed, despite a $1.4 trillion debt swap announced by Chinese officials today, the market reaction was moderately bearish across the board, suggesting that other factors are driving the complex narrative in the meantime. We expect copper to fluctuate around the $9,550/t level next week. In the meantime, the metal weakened back to $9,443.50/t and aluminium struggled above the $2,700/t, edging lower to $2,620.50/t. The rest of the complex followed suit lower on the day.

Likewise, on the back of underwhelming support announcement from China, oil prices retreated. Precious metals also declined, offsetting yesterday's gains, with gold and silver falling into $2,685/oz and $31.65/oz, respectively.

All price data is from 08.11.2024 as of 17:30