US stocks opened lower today as investors digested fresh economic data and central bank moves. The US PPI report, which measures the average change in selling prices received by domestic producers, showed an unexpected uptick in inflation, rising from 2.6% YoY in October to 3.0% in November. This suggests persistent price pressures in the economy. While expectations for a 25bps rate cut at the Federal Reserve’s meeting next week remain unchanged, markets have tempered their outlook for aggressive monetary easing in 2024. In Europe, the ECB delivered a widely anticipated 25bps rate cut, bringing the Deposit Facility Rate to 3%. Meanwhile, the SNB also lowered its policy rate, cutting it from 1.0% to 0.5%, marking the lowest level since November 2022. The dollar index continued its upward momentum, testing the 107 level, while the 10-year US Treasury yield climbed to test 4.3%.

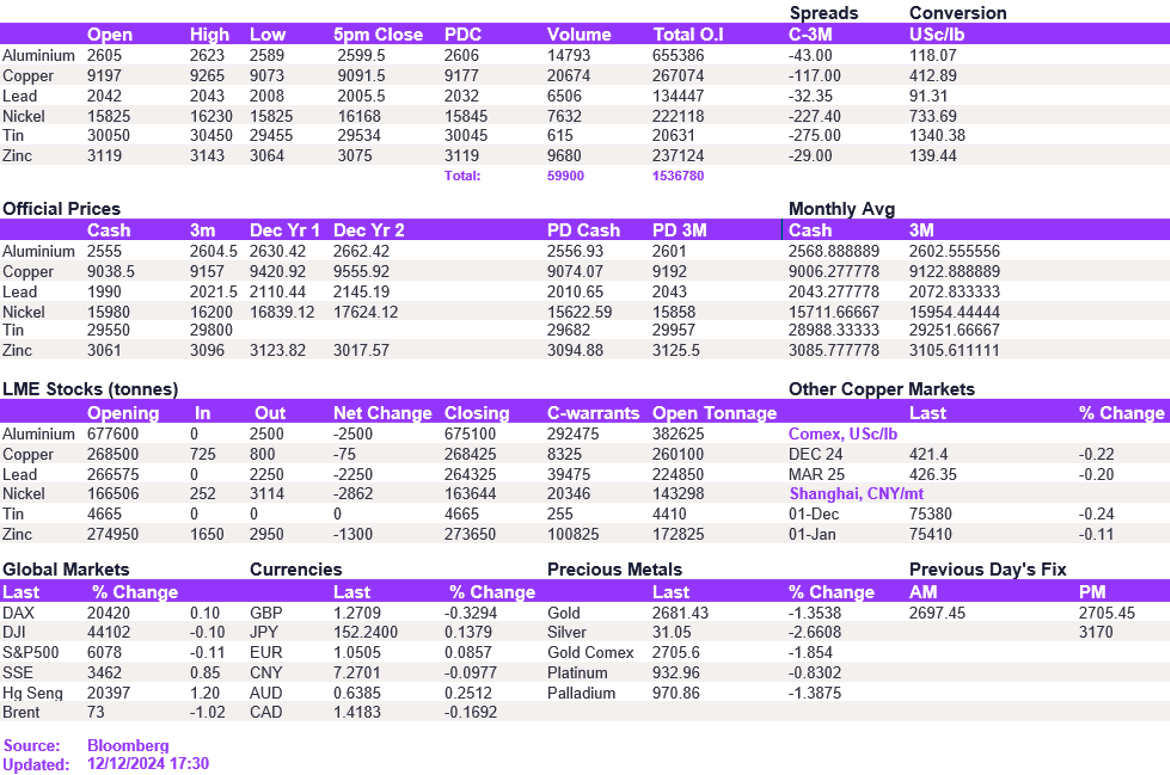

A mixed day of trading was seen across the base metals space, with mean reversion strategies in place. Copper struggled to maintain its position above the $9,200/t level, eventually softening below this mark to reach $9,091.50/t. Aluminium held steady above $2,600/t. Lead saw the end of short-covering strategies, resulting in a second day of protracted weakness to $2,005.50/t. In contrast, nickel rebounded and moved back above the $16,000/t level, reaching $16,168/t.

The gold market saw profit-taking today, with the metal retreating from its recent highs to trade at $2,679/oz. Silver followed suit, slipping below the $31.0/oz level. Oil prices also gave back yesterday’s gains, with WTI at $69.30/bbl and Brent crude at $72.60/bbl.

All price data is from 12.12.2024 as of 17:30