The Dow Jones opened higher today, bucking the broader market trend as the S&P 500 and Nasdaq tumbled. The latest GDP data showed the US economy growing at an annualized rate of 2.8% in Q3, reflecting steady expansion. However, a slight decline in personal consumption, which fell from 3.7% to 3.5% in Q3, signalled a cooling in consumer spending. This was partially offset by higher personal income figures, which continue to support household resilience. Meanwhile, the closely watched PCE inflation data met expectations, with headline PCE rising 2.3% YoY and Core PCE up 2.8% YoY, suggesting that while inflationary pressures are moderating, risks of a resurgence remain. The dollar eased sharply, dropping to 106.1, while the 10-year US Treasury yield fell to 4.24%.

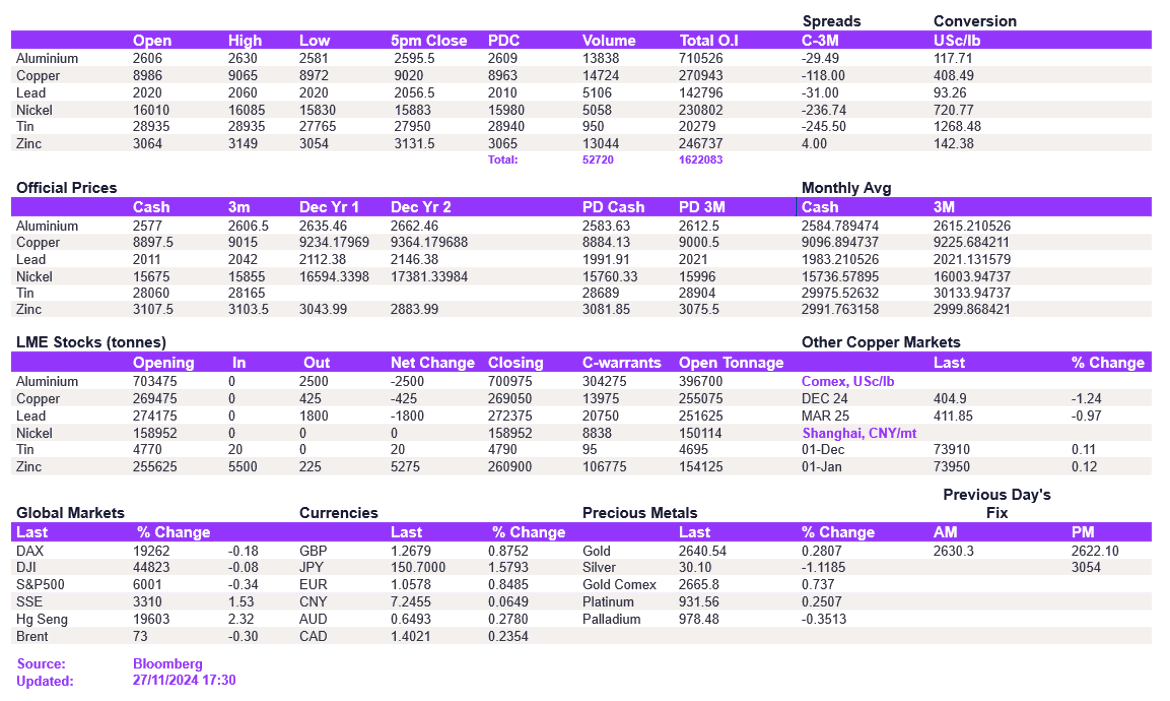

In the LME space, base metals experienced mixed performance. Lead and zinc surged, breaking above the $2,050/t and $3,130/t marks, respectively. Zinc orders for withdrawal from LME warehouses spiked to their highest levels since 2015, highlighting tightening supply dynamics. In contrast, tin prices plunged to $27,980/t, their lowest levels since March. Aluminium fell below its key support level, trading at $2,595/t while copper managed modest gains, edging slightly higher to $9,011/t.

In precious metals, gold edged higher, trading at $2,642.5/oz, while silver slipped to $30.15/oz but managed to hold above the critical $30 support level. Oil prices traded flat, with WTI and Brent crude at $68.8/bbl and $72.8/bbl, respectively.

All price data is from 27.11.2024 as of 17:30