The market opened on a volatile note this morning following Trump's announcement of new tariffs: an additional 10% tariff on Chinese goods and 25% on Canadian and Mexican goods. However, the initial risk-on appetite failed to last as investors digested a macroeconomic report revealing that consumer confidence has reached its highest level in more than a year. Although Trump has the authority to impose tariffs almost immediately while in office under Section 301 of the Trade Act 1974, the immediate impact on the market appears limited, thus carrying less significance for now. As a result, both the US equities and the dollar index continued to gain momentum, with the latter remaining above the 107 level. Markets are now awaiting the release of PCE figures tomorrow, which will provide more clarity on the Fed's future policy decisions. Meanwhile, the 10-year US Treasury yield is now trading at 4.30%.

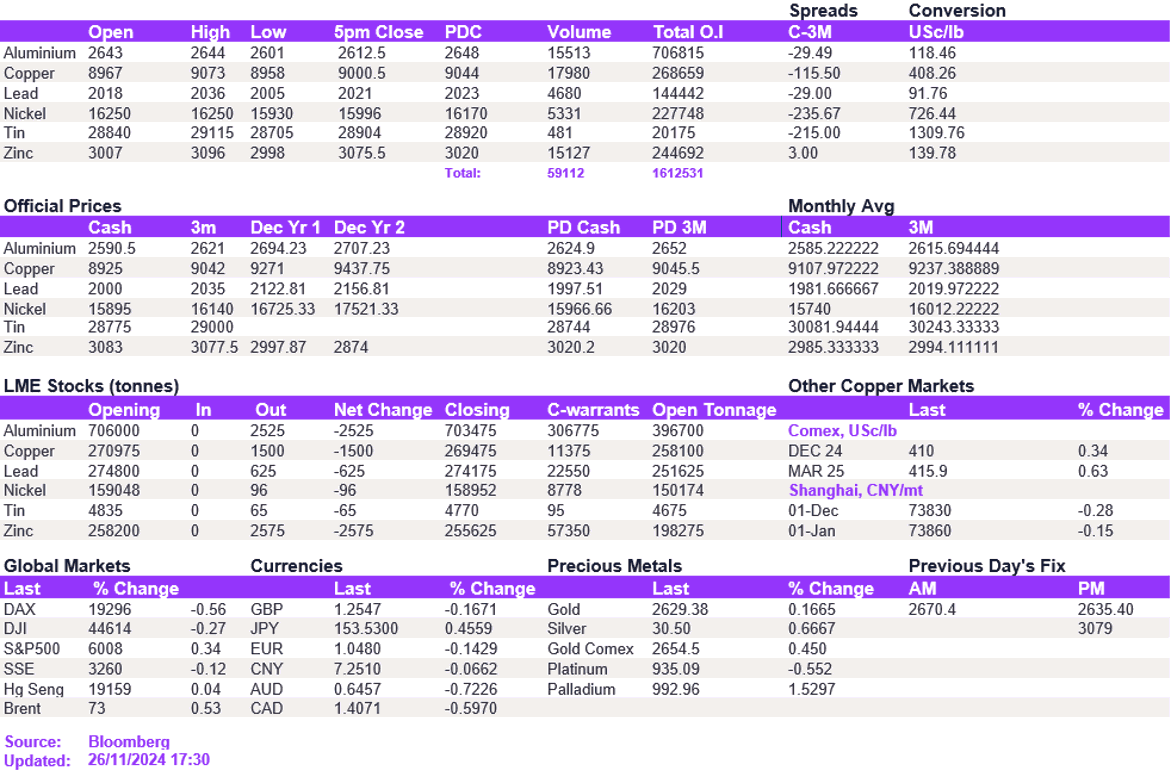

With the dollar holding steady, the base metals space held within the previous week's range. Additionally, the yuan is starting to stabilise against the dollar, following the PBoC's daily reference rate set at approximately 7.2. As a result, copper dipped back below $9,000/t but managed to close back above at $9,000.50/t. Likewise, aluminium held above the $2,600/t level at $2,612.50/t. Nickel reversed earlier gains, falling back below the $16,000/t support level. Zinc is the only exception, with markets turning more bullish, prompting prices to test the $3,100/t level.

Oil prices showed moderate gains today after reports indicated a potential delay in output increases by OPEC+. As a result, WTI and Brent strengthened to $69/bbl and $73/bbl, respectively. Gold and silver held steady following yesterday's weakness, with the metals struggling below the $2,620/oz and $30.20/oz support levels, respectively.

All price data is from 26.11.2024 as of 17:30