US stocks opened mixed today, with the Dow Jones declining while the Nasdaq climbed higher, reaching new record levels. The final reading of the S&P US Manufacturing PMI was revised upward from 48.8 to 49.7, signalling a marginal improvement in the manufacturing sector as it edges closer to stabilisation. In China, the Caixin Manufacturing PMI for November exceeded expectations, rising to 51.5, pointing to expansion in factory activity. This uptick is likely influenced by anticipated tariffs from Donald Trump, who is set to take office next year, prompting Chinese exporters to accelerate production and shipments before the tariffs are imposed. In Europe, manufacturing data remained subdued. The UK’s final PMI was revised downward to 48.0, reflecting a deeper contraction in the sector, while the Eurozone’s final PMI remained unchanged at a weak 45.3. Eurozone unemployment in October held steady at 6.3%, indicating a stable but fragile labour market.

Meanwhile, in France, all eyes were on the vote for a controversial social security plan. Opposition parties have promised a no-confidence vote against conservative Prime Minister Bernier, which will most likely lead to the government’s collapse. This political uncertainty has driven the risk premium on French government debt to rare heights, with the yield spread between French and German 10-year bonds widening to 87bps. The dollar index surged today while the 10-year US Treasury yield stayed largely unchanged, hovering just above 4.2%.

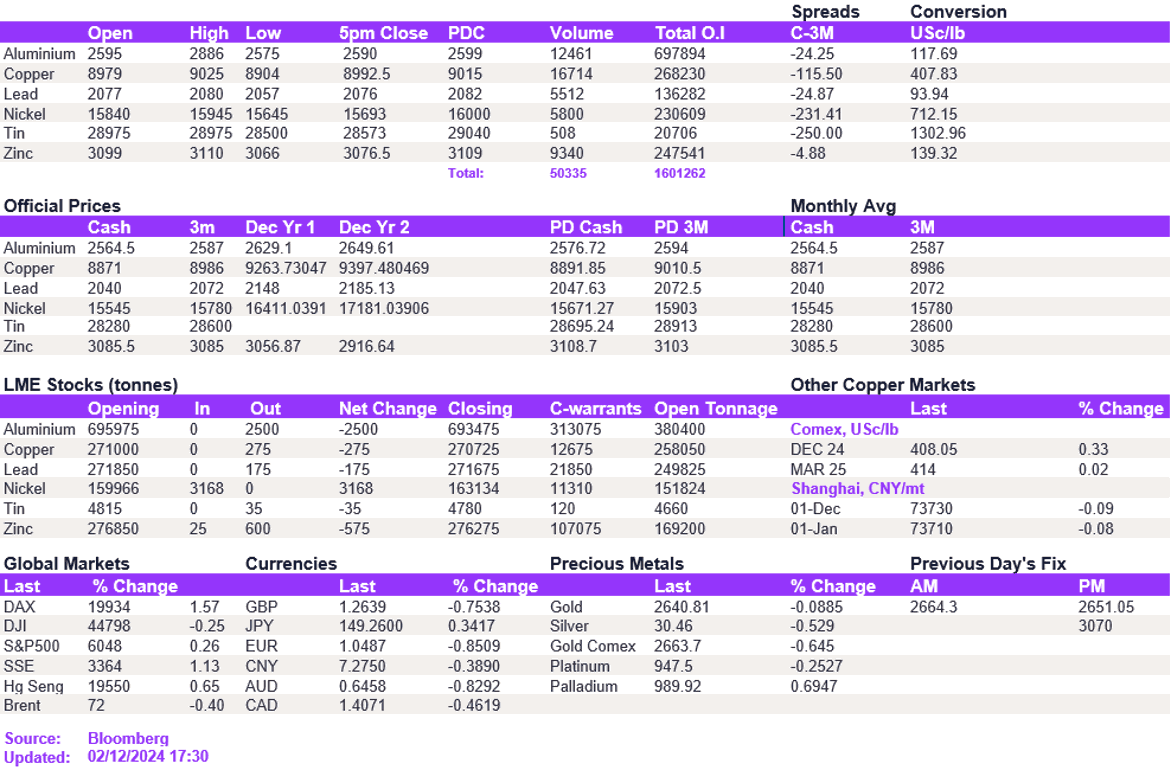

A stronger dollar has once again put pressure on the base metals complex. This is despite a moderately positive sentiment out of China, where manufacturing performance has improved for the second straight month. Moreover, China skipped the Politburo readout for its regular November meeting, leading markets to speculate that stimulus support may be on its way. This highlights the ongoing dominance of the dollar over the metals market. As a result, copper fluctuated around $9,000/t, and aluminium remained below the $2,600/t level, closing at $2,590/t. Lead continued to experience short covering, prompting it to reach $2,076/t. Zinc struggled above the $3,100/t; however, the cash to 3-month spread remains in backwardation.

Precious metals softened. Gold edged slightly lower to $2,640/oz, while silver declined to $30.40/oz, holding firmly above the $30 support level. Oil prices saw modest gains, with WTI trading at $68.40/bbl and Brent crude at $72.20/bbl, supported by steady demand signals and supply concerns.

All price data is from 02.12.2024 as of 17:30