US stocks opened higher today after the release of the CPI report, which came in line with expectations. Headline inflation showed a slight uptick in November, rising from 2.6% to 2.7% YoY, driven by increases in food and used vehicle prices. Core CPI remained steady at 3.3% YoY, unchanged from October. Markets interpreted the data as reinforcing expectations for a 25bps rate cut by the Federal Reserve next week, with forward swaps now pricing in almost a 100% probability of such a move. The 10-year US Treasury yield rose to 4.25%, likely reflecting reduced expectations for deeper rate cuts in the upcoming year. Meanwhile, the dollar index unexpectedly jumped to 106.7, which contrasts with typical behaviour following dovish signals and could indicate continued demand for the dollar as a safe haven.

Base metals weakened slightly due to a weaker yuan following reports that Beijing is considering allowing the currency to move without a fixed rate, potentially letting it weaken next year. In recent weeks, the yuan has been fixed at 7.2-7.3 against the strengthening dollar, which has helped to limit losses. If the yuan is allowed to float freely, the yield differential between the US and China will play a crucial role in influencing the currency pair. Although the Fed is expected to cut interest rates in the coming months, the scale and pace of these cuts are likely to be moderate, which will maintain a strong differential with Chinese bond yields. As a result, this could lead to a weaker performance of the yuan against the dollar, exerting downward pressure on base metal prices.

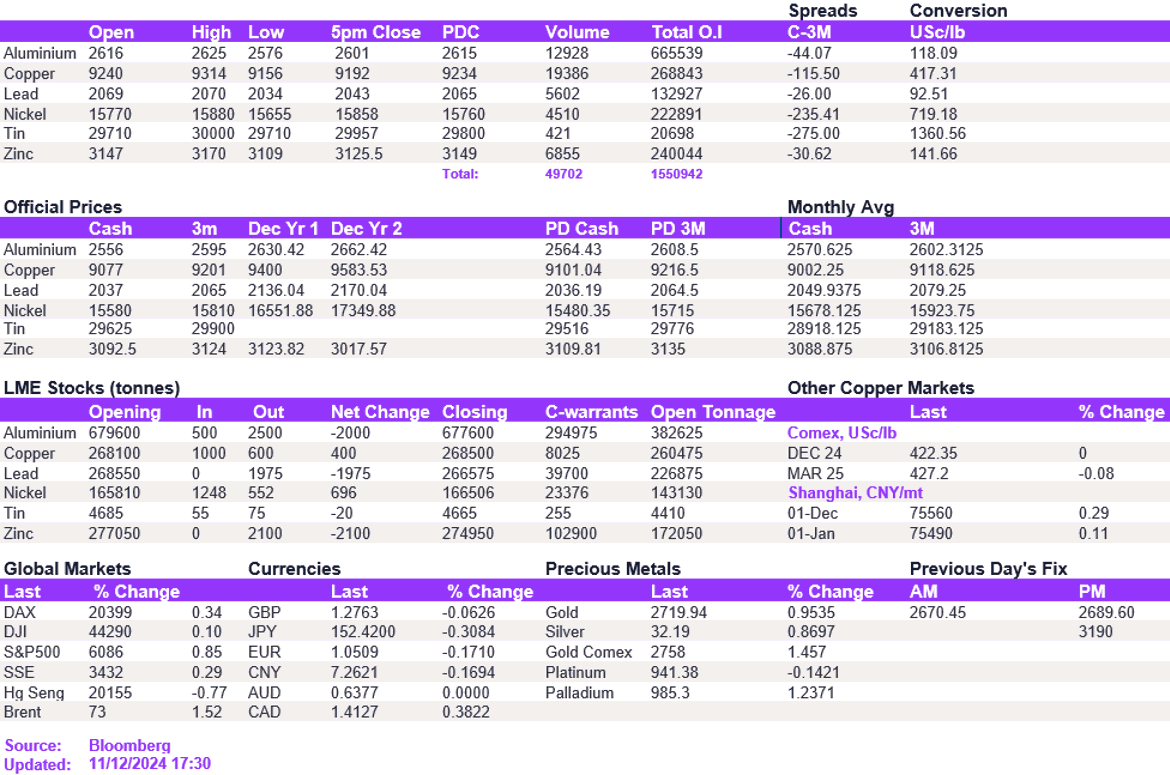

As a result, aluminium and copper held steady at $2,601/t and $9,192/t, respectively. Zinc continued to rise gradually, reaching $3,125.50/t. Meanwhile, lead weakened, breaking below the robust $2,050/t level to $2,043/t.

Gold extended its upward streak, climbing to $2,712/oz, the highest level this month, while silver edged higher, surpassing the $32/oz mark. Oil prices also increased steadily, with WTI trading at $69.50/bbl and Brent crude at $72.90/bbl, supported by uncertainties surrounding the transition of power in Syria.

All price data is from 11.12.2024 as of 17:30