US stocks had a mixed reaction on the open, fluctuating near the highs, suggesting that the market might be losing steam. Meanwhile, US producer prices strengthened in October, growing by 2.45% YoY. US initial jobless claims fell to 217,000, marking the lowest level since May. This data once again underscores the resilience of the US economy in adapting to prolonged higher interest rates. As a result, market expectations for a rate cut in December have decreased to 75%, with an even lower probability of just 32% for a cut in January. The dollar, while stronger on the open, struggled above the 106.50 level, offsetting today's gains back to 106.42. The US 10-yeat Treasury yield weakened to 4.40%.

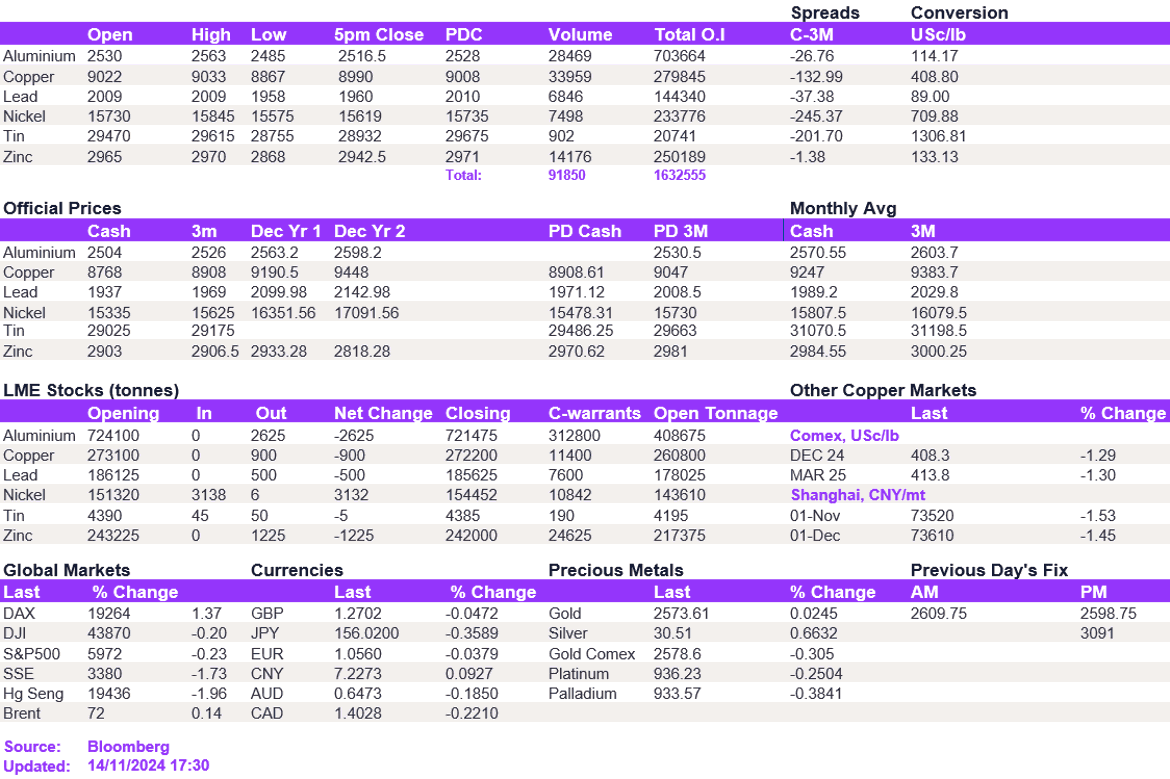

The base metals complex tracked dollar moves closely, weakening on the open but recovering some losses closer to the day's end. Copper temporarily breached the robust $9,000/t level, prompting a close slightly below at $8,990/t. Likewise, aluminium struggled below the $2,500/t support, resulting in moderate day-on-day softness, closing at $2,516.50/t. Nickel continued to edge closer to the robust support of $15,700/t. Lead sold off after it breached the $2,000/t mark, prompting weakness to $1,960/t. Zinc remained supported above $2,900/t.

Oil futures edged higher as the gains were capped by the IEA report which forecasted a large crude supply glut for 2025. Gold and silver also strengthened given a weaker dollar, trading at $2,574/oz and $30.46/oz at the time of writing.

All price data is from 14.11.2024 as of 17:30